Challenge

What does sustainable tax compliance management (Tax CMS) look like?

Increasing regulatory requirements, the high complexity of business processes and the ever-increasing mass of data increasingly require the digitization of tax compliance management in order to identify tax risks in good time and avoid them in the long term. What is required is a continuously updated overview of possible tax risks as well as automated processes for handling large amounts of data and monitoring of the control systems in the tax area.

But for many companies, setting up an effective and efficient tax CMS is a major challenge - not least when it comes to indirect taxes. Due to the large number of transactions in which indirect taxes have to be taken into account, regular checks are very time-consuming. There is also often a lack of personnel capacity for these complex and time-consuming tests.

More transparency and efficiency for a sustainable Tax CMS

The solution: A data-driven tax compliance management system. Together with our cooperation partner Impero A/S we offer you the combination of a web-based compliance solution with our mass data analysis tool Tax Intelligent Solution (TIS). This enables you to ensure your tax compliance quickly and in a way that saves resources thanks to efficient control implementation and documentation - and with the system being permanently up-to-date.

Tax Intelligence Solution (TIS)

Mass data analysis tool developed by KPMG for viewing and controlling all tax-related processes in the company. By means of one-off or continuous analyses, discrepancies can be uncovered and made available for further processing in Impero.

Impero

User-friendly compliance management platform from our partner Impero A/S for digitizing the tax CMS workflow. The results from TIS can be easily transferred to the system, recommendations for action can be derived and processed there. Tax risks can thus be reduced and potential increased.

With mass data analysis and workflow management for automated tax compliance

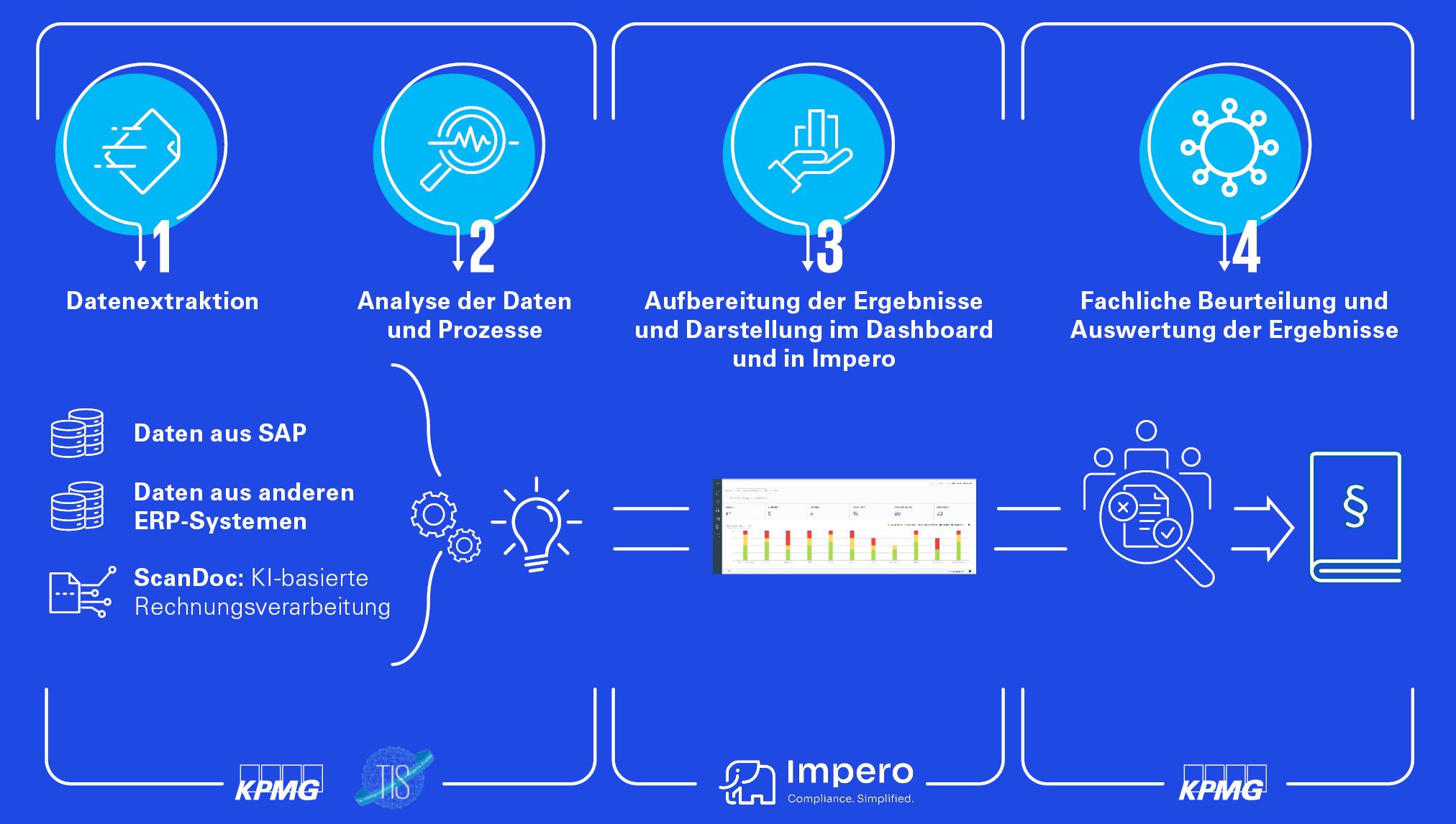

The mass data analysis tool TIS and the compliance management solution from Impero can each be introduced independently and used in the company. Above all, the combination of both solutions can further increase efficiency. The following steps show the interaction of TIS and Impero:

Chart (in German only)

- Data extraction: The first step is data extraction. SAP and other ERP systems can be connected, but also digitized invoice documents (scans).

- Analysis of the data and processes: In the second step, TIS analyzes automatically and accurately discover inconsistencies in transactional mass data. Depending on the selected project approach, the professional assessment and evaluation of the results can be carried out together with our tax experts.

- Preparation of the results and presentation: In the third step, all relevant information is transferred from TIS to Impero or Microsoft Power BI to enable the results to be evaluated. Graphic preparations (dashboards) make the status transparent.

Deriving impulses for action: Finally, clear impulses for action can be derived from the results of the analyses.

TIS in connection with Impero can be easily, quickly and flexibly established in your tax compliance, either directly in your existing processes or seamlessly as a managed service from KPMG. Benefit from flexible solutions instead of a rigid one-size-fits-all approach: individually select the packages and solutions that are right for you, as well as the corresponding content.

In summary, the combination and integration of TIS and Impero enables you to have automated, data-driven tax compliance management, with which you can position yourself even more efficiently and digitally for the future. We would be happy to support you with the implementation.

Our team combines many years of experience and expertise in the areas of tax consulting and data & analytics. In this way we create new synergies and solutions for the challenges of the present and the future. Contact us.

Further Information

Further Information (in German only)

Your contacts

Stay up to date with what matters to you

Gain access to personalized content based on your interests by signing up today

Christian Stender

Partner, Chief Technology Officer Tax

KPMG AG Wirtschaftsprüfungsgesellschaft

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia