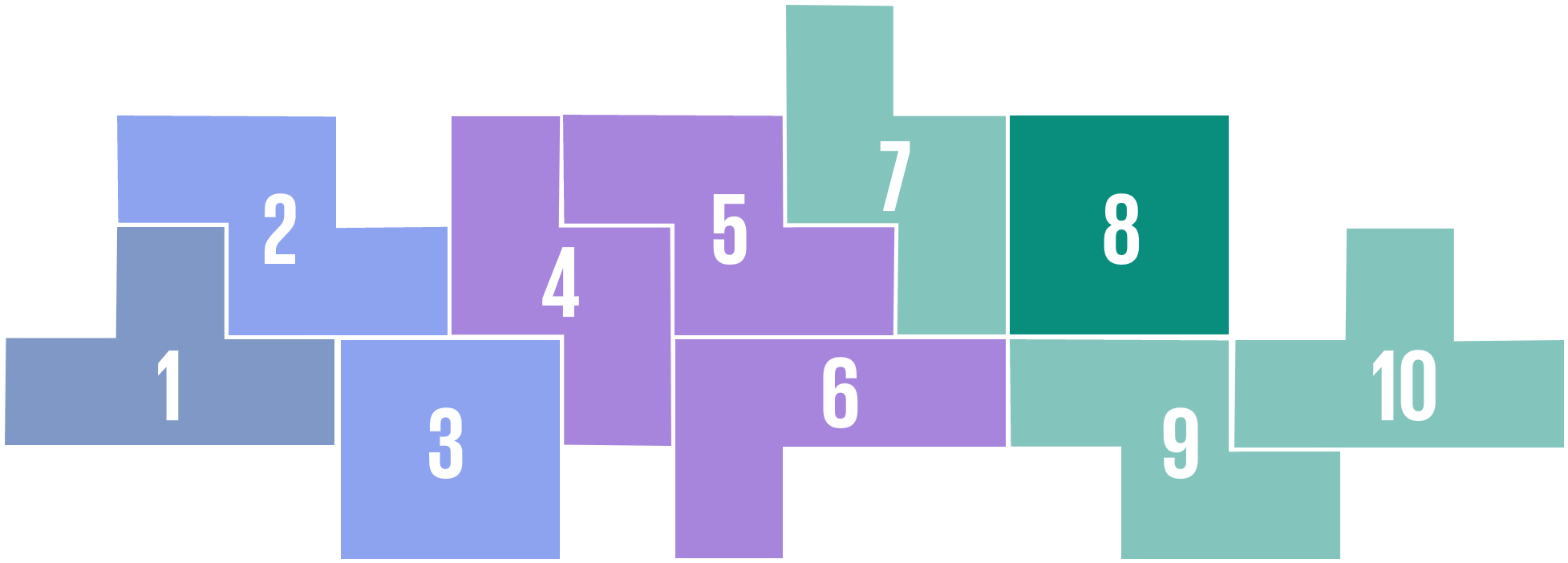

08 Driving Capital Formation & Growth

Ten Key Regulatory Challenges of 2026

Focus on capital-raising sources to promote economic growth and innovation, including private credit, public markets, and the role of retail investors.

“The likely continuation of decreasing interest rates will drive M&A and IPO activity. For banks, size and scale will matter as they face the challenges of AI adoption and a rapidly changing regulatory environment; developing a strategy will be challenging given market sentiment that remains unpredictable.”

Henry Lacey

Principal

Advisory

“Accelerated regulatory approvals are driving an uptick in large-scale banking M&A and regional bank consolidation, with the approval window for major deals now shortened to approximately three months.”

Nadia Orawski

Principal

Advisory

“This is a time of both opportunities and risks. Easing of regulatory constraints and the rise of private assets means companies will need to evolve their risk and compliance programs to protect their customers and their own reputations.”

Mike Sullivan

Partner

Advisory

Private Credit

Rapidly expanding segment of nonbank financial intermediaries highlights a shift from traditional bank financing to alternative sources. Regulatory concerns include the potential for elevated systemic risk through interconnectedness with other financial entities, combined with a lack of transparency or reporting on private credit market participants.

Examples | What to Watch |

|

|

IPO Revitalization

Responding to an extended decline in the number of IPOs, regulators (and legislators) seek to revitalize the attractiveness of IPOs as a means of raising capital (e.g., easing requirements such as reduced documentation and investor communications as well as scaling certain requirements post-IPO) and bringing more investment opportunity and diversification to the public markets.

Examples | What to Watch |

|

|

Retail Access & Protections

Intended expansion of retail investor access, with safeguards, to invest in private market opportunities, giving consideration to ideas such as:

- Amending rules for accredited investors and exempt offerings.

- Permitting retail investment (through funds) to invest in private funds.

Examples | What to Watch |

|

|

Bank Formation

Acceptance of new bank entrants/models to accommodate changes in the financial markets; areas considered include:

- ILCs, de novo bank charters.

- Revisions to expand eligibility of private equity and other nonbank entities to bid for failed banks.

Examples | What to Watch |

|

|

Mergers & Acquisitions

Continued application of existing guidance focusing on anti-competitive transactions to maintain open, competitive markets and encourage innovation.

Executive directives will impact cross-border transactions in areas related to global supply chains, tariffs, “critical technologies,” and national security.

Examples | What to Watch |

|

|

08 Driving Capital Formation & Growth

Read the document

Download the SectionDive into our thinking:

Explore more

Get the latest from KPMG Regulatory Insights

KPMG Regulatory Insights is the thought leader hub for timely insight on risk and regulatory developments.

Meet our team