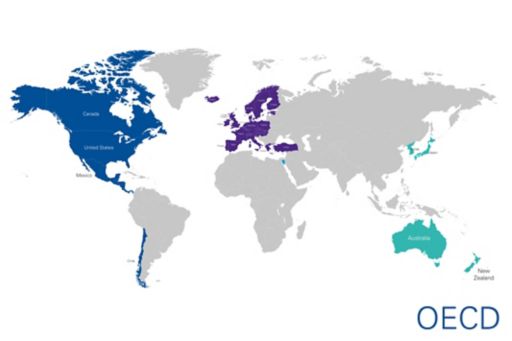

TRACE (Treaty Relief And Compliance Enhancement) is an initiative of the OECD Finance Committee. The aim is the automated application for tax reductions/refunds on a double taxation agreement (DTA) basis.

In addition to the time and cost savings for the taxpayers (investors) involved, liquidity benefits are sought. The focus is on tax relief at the source. Participating states are free to opt for an ex post refund through the TRACE procedure if they so wish. Under TRACE, an exemption or refund should be much quicker and less bureaucratic than with the existing procedures.

KPMG advises you before the introduction of TRACE with a view to the upcoming tax law developments. In addition to the technical plan for the required adjustments, we support you in the necessary reorganisation of processes and systems. Until TRACE is implemented, KPMG is actively involved in optimising your business entity’s traditional withholding tax refund processes or takes over the process completely for you. We have tools that enable the process to be highly automated on your behalf.

KPMG will provide you with the international GloW Track tool if required. This is web-based application that can be used to analyse withholding taxes, stamp duties and transaction taxes on cross-border investments in over 90 countries. It is worth it if, for example, tax amounts that were rightly withheld under national law and the DTAs can be reclaimed under certain conditions if their withholding is not permissible under EU law (free movement of capital).

Independently of the introduction of TRACE, banks, insurance companies, investment companies, investment funds, family offices and other capital investors with international equity or bond investments can benefit from optimising or outsourcing their existing withholding tax refund process.

Please get in touch with us. We help you get a full and speedy refund of withholding tax at the lowest possible cost.

Andreas Patzner

Partner, Financial Services, Tax Asset Management

KPMG AG Wirtschaftsprüfungsgesellschaft