Disruption, risk, complexity…and opportunity

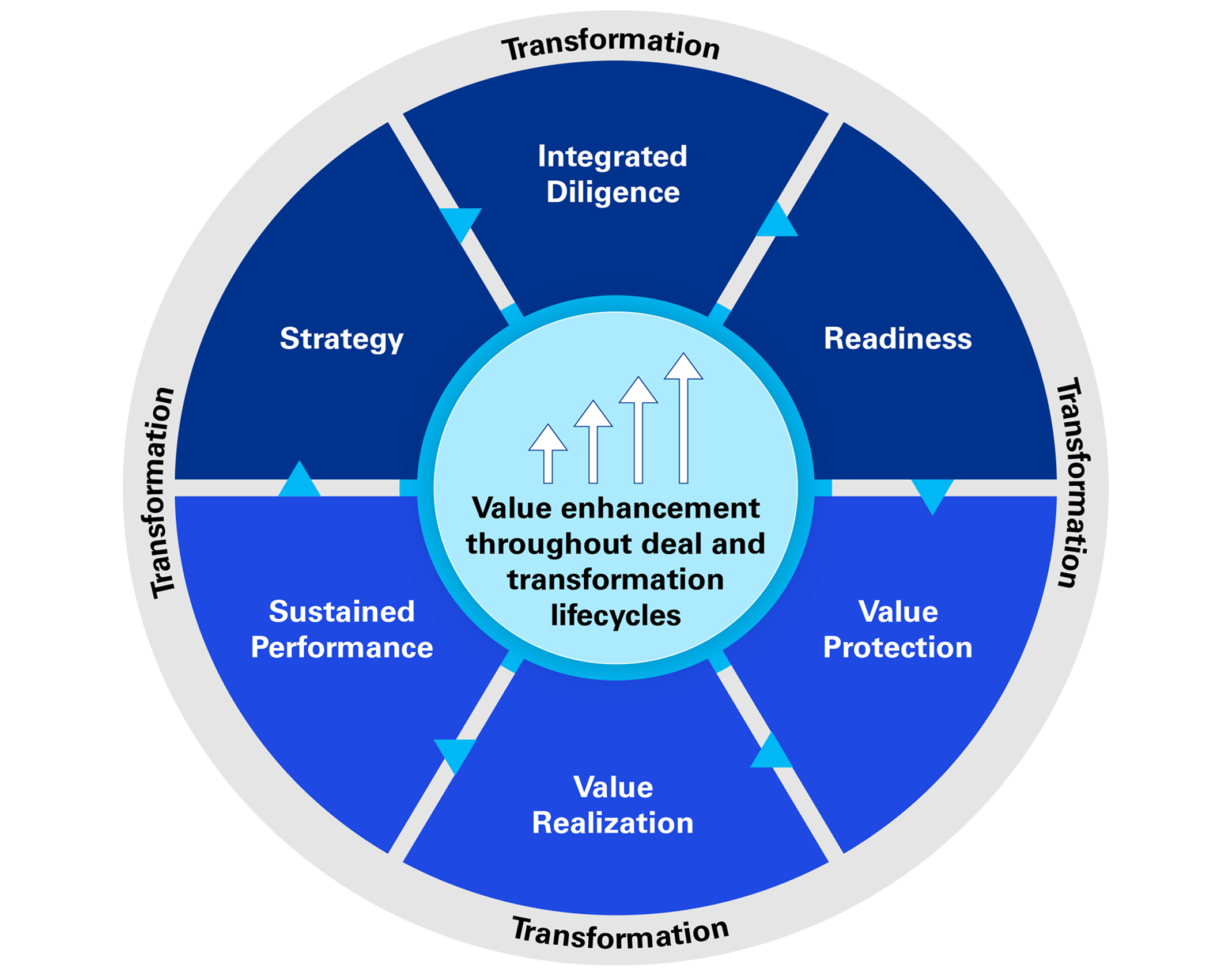

Make the most of M&A opportunities with data-driven, AI-enabled insights that drive faster outcomes. How to be successful in complex M&A. A relentless focus on speed to value and precise execution will help companies achieve superior outcomes. What's at stake. Disruption, risk, complexity…and opportunity. Dealmakers continue to face challenges with their ability to efficiently execute M&A transactions in a complex global environment that includes tariff uncertainties and political volatility. To be a winner in this challenging environment, you need to capitalize on opportunities that enhance value across every step of every deal cycle, from strategy to due diligence, integration, separation, and beyond. And to do that, you need faster insights, more innovative strategies, and a deeper understanding of what’s happening in your industry. Capitalize on a powerful combination of industry and functional expertise and AI-enabled solutions to help you win the right deals and achieve long-term value.