It is widely accepted that, despite best intentions, many New Zealand organisations are not meeting their obligations under the Holidays Act.

We are now a few years on from when the issue initially surfaced and we are still seeing an increasing number of new high profile cases emerging.

It is evident that there is a higher degree of awareness of the issue, with some important court rulings addressing problematic areas such as ‘what constitutes ordinary pay based on the frequency of payment’. One of the largest payroll system providers has recently acknowledged issues with some of its payroll systems.

The regulatory body has also significantly stepped up payroll audits from 2016 and there has been wide-spread media coverage of some high-profile holiday pay remediation projects completed and in progress, with some back-payment liabilities ranging in the tens of millions. This is prompting businesses to ask “are we sure we are paying the correct amount of holiday pay?”

Currently, a key consideration during mergers and acquisitions is holiday pay exposure and we are seeing more deals requiring due diligence over this as well.

The Government commissioned a review of the current legislation which has now been completed and the findings are currently being presented. This may result in changes to the Act and/or further guidance on the application of the Act in the near future potentially requiring further work by employers to ensure their systems and processes are compliant.

Whilst economic recovery is currently taking centre stage, organisations’ compliance obligations still remains with the risk of the financial exposure increasing.

If your organisation is yet to assess its compliance position or you are nervous as to whether your initial assessment was robust enough, there are some clear red flags in terms of determining whether you have a risk of non-compliance. Some common issues for employers include a workforce that works variable hours regularly, payment of allowances, commission and bonuses, regular changes to employee’s work pattern, work performed over public holidays and multiple types of employment contracts. Experience tells us that there are a number of factors which makes it notoriously difficult to meet the requirements of the Act, thereby increasing the risk of non-compliance, some of which are not fully in the control of employers:

- The design of the Act which requires the exercise of judgments consideration of employees’ work patterns is open to interpretation;

- Incorrect Payroll system configuration;

- Currency of measure: Payroll systems are designed to track in hours whereas the Act talks about holiday pay in ‘weeks’ and ‘days’;

- Incorrect payment and provision of entitlements to casual and fixed term labour;

- Set and forget payroll practices, that are not reviewed or updated to reflect the current work environment;

- Lack of expertise in the payroll function; and

- Incorrect treatment of different pay components.

Request a Self-Assessment Checklist

To provide insights into your Holidays Act compliance position, please contact Associate Director, Mosh Hilal to request a Self-Assessment Checklist.

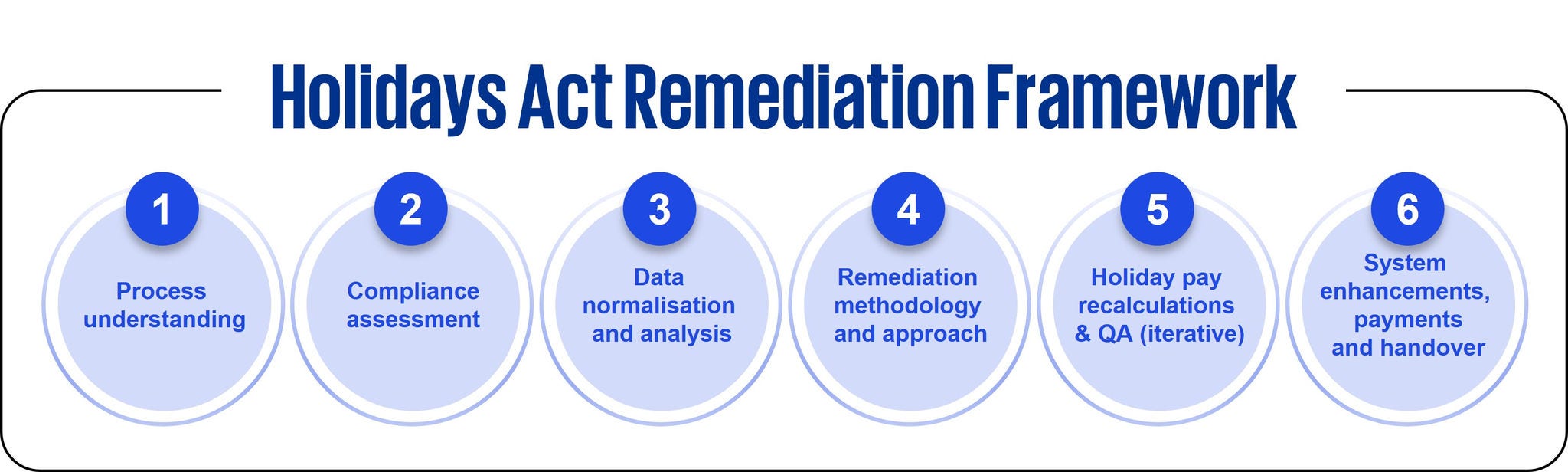

Identification of non-compliance is only one part of the issue faced by organisations. The remediation of non-compliance is proving to be a bigger challenge due to the need for a multi-disciplinary team who understand the requirements of the Act and are able to develop and implement practical solutions.

Depending on the size of your organisation, remediation projects can take over a year to complete and require extensive stakeholder engagement and financial investment. Some of the common considerations during Holidays Act remediation include:

- Availability and the quality of the data;

- Translating the legal requirements into your business context;

- Effective communication and engagement with stakeholders (e.g. employees, regulator, unions, etc.);

- Contacting and validating former employees;

- Enhancement of payroll systems, procedures and practices to ensure compliance on a go-forward basis; and

- Impact of other legislation e.g. Unclaimed Money Act 1971.

Inability to correctly navigate through the above can result in significant underpayments and/or overpayments. Other issues include:

- Ongoing non-compliance resulting in further exposure and regulatory scrutiny;

- Heightened risk of fraudulent claims of back-pay when trying to contact and remediate former employees’; and

- Poor employee engagement and reputational damage.

Holidays Act compliance assessment and remediation also provides an opportunity for employers to identify root causes for historical overpayments which is very common and can result in significant leakage. As part of the go-forward remediation, enhancements and controls can be implemented to manage this ris

Remediation for ex-employees presents its own unique challenges, particularly in relation to communicating with ex-employees which can be time-consuming due to the effort required to:

- Contact terminated employees;

- Demonstrate to the regulator that you have made reasonable effort to contact terminated employees;

- Validate the ex-employees to ensure they are legitimate and not fraudulent;

- Process back-pay calculations;

- Communicate with ex-employees on back-pay results; and

- Resolve/address queries raised by ex-employees.

The KPMG Holidays Act Terminated Employees Management (TEM) portal is a proven solution to automate many of the time-intensive and risk-prone tasks. TEM portal has been designed in collaboration between our Holidays Act experts and our public-sector focused cloud development team, who call upon wide ranging experience, building large scale public-facing notification systems.

The portal utilises cutting edge Azure cloud technology, and is designed to be easy to use, scalable, and secure. Ex-employees (users) have a seamless, friendly interface to submit their application and track progress, helping minimise the number of queries your customer service team receive.

Our modular solution design enables the tool to be rapidly deployed to your organisations’ cloud, or if preferred, we can host the tool in our highly secure KPMG Azure cloud. This design also ensures there is minimal input required from technical specialists within your organisation.

One of the key benefits of TEM is that it can be easily customised in its appearance and messaging to suit the respective organisation culture, look and feel. This helps create that personal connection and ex-employees have a better experience using the portal.