More transparency for clear purchase decisions

The KPMG Pre-Deal PPA Solution provides an efficient and reliable way for potential buyers to gain insights into the purchase price analysis of a company acquisition. Our solution assesses and visualizes these impacts in the shortest possible time to enable an in-depth due dilligence based on a quantitative and qualitative analysis - despite the challenge of a very short timeframe with limited data availability.

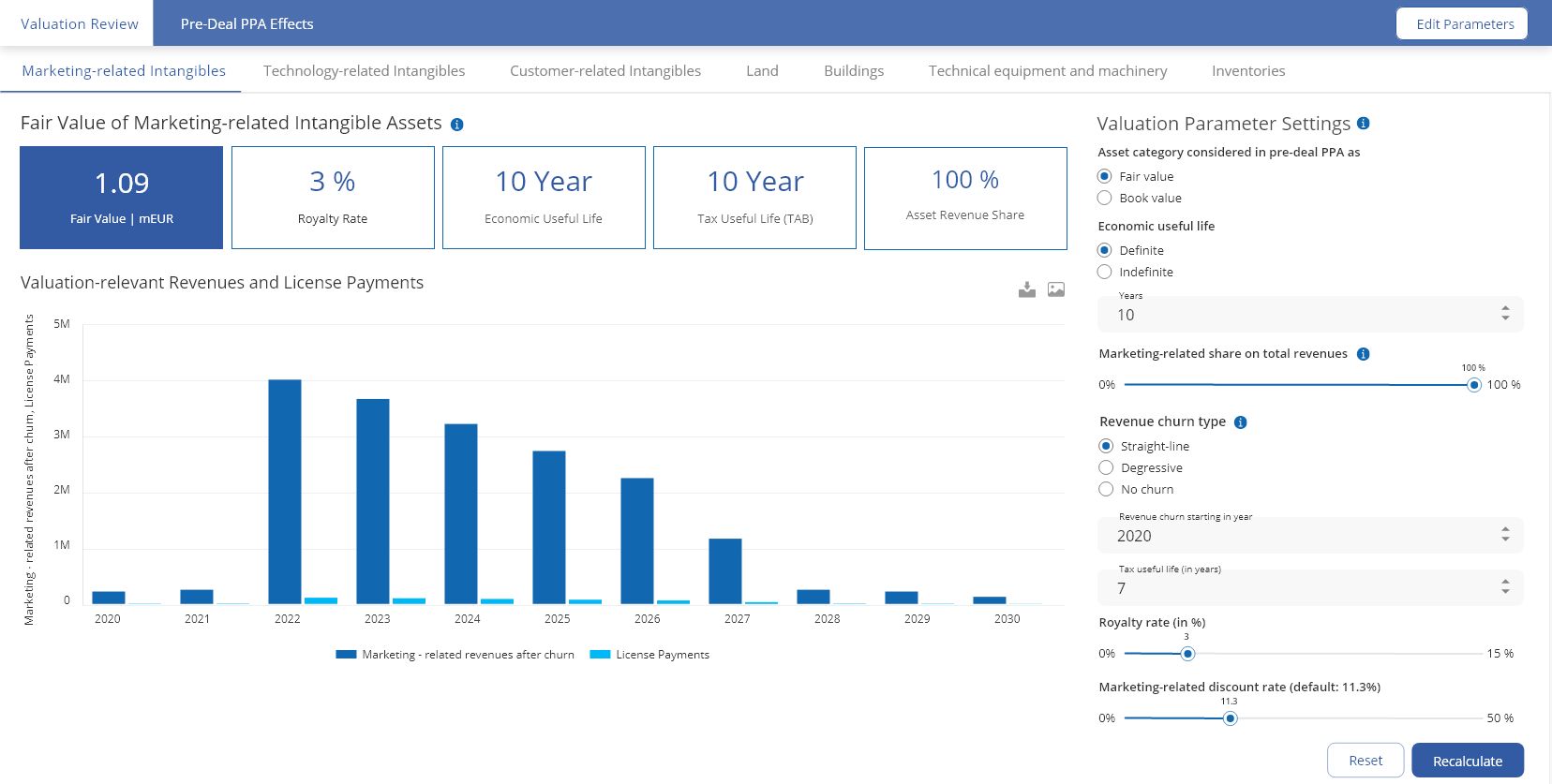

Achieve a reliable indicative valuation of intangible and tangible assets as well as liabilities using KPMG's extensive industry-specific database. Our intuitive solution makes it easy to integrate your own inputs and review data accuracy without sacrificing quality assurance or value determination outcomes.

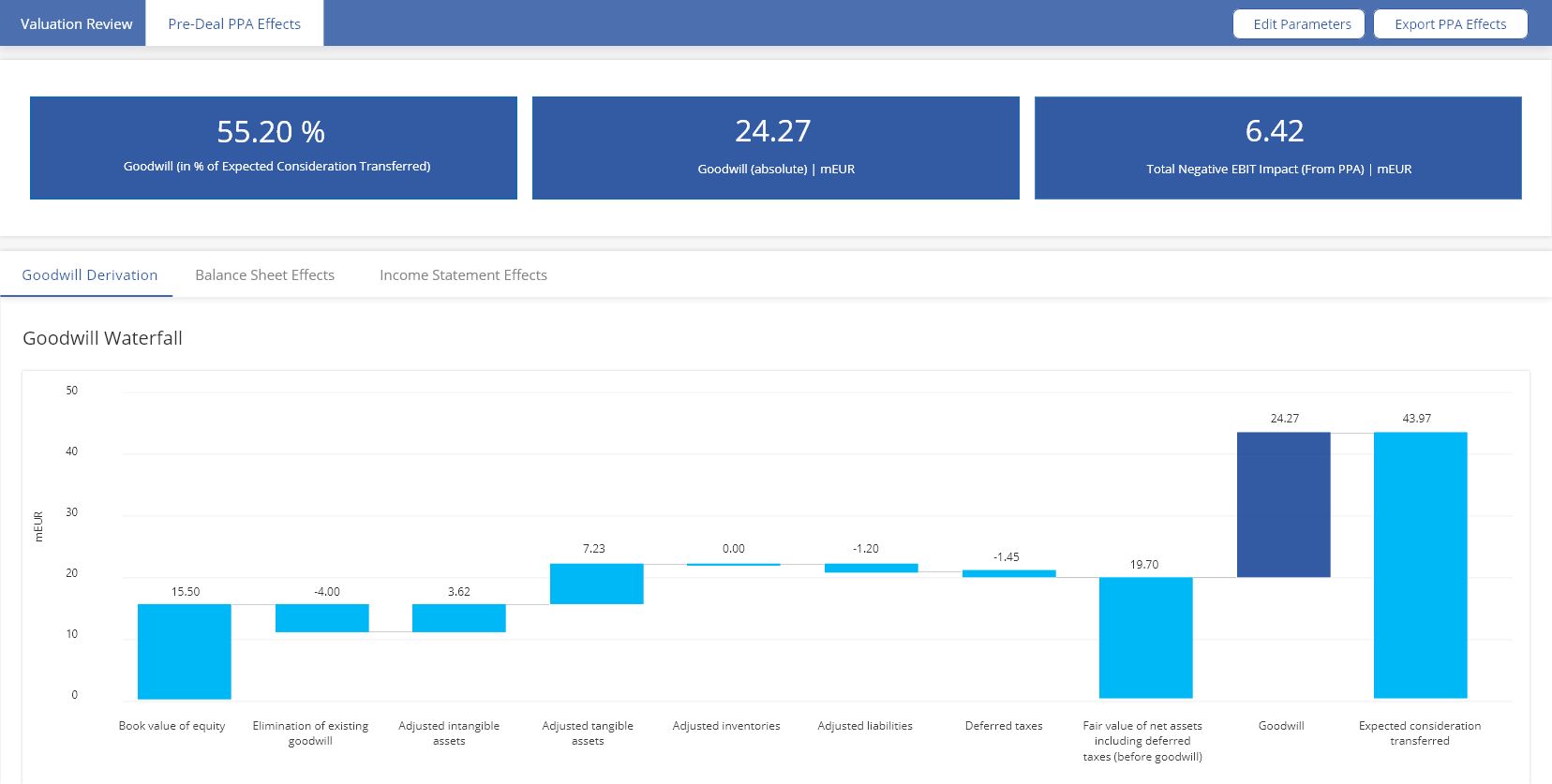

Insights into the KPMG Pre-Deal PPA Dashboard

Easy to use, interactive and available anywhere

All benefits at a glance:

- Effective: A short input process creates space for analyses and scenario calculations

- Simple: Straightforward execution of Pre-Deal PPA through clear process control

- Reliable: the fully integrated calculation model (in the style of IFRS 3) is based on KPMG evaluation standards with the inclusion of PPA benchmark data

- Clear: visualization of essential PPA effects and relevant evaluation parameters in a dashboard

- Practical: results can be exported in Excel

Output scope

- Values of tangible and intangible assets and liabilities

- Derivation of goodwill

- Balance sheet effects resulting from the PPA

- Presentation of impacts on profitability

- Possibility of entering your own assessment assumptions