Going public is the culmination of a longer-term strategic plan for the lifecycle of your company. Whether you're a successful entrepreneur looking for investors to take your company to the next level or a private equity investor looking at an exit strategy, it's important to spend time determining whether going public is the best option for your business.

There are substantial benefits to becoming a public company, however, the IPO process brings with it some disadvantages and challenges so a careful review of all your financing options should be performed before committing to go public.

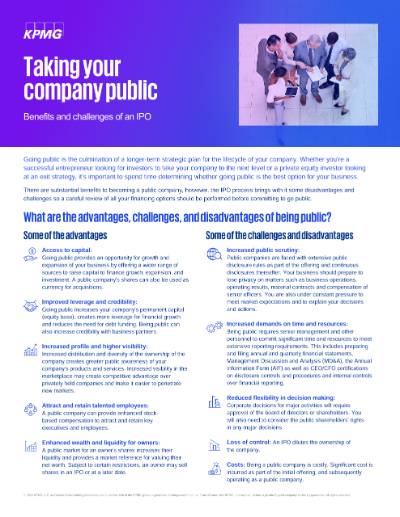

What are the advantages, challenges and disadvantages of being public?

Some of the advantages:

- Access to capital: going public provides an opportunity for growth and expansion of your business by offering a wider range of sources to raise capital to finance growth, expansion and investment. A public company's shares can also be used as currency for acquisitions.

Improved leverage and credibility: going public increases your company's permanent capital (equity base), creates more leverage for financial growth and reduces the need for debt funding. Being public can also increase credibility with business partners. - Increased profile and higher visibility: increased distribution and diversity of the ownership of the company creates greater public awareness of your company's products and services. Increased visibility in the marketplace may create competitive advantage over privately held companies and make it easier to penetrate new markets.

- Attract and retain talented employees: a public company can provide enhanced stock-based compensation to attract and retain key executives and employees.

- Enhanced wealth and liquidity for owners: a public market for an owner's shares increases their liquidity and provides a market reference for valuing their net worth. Subject to certain restrictions, an owner may sell shares in an IPO or at a later date.

Some of the challenges and disadvantages :

- Increased public scrutiny: public companies are faced with extensive public disclosure rules as part of the offering and continuous disclosures thereafter. Your business should prepare to lose privacy on matters such as business operations, operating results, material contracts and compensation of senior officers. You are also under constant pressure to meet market expectations and to explain your decisions and actions.

- Increased demands on time and resources: being public requires senior management and other personnel to commit significant time and resources to meet extensive reporting requirements. This includes preparing and filing annual and quarterly financial statements, Management Discussion and Analysis (MD&A), the Annual Information Form (AIF) as well as CEO/CFO certifications on disclosure controls and procedures and internal controls over financial reporting.

- Reduced flexibility in decision making: corporate decisions for major activities will require approval of the board of directors or shareholders. You will also need to consider the public shareholders' rights in any major decisions.

- Loss of control: an IPO dilutes the ownership of the company.

- Costs: being a public company is costly. Significant cost is incurred as part of the initial offering, and subsequently operating as a public company.

To learn more about how we can help you to access the capital markets, contact one of our KPMG in Canada IPO Advisory professionals.

Insights and resources

Connect with us

Stay up to date with what matters to you

Gain access to personalized content based on your interests by signing up today

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia