Digital Gateway GenAI. Expect More.

With KPMG Trusted AI as our foundation, we help tax functions build and deploy responsible, ethical and fair GenAI programs that create value across tax operations.

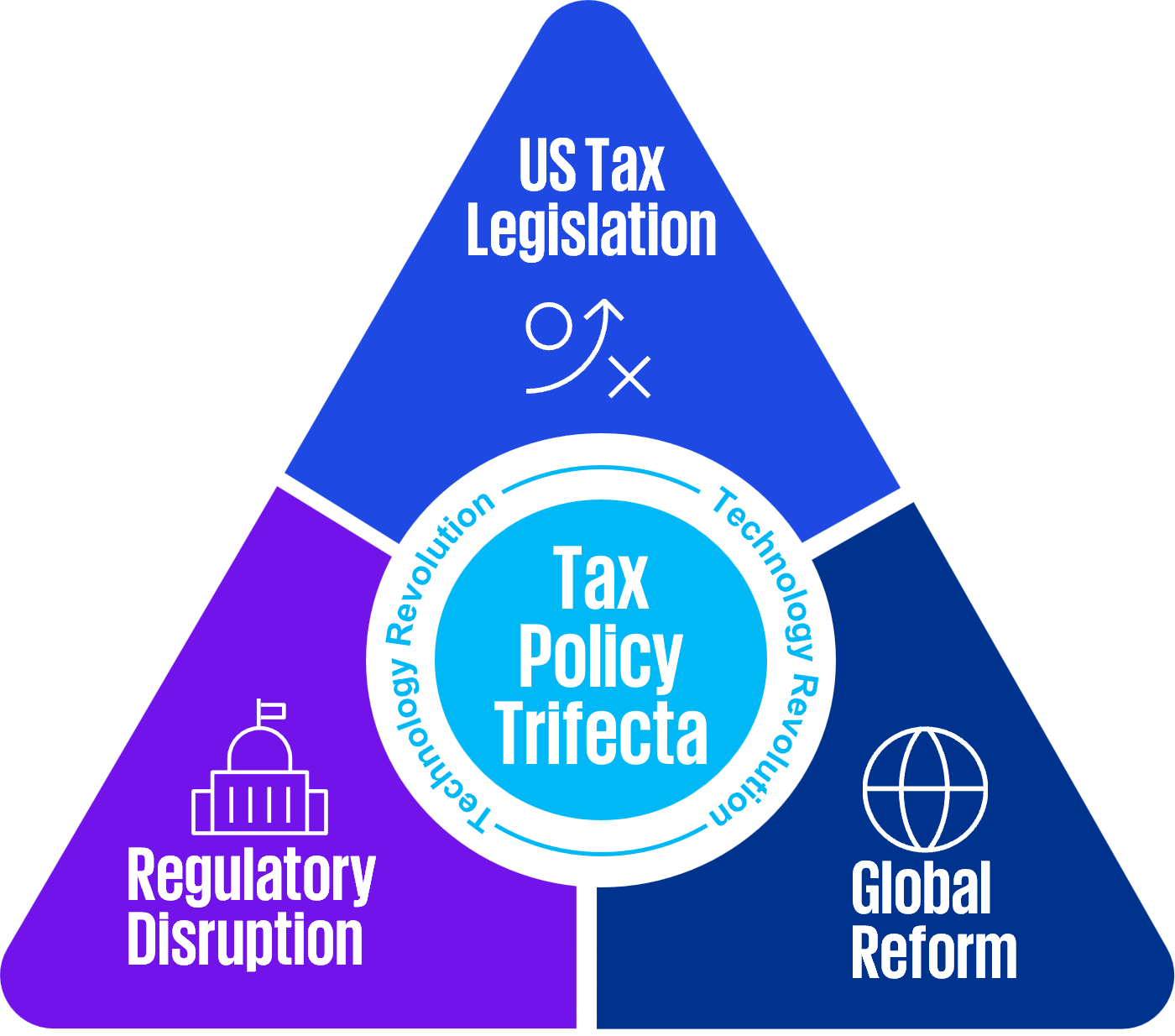

Three significant disruptors are coming together at the same time – understanding and implementing the recently enacted One Big Beautiful Bill, ongoing implementation of the OECD's global tax deal, and frequent regulatory and tariff changes.

These factors are transforming the corporate tax function – are you prepared?

KPMG analysis and observations regarding sector or industry-specific provisions in the bill.

Catching Up on Capitol Hill

Insights from KPMG professionals on what's happening in Washington that affects business taxation

Capitol Hill Weekly

Brief overviews of legislative updates and their implications

TaxNewsFlash

The latest tax developments pertaining to the United States and U.S. industry sectors, and as being reported by KPMG firms from around the globe

January 9, 2026 | New Year, New Bill?

This episode of Catching Up on Capitol Hill covers what Congress might realistically do in 2026 and if it will include tax measures.

November 07, 2025 | Real Estate Tax Chat: A Focus on OB3 and Year-End Planning for 2025

With 2026 fast approaching, join KPMG LLP (KPMG) for a year-end tax planning session that will focus on topics important to real estate companies and investors.

Expensing opportunities for qualified sound recording productions

The One Big Beautiful Bill Act (OB3) adds a new category of assets, known as “qualified sound recording productions” (QSRs).

The One Big Beautiful Bill Act

Key considerations for global mobility programs

During this webcast, we explore the OECD's Pillar Two framework and the recent release of the "side-by-side" agreement. The guidance significantly changes the Pillar Two landscape by providing for an exclusion of U.S. parented groups from the Income Inclusion Rule and Undertaxed Profits Rule under the “side-by-side” system, changes to the treatment of non-refundable tax incentives, and other safe harbors.

January 13, 2026 | Pillar Two Side-by-Side: Has the OECD Finally Found Its Stride?

In this episode of Inside International Tax, we examine the impact on US and foreign multinationals of the OECD’s Side-by-Side Package, which includes the long-awaited Side-by-Side Safe Harbor and other guidance and safe harbors intended to reduce the compliance costs of the GloBE system and protect substance-based credits.

BEPS 2.0: Pillar Two

KPMG insights about the impact of the Pillar Two—global minimum tax rules—and how companies are responding

Pillar Two compliance

Under the new OECD Pillar Two minimum tax regime, companies now face new complex tax reporting requirements. Many multinational enterprises (MNEs) impacted by Pillar Two have already started preparing for these new reporting requirements.

September 3, 2025 | MAP Quest: A Conversation with Doug O'Donnell on Cross-Border Dispute Resolution

In this episode of Inside International Tax, we explore the Mutual Agreement Procedure (MAP) as a treaty-based process for resolving double taxation disputes between countries, focusing on how the MAP process operates at the IRS and internationally.

During this webcast, professionals from the KPMG Washington National Tax office will dive deeper into the implications of OB3. As states begin to calculate the negative impacts of the One Big, Beautiful Bill (OB3) on their upcoming revenues, some states have been quick to decouple from various OB3 tax changes to IRC sections 174, 168(n), and 163(j). If state tax was not already complicated enough, these decoupling acts are proving to have impacts far beyond what was expected.

KPMG Tariff Modeler

Identify the impact of tariffs for today and build for tomorrow.

Data-driven tariff recovery services

Unlock speed, accuracy, and savings

Trade and Tariff Insights

Navigating the future of trade and tariffs - Stay informed with KPMG

Customs Valuation Strategies to Manage Tariff Disruption

Explore strategies to assist your business in mitigating the financial implications of tariffs on imported products

With KPMG Trusted AI as our foundation, we help tax functions build and deploy responsible, ethical and fair GenAI programs that create value across tax operations.

Harnessing GenAI for Research Tax Credits

Why combining human expertise with AI is the future of research tax credit strategy

GenAI and the evolution of indirect tax: Why, where, and how

Learn how to harness the power of GenAI in the Indirect tax function.

Chief Financial Officer Pulse Survey

A 2025 tax cliff, global reform, and regulatory changes—the “Tax Policy Trifecta”—is poised to create massive disruption for businesses, triggering the need for the strategic evolution of tax departments.

8 leading practices for standing up a GenAI program for tax

A strategic and technical guide for tax leaders to harness the power of GenAI in the tax function