Pillar Two compliance

Under the new OECD Pillar Two minimum tax regime, companies now face new complex tax reporting requirements. Many multinational enterprises (MNEs) impacted by Pillar Two have already started preparing for these new reporting requirements.

Pillar Two compliance—Navigating the complexity

Download PDFIt is essential that you become familiar with the details regarding the frequency, complexity, and due dates for various forms and returns related to OECD Pillar Two compliance.

KPMG is well-positioned to help companies meet these complex filing requirements. The KPMG delivery model for Pillar Two compliance consists of various technology tools and a global network of tax professionals who are up to speed on leading practices and approaches for evolving Pillar Two compliance requirements.

Why KPMG

KPMG offers a thorough and tailored approach to assist companies with meeting their Pillar Two compliance requirements. Our balanced delivery model, managed service solution, and three-tier delivery model offers efficient and effective compliance processes. KPMG technology solutions and Digital Gateway platform, provide centralized data management, real-time visibility, and audit-ready reporting. Our far-reaching KPMG global organization and extensive experience with global tax compliance makes KPMG well-equipped to support multinational companies in navigating the complexities of Pillar Two compliance.

Dive into our thinking:

Pillar Two compliance—Navigating the complexity

Download PDF

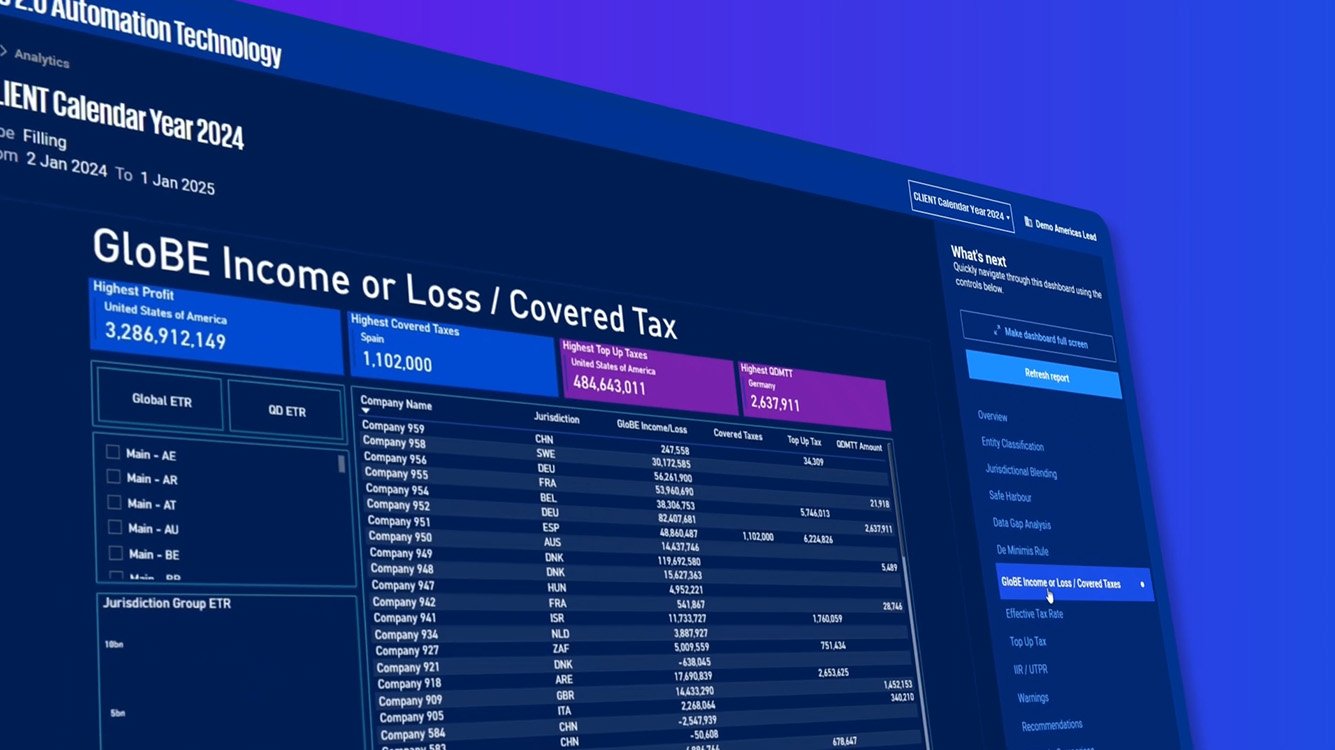

KPMG BEPS 2.0 Automation Technology (KBAT)

KPMG BEPS 2.0 Automation Technology (KBAT) is a scalable and transparent solution that integrates with the KPMG Digital Gateway platform and modeling suite to produce relevant Pillar Two GloBE Information Returns and local reporting packages.

Sign up for the KPMG BEPS 2.0 Automation Technology (KBAT) Demo

Explore more

BEPS 2.0: Pillar Two

KPMG insights about the impact of the Pillar Two—global minimum tax rules—and how companies are responding

Be ready for disruption - tax insights

Tax insights and analysis to help organizations respond with speed and confidence

Inside International Tax

A KPMG TaxRadio podcast series, features insights into current international tax trends and developments.

Pillar Two Insights Center

Gain forward-thinking insights on BEPS 2.0 Pillar Two regulations.

Explore services

International Tax

Helping multinational organizations succeed in the current complex international tax environment.

Learn moreModeling a World of Tax

The far reaching power of KPMG tax models.

Learn moreWashington National Tax

The technical core of the U.S. Tax practice

Learn moreMeet our team