Determine the cost of capital more quickly

With an efficient approach, you can easily derive your cost of capital without lengthy research and data preparation.

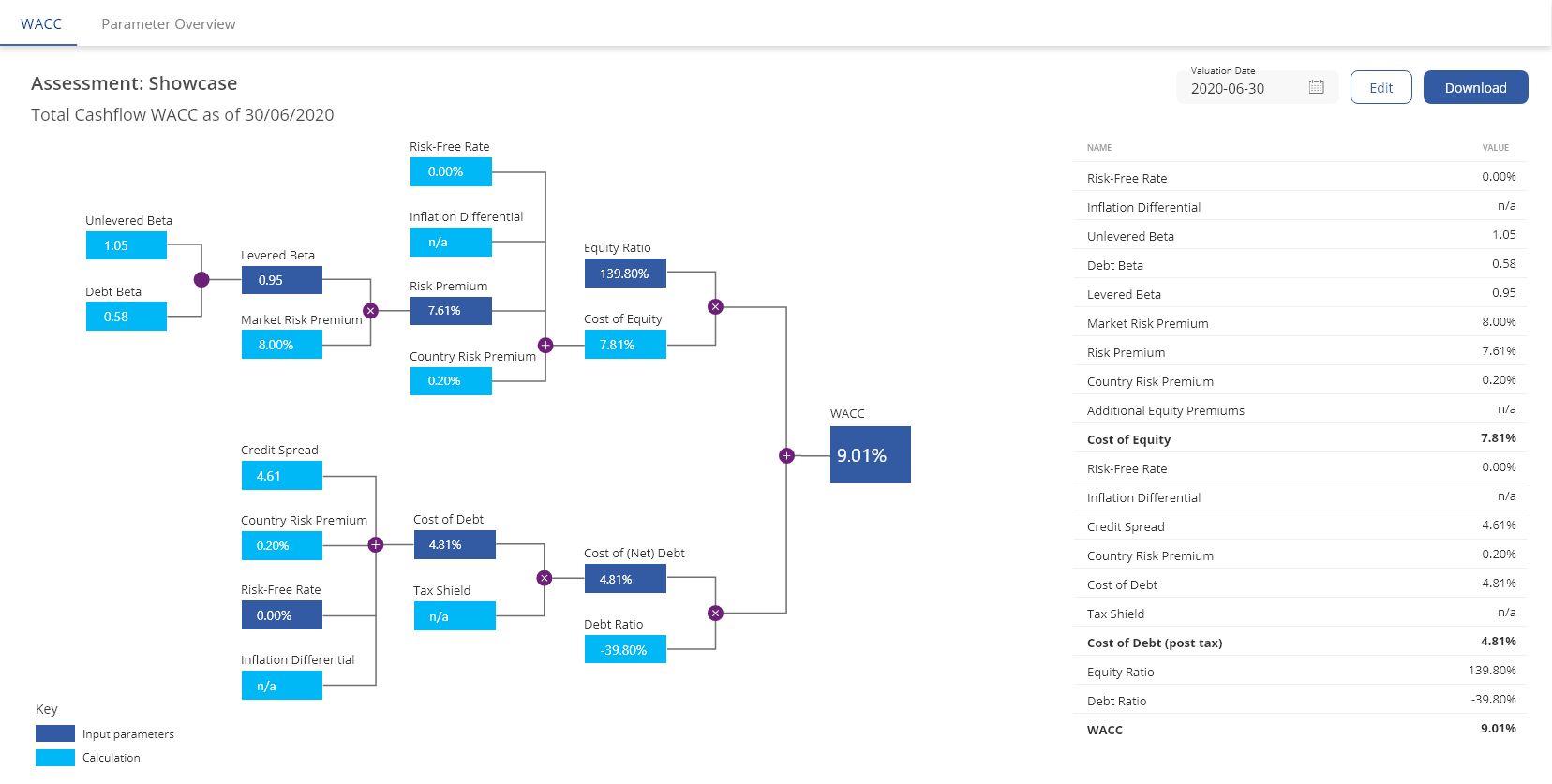

KPMG Valuation Data Source provides a comprehensive overview of all key cost of capital parameters - including beta and credit spread. Our solution guides users through the calculation of their individual weighted average cost of capital (WACC) or the corresponding cost of equity in just a few steps. Users can enter their preferred reporting data, countries and currencies and customize the settings for the WACC calculation by selecting from various filter functions such as industry type, region and profitability criteria such as margins or growth rate.

Our dynamic tool offers maximum flexibility in parameter and calculation settings, allowing you to access the data calculated by KPMG or integrate your own values. To further speed up the processes, industry betas can be used for the initial assessment of the cost of capital derivation. All queries are automatically saved as soon as they are created; therefore, simply select a cut-off date to receive results, which can be downloaded as Excel or PDF files with the technical documentation.

The tool provides powerful insights into global trends and gives you the upper hand in accessing up-to-date market data from over 150 countries. Our interactive dashboard tracks the performance of more than 16,500 companies, providing unparalleled access to relevant financial metrics across a range of industries and regions. With our convenient platform, you can access it anytime, anywhere.

All benefits at a glance

- Reliable and monthly updated data

- Potential access to cost of capital parameters from more than 150 countries

- Compilation and storage of your own peer group from over 18.000 companies worldwide

- Inclusion of historical reporting dates using available data from 2012 to the present

- Cash flow currency selection

- Parameters available for download as Excel spreadsheet or pdf file

Available parameters:

- WACC / Cost of Equity

- Risk-free interest rate

- Beta factors:

- Five-year beta factor

- Two-year beta factor

- One-year beta factor - Credit spread

- Market risk premium

- Country risk premium

- Inflation delta

- Average tax rate

- Selected exchange rates

Insights into the dashboard

User-friendly, interactive and available at anytime

Dr. Andreas Tschöpel

Partner, Deal Advisory, Valuation

KPMG AG Wirtschaftsprüfungsgesellschaft