Integrating Tariff Modeling with Economic Indicators for Enhanced Tariff Reduction

Explore strategic approaches to help minimize the financial impact of new tariffs and maintain supply chain stability.

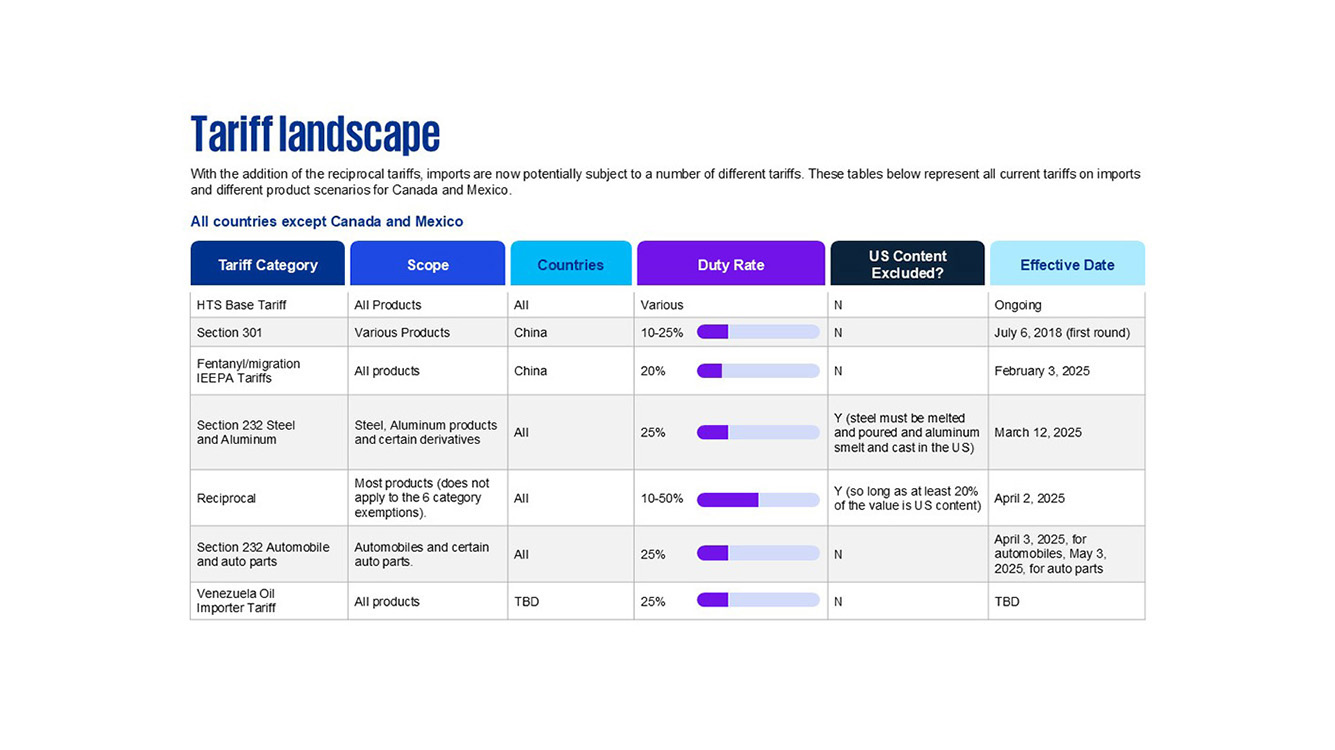

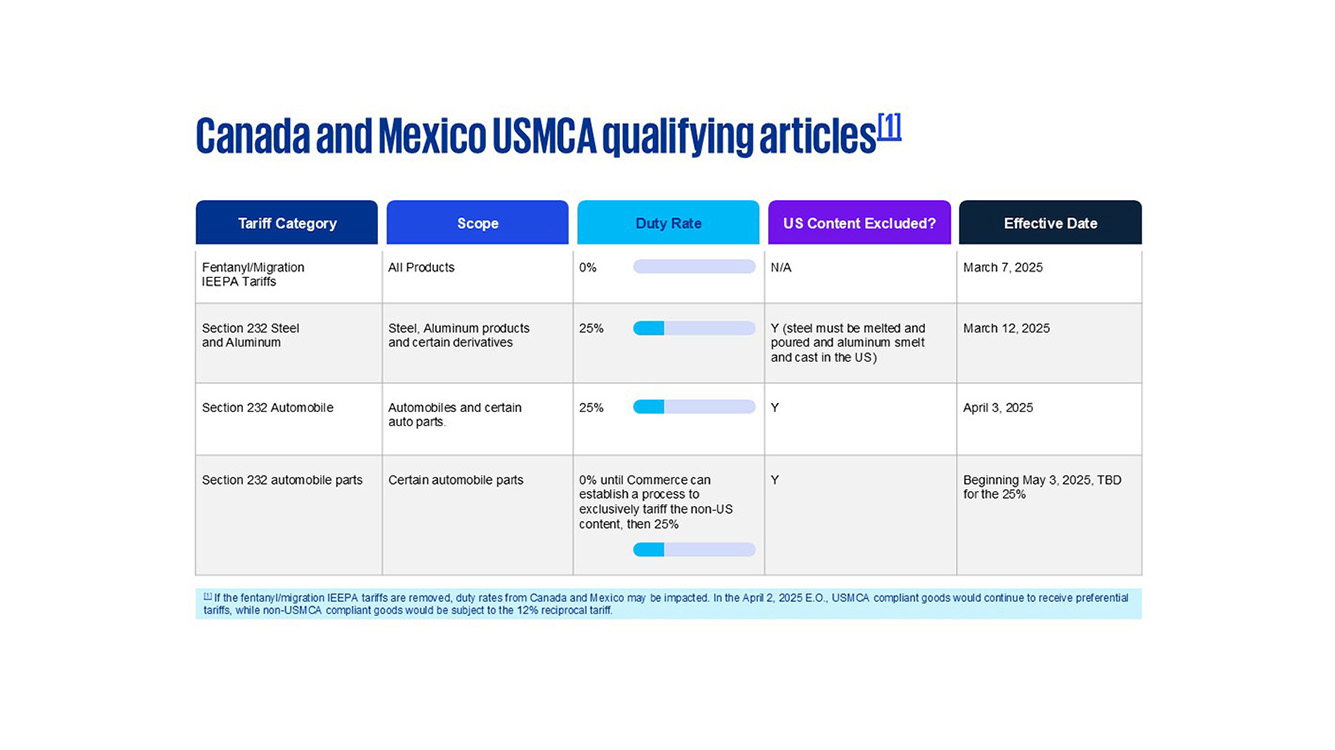

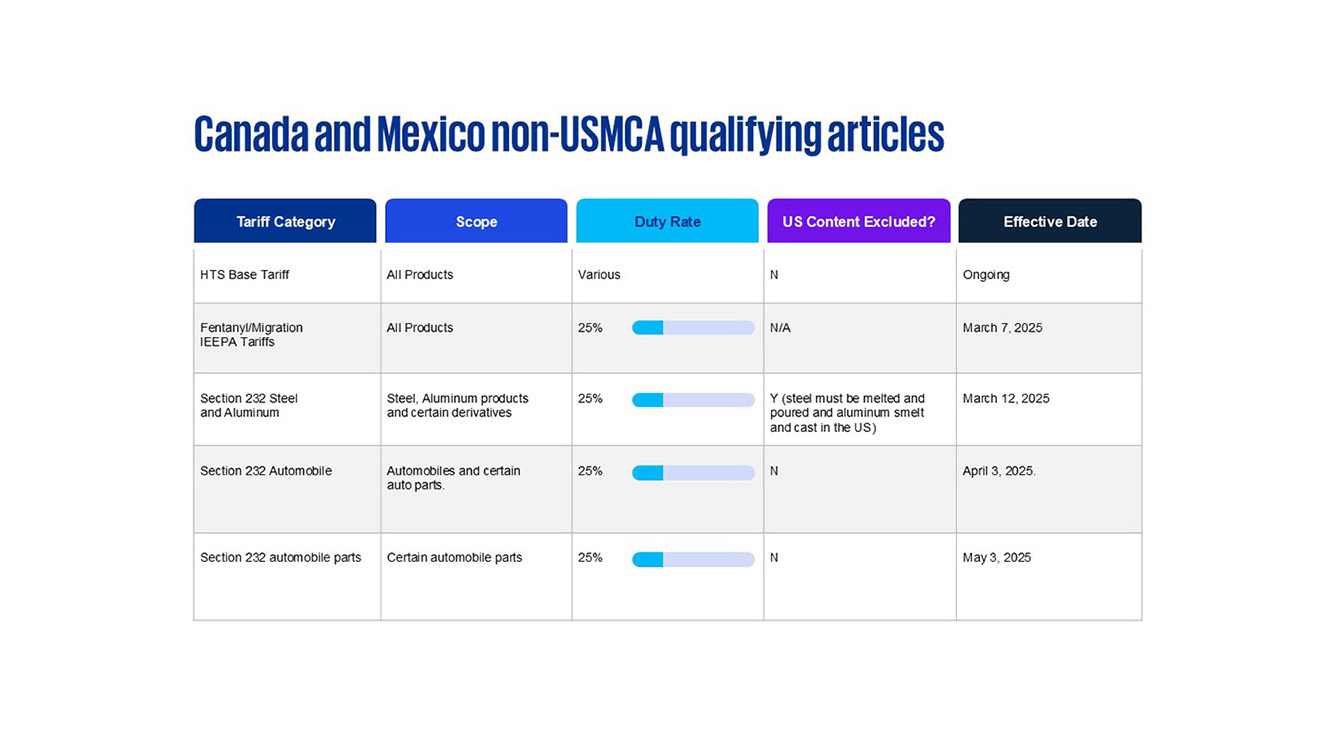

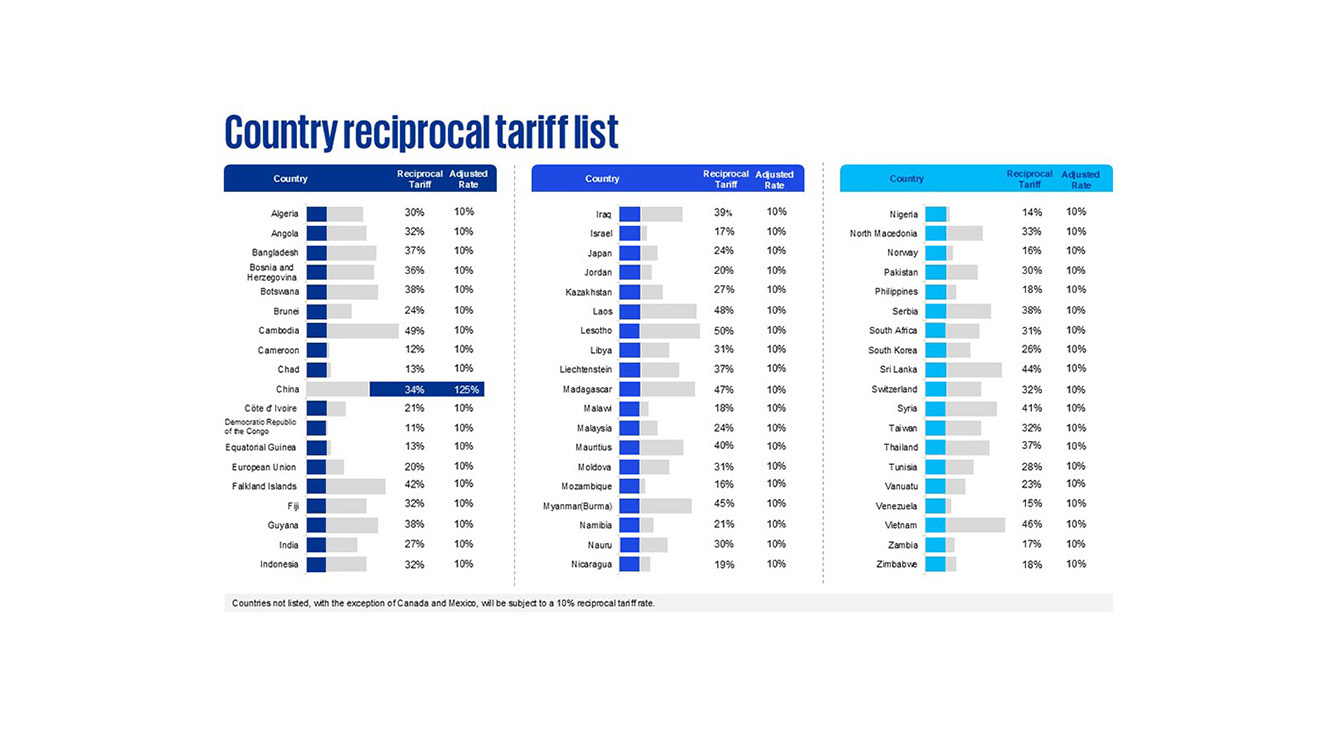

The new tariff regulations announced by President Trump on April 2, 2025, introduce a complex and evolving landscape that businesses must navigate to minimize financial impact and maintain supply chain stability. The "Regulating Imports with a Reciprocal Tariff to Rectify Trade Practices that Contribute to Large and Persistent Annual United States Goods Trade Deficits" Executive Order imposes a 10% tariff on all countries, with additional country-specific reciprocal tariffs set to take effect.

These tariffs are designed to address trade imbalances but come with significant economic consequences. Our research indicates that while tariffs aim to protect domestic industries, they often lead to higher costs for consumers, particularly lower-income individuals, and can stifle economic growth - as seen during the 2018-2019 trade war that saw increased prices on specific goods and reduced investment, with job losses in manufacturing outweighing gains in the steel sector.

Dive into our thinking:

Integrating Tariff Modeling with Economic Indicators for Enhanced Tariff Reduction

Read the full article

Download PDFFor the President and his administration, tariffs are seen as a primary means to several ends:

The current round of tariffs is expected to have even more severe impacts due to their broader scope and the ongoing inflationary pressures.

For detailed information, explore our full analysis including insights from KPMG Economics and Trade & Customs practice that provide strategic guidance and tools to help you navigate the new tariff maze and maintain supply chain stability.

Dive into our thinking:

Tariff Modeler - KPMG Trade Data and Technology

Download PDFExplore more

Customs Valuation Strategies to Manage Tariff Disruption

Explore strategies to assist your business in mitigating the financial implications of tariffs on imported products

Trade and Tariff Insights

Navigating the future of trade and tariffs - Stay informed with KPMG

Policy in Motion: Insights for navigating with confidence

Your resource for the latest on trade, tariff and regulatory policy changes.

Tax Policy Trifecta

Stay informed about potentially significant changes to the U.S. tax landscape in 2025 and beyond. You'll find resources below about proposed and enacted legislation that can help you follow the direction of tax developments in Washington.

Trade & Customs

Global support to navigate change and identify opportunity

Meet our team