Trade & Customs publications

News and articles on trade developments, tariffs, laws, and regulations.

Articles

Latest Releases on Trade Trends

Export Controls and Sanctions

Compliance, Savings, and Tariff Management

Reports & Surveys

Tariffs and Valuation

Tariffs can have a substantial effect on any valuation analysis. Learn more about how to assess rapidly changing policies and environments that are creating significant uncertainty which may need to be reflected in any valuation analysis.

The New Steel and Aluminum Tariffs Explained - What Companies Need to Know

The latest updates to Section 232 introduce significant compliance challenges for importers of steel and aluminum derivatives, but proper measures can also avoid overpaying the tariffs.

Reciprocal Tariff Pause: The 90 Day Countdown

The Reciprocal Tariff Pause represents a unique and transformative opportunity for companies to reassess and enhance their trade compliance programs.

Duty Drawback for Reciprocal Tariffs

US Customs and Border Protection recently clarified that U.S. duty drawback would be permitted for reciprocal tariff duties. As a result, companies that import and subsequently export products may be eligible to reclaim these duties.

The ROI of Global Trade Management Systems

With rapid changes in global trade regulations, the risk of noncompliance has increased. To minimize compliance risks and improve operational efficiency, adopting a global trade management (GTM) system becomes a compelling choice.

Export Compliance in the Life Sciences - Keys to International Growth

In the evolving world of pharmaceutical and life sciences, it is vital for companies to understand the activities that involve exports and expose them to risks, and how to mitigate those risks with an effective internal compliance program.

New Chief Trade Officer's First 100 Days

The KPMG Trade & Customs practice helps companies keep up with changing global trade regulations while processing transactions in real time without compromising compliance.

2019 Tariff Survey Infographics

How are tariffs impacting organizations? Over 100 trade and operations professionals share their insights.

Duty Drawback Industry Benchmarking

This survey gauges the impact of Duty Drawback as a mechanism to recover increased punitive tariffs by section 201 and 301 as well as the effect of regulatory changes enacted by the Trade Facilitation and Enforcement Act.

Trade Enforcement Survey 2018

This report provides the finding of how industry peers are prepared for, or managing, U.S. Customs and Border protection reviews and audits.

First Sale for Export Retail Industry Benchmarking

This report provides the findings of the FSFE Survey conducted by KPMG in 2018.

How to Make the Case for Global trade Management Systems

When building your case, and corresponding ROI, you must look at the totality of your company's circumstances.

2021 Export Controls & Sanctions Survey

Balancing business priorities and risk realities - In February 2021, KPMG engaged export and sanctions professionals at multinational firms to gather their input on a variety of business-critical issues.

2020 Transfer Pricing and Trade Compliance Survey Results

This survey provides insight into how companies handle, manage, and react to transfer pricing adjustments from a tax and customs perspective.

How Do Tariffs Affect Deal Value?

This report spotlights five questions that can help organizations understand the role of trade and tariffs in determining deal value.

A Framework for OFAC Compliance Commitments: An Overview

On May 2, 2019, the office of Foreign Assets Control (OFAC) released "A Framework for OFAC Compliance Commitments" (the Framework), which details the agency's view on the most important elements of a sanctions compliance program (SCP).

Trade Enforcement Survey 2018

This report provides the finding of how industry peers are prepared for, or managing, U.S. Customs and Border protection reviews and audits.

Blockchain Solutions for Duty Drawback

Duty drawback is one of the most complex areas of global trade. Our blockchain solution helps pre-validate data in one location, helping you to efficiently and smoothly validate and file your drawback claims.

Key Controls for Export Compliance Programs

Your export controls and sanctions program rests on your key controls. Identifying and managing them is central to maintaining a strong compliance program.

Learn more

Navigating Tariff Complexity: A Strategic Lens for Business Resilience

Managing tariff risks and unlocking business opportunities

Identifying and mitigating corporate exposure to tariffs

A thorough approach to tariff mitigation

Integrating Tariff Modeling with Economic Indicators for Enhanced Tariff Reduction

Explore strategic approaches to help minimize the financial impact of new tariffs and maintain supply chain stability.

Customs Valuation Strategies to Manage Tariff Disruption

Explore strategies to assist your business in mitigating the financial implications of tariffs on imported products

External Publications

Transfer Price Adjustments Don’t Necessarily Increase Import Duty Costs

June 2021

This articles discusses how the global pandemic has forced multinational enterprises to reassess previous transfer pricing policies and consider making compensating adjustments to bring their intercompany transfer price for goods into an acceptable arm's-length range, often retroactively.

Transfer Price Adjustments Don’t Necessarily Increase Import Duty Costs

June 2021

In this article, the authors discuss challenges arising for multinational enterprises to mitigate the effects of the fluctuations in the prices of imported goods from a customs perspective.

Confronting Tariffs: Trade War Tips for CPAs

January 2020

Trade & Customs leaders from KPMG share tactics and strategies CPAs can use to assist their organizations as they turn today’s trade disruption into a competitive opportunity now and in the years ahead.

Transfer Pricing Adjustments? Don’t Forget About Customs

January 2019

Multinationals may make new or larger-than-usual financial adjustments to bring transfer prices within arm’s length ranges as a result of additional tariffs. This article focuses on these transfer pricing adjustments.

Service Insights

Navigating the New Reciprocal Tariffs

In response to trade imbalances, the US has implemented reciprocal tariffs on most imports from all countries, beginning April 5, 2025.

First Sale for Export: A Crucial Savings Opportunity

The importance of First Sale for Export has exploded given the dynamic trade landscape, especially under the current tariff environment. First Sale drives continual savings with minimal investment. If your company isn't leveraging it - you may be a step behind.

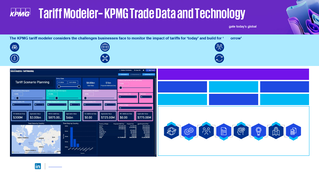

Tariff Modeler

The KPMG approach to tariff modeling leverages the latest technology, including GenAI, while considering the data needed to navigate today’s global trade disruption. Digital transformation for our clients aligns your global trade data and technology with your organizational objectives.

Labor Risk Dashboard

Labor exploitation is pervasive across the private sector and a scourge for businesses globally. KPMG can help assess your risk and prioritize action.

Updated CTPAT Trade Compliance Program Requirements

The Customs Trade Partnership Against Terrorism (CTPAT) Trade Compliance Program is a core trade compliance program for many importers. KPMG can assist with a wide array of CTPAT services.

U.S. Duty Drawback - Why Now?

Duty drawback might seem tricky, but the right combination of automation and human know-how allows for a streamlined process that optimizes duty recovery while prioritizing compliance.

Foreign Trade Zone Services

Making sound investments in trade technology and processes to meet changing regulatory requirements is integral to the efficient and compliance operation of a foreign-trade zone (FTZ).

Enhanced Export Due Diligence

KPMG Trade & Customs services helps clients meet the ever-increasing regulatory expectations for end-use and end-user export due diligence.

New Year Brings New Chinese Trade Controls on Cryptography

How China's new import and export controls on commercial cryptography may impact your business.

China's Export Control Law

Professionals from the KPMG Trade & Customs - Global Export Controls and Sanctions practice discuss the Export Control Law of the People's Republic of China, and what it will mean for exporters.

Sanctions Screening Optimization for Corporations

KPMG uses tested methodology to help ensure the success of sanctions screening programs.

BIS Issues Two New Rules with Far Reaching Effect

Getting ahead of Bureau of Industry and Security (BIS) regulations will help exporters remain compliant and limit business disruption.

First Sale for Export: A Crucial Savings Opportunity

First Sale for Export has been a duty-savings mainstay for years. But its popularity has exploded given the dynamic trade landscape. First Sale drives continual savings with minimal investment. If your company isn’t leveraging it—you may be a step behind.

KPMG Buy America, Buy American, Trade Agreement Acts Services

Are you complying with U.S. government domestic preference programs in a global economy?

Trade Savings for Retailers - COVID19

Reducing import costs in a turbulent time to improve cash flow.. How the retail industry can manage trade disruption from COVID-19.

Developing an Agile Tariff Strategy

Learn more about developing an agile tariff strategy while preparing for an economic downturn. There are a number of strategies companies should consider to help exclude, mitigate, recover, and defer tariffs during a period of uncertainty.

KPMG Tariff Tracker (February 2020)

This resource provides a snap shot of Section 301 tariffs on China-origin good; EU-origin-good; and Section 232 tariffs on global steel and aluminum products.

TaxNewsFlash-Trade & Customs

Explore more

Trade and Tariff Insights

Navigating the future of trade and tariffs - Stay informed with KPMG

Policy in Motion: Insights for navigating with confidence

Your resource for the latest on trade, tariff and regulatory policy changes.

Tax Policy Trifecta

Stay informed about potentially significant changes to the U.S. tax landscape in 2025 and beyond. You'll find resources below about proposed and enacted legislation that can help you follow the direction of tax developments in Washington.

Meet our team