Insurance companies are currently facing a multitude of challenges. Fierce competition among established companies, new players in the market, the all-dominant topic of digitalisation and also increasing regulation are putting insurance business entities under pressure to realign their business model in a sustainable way.

But for many business entities, adapting to the new realities is challenging. What can be done if the business model that has been tried and tested for decades no longer has any real prospects for the future in its current form?

There are challenges to be addressed. Business entities should therefore:

- Actively drive acceleration and automation of processes;

- Streamline and automate processes around their models;

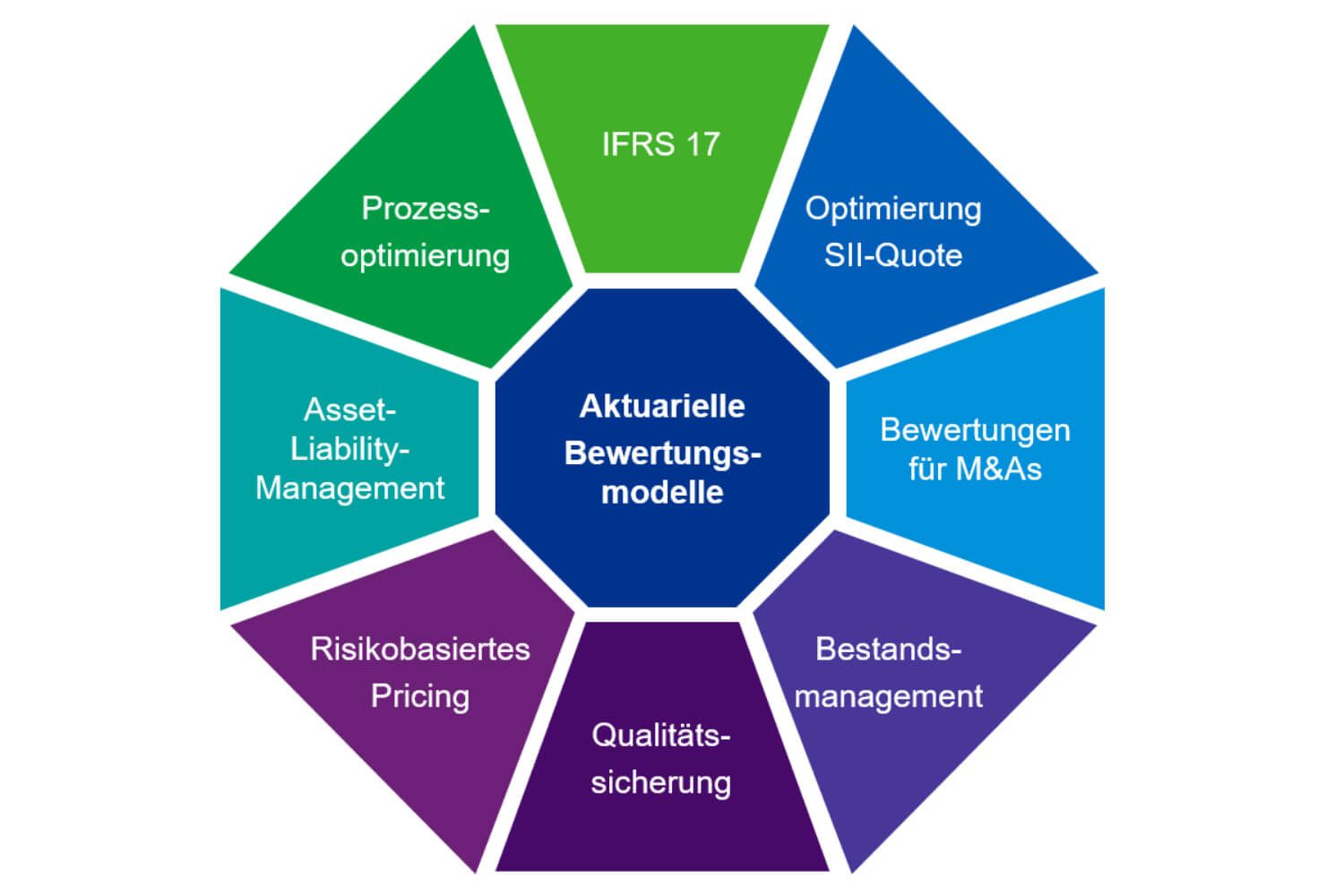

- Address necessary adjustments to the actuarial model due to the requirements of IFRS 17;

- Drive the use of data science methods, e.g. in pricing.

Benefit from our expertise

We are no strangers to the challenges currently facing insurance companies. We have the experts with the know-how you need to make your business entity sustainably fit for the future. Thanks to our worldwide network, we are in a position to provide comprehensive support to globally active business entities, just as we are able to advise smaller business entities on detailed questions - and know-how to implement our suggestions in a practical way.

Stefan Heyers

Partner, Financial Services, Head of Insurance

KPMG AG Wirtschaftsprüfungsgesellschaft

Our solutions for you include:

- Analysis and inventory of the processes and data in your business entity

- Analysis of optimisation possibilities

- Design and implementation support

- Adjustment of the projection models for life and health insurance companies

- Analysis of the models and data as well as identification of optimisation possibilities

- Analysis of possibilities for feasibility optimisation

- Implementation of the changes

Our Experience – Your Future Success

Take advantage of our expertise, which we have gained in large modelling projects at a large number of differently organised insurance companies. It is important to us that we always keep the big picture in mind in our solutions for our customers. Because we think long-term success. In doing so, we always incorporate the knowledge of other KPMG experts, such as industry knowledge, IT expertise, accounting knowledge or actuarial know-how. We always support our customers as partners.

Have we got you interested? Then feel free to contact us!

Actuarial models are key

They form the basis for successful company management

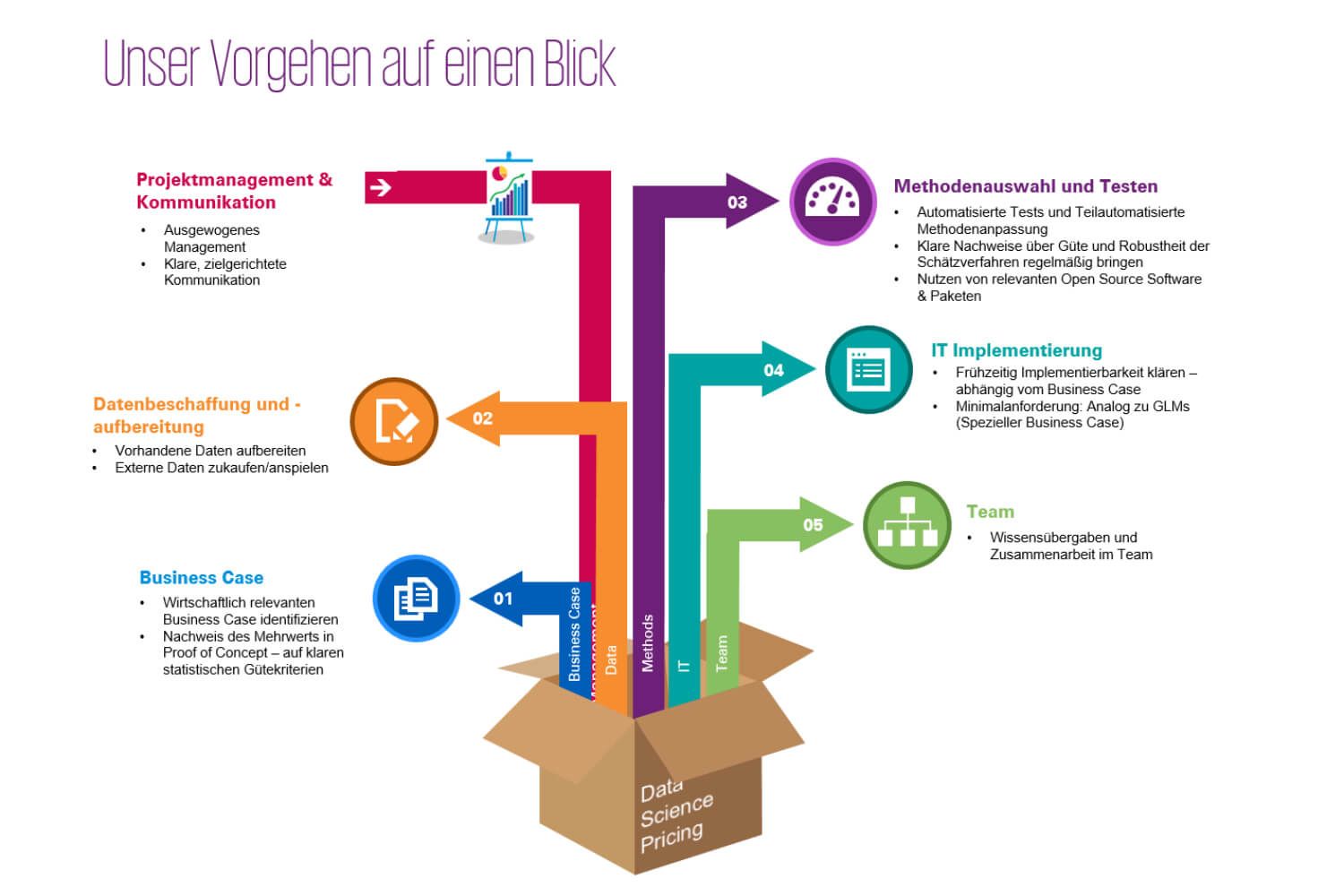

Leveraging Data Analytics in Pricing

The infographic illustrates data science methods in pricing