In order to remain competitive, compliance activities must be increasingly efficient, flexible and cost-effective - without losing any of their effectiveness. KPMG's Regulatory & Compliance department supports banks, insurance companies and securities and financial services institutions in setting up, reorganising and further developing their compliance function.

Compliance management at a glance

Effective compliance management is a central element of good corporate governance. It ensures that internal guidelines as well as legal and regulatory requirements are adhered to - both nationally and internationally.

A compliance management system (CMS) encompasses all relevant processes, structures and measures. It helps to recognise risks of non-compliance at an early stage and to manage them systematically. A structured CMS is becoming increasingly important, especially in highly regulated sectors such as the financial industry.

Even if there is no general legal obligation to introduce a CMS, supervisory authorities expect an appropriate and effective compliance system - for example as part of MaRisk or BAIT. For many institutions, a CMS is de facto indispensable.

Stefanie Carolin Feldhoff

Partner, Financial Services

KPMG AG Wirtschaftsprüfungsgesellschaft

Shaping compliance transformation

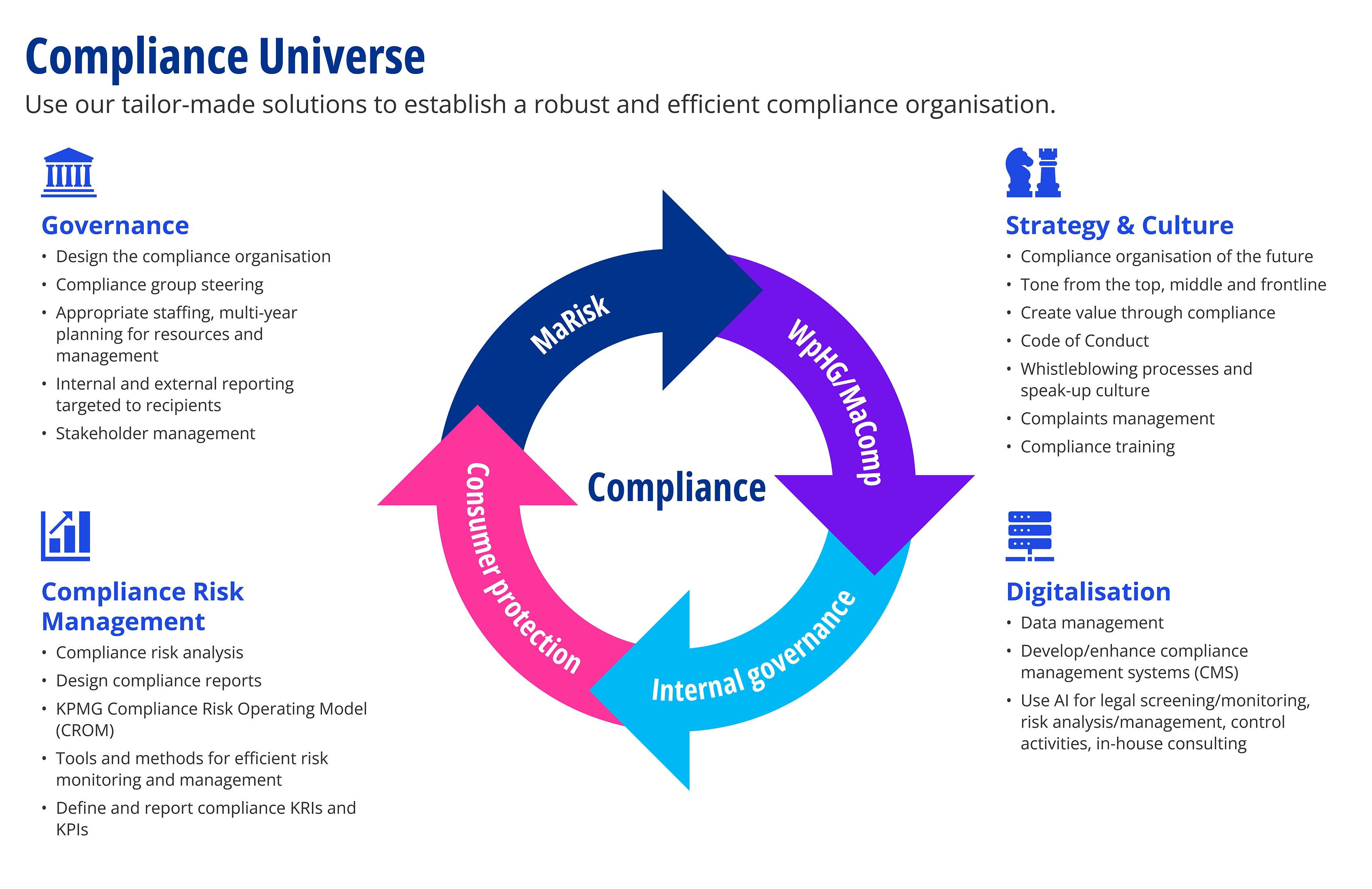

Four key components are crucial for a strategy-led compliance and risk function:

We harmonise the key elements of an effective compliance framework. The following services help you to successfully implement your compliance and risk transformation:

Governance

- Support in the appropriate design of organisational structure specifications

- End-to-end implementation support for change and transformation projects

- Development of a customised resource management strategy using the "KPMG Capacity Steering Model"

Compliance Risk Management

- Implementation of an institution-specific compliance risk analysis

- Introduction of modern compliance reporting including targeted key risk indicators (KRI) and key performance indicators (KPI)

- Support in the design of control and monitoring activities to ensure compliance with regulatory requirements

Focus: Compliance Risk Operating Model (CROM)

- Identification of opportunities and potential for the further development of the compliance organisation

- Development of a sustainable action plan for the effective implementation of the transformation

Strategy & Culture

- Support in the development of a compliance strategy and objectives based on the company's mission statement

- Conceptualisation and implementation of individual governance principles, depending on the overall corporate strategy

- Conducting compliance training for requirement levels ranging from specialist employees to Management Board and Supervisory Board level

- Creation of topic-related guidelines such as codes of conduct, anti-corruption and data protection guidelines

Digitisation

- Support with the partial or holistic design and development of a compliance management system

- Three-step plan for establishing a modern and future-proof data governance framework

- Support in the selection and introduction of AI solutions in the various compliance areas

We support you along the entire value chain - with sustainable and innovative solutions that make your compliance function fit for the future.

Feel free to contact us - we look forward to talking to you.

Stay up to date with what matters to you

Gain access to personalized content based on your interests by signing up today