Working capital trends in the US market

Opportunity to unlock liquidity, lower the cost of capital, and support strategic investments

Economic environment

US companies continue to face a dynamic macroeconomic landscape shaped by trade policy uncertainty, tight credit conditions and cautious consumer behavior. Despite relatively resilient economic outcomes, the focus on liquidity and operational efficiency remains paramount.

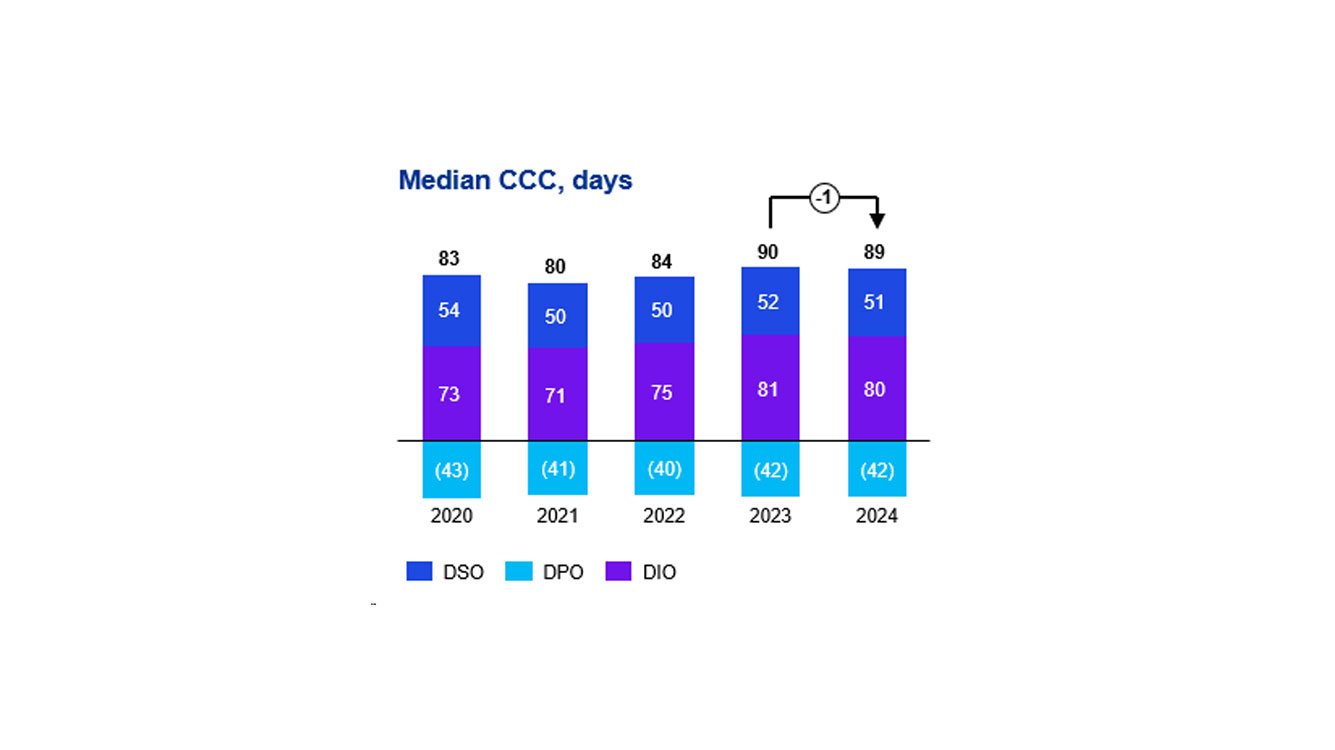

We analyzed working capital trends across a sample of over 2,700 US public companies from 2020 to 2024, with breakdowns by sector and company size. Our analysis shows that working capital levels, measured by the Cash Conversion Cycle (CCC), increased from 83 to 90 days between 2020 and 2023, before slightly improving to 89 days in 2024.

Working capital performance

The overall CCC in the US showed a modest upward trend from 2020 to 2023, peaking at 90 days, followed by a slight improvement to 89 days in 2024. This trajectory was primarily driven by elevated inventory levels (DIO), which rose from 73 days in 2020 to 80 days in 2024—indicating persistent inventory holding challenges. Days Sales Outstanding (DSO) decreased slightly, ending at 51 days in 2024. Days Payable Outstanding (DPO) remained flat at 42 days in 2024, suggesting consistent supplier payment terms and practices over the period.

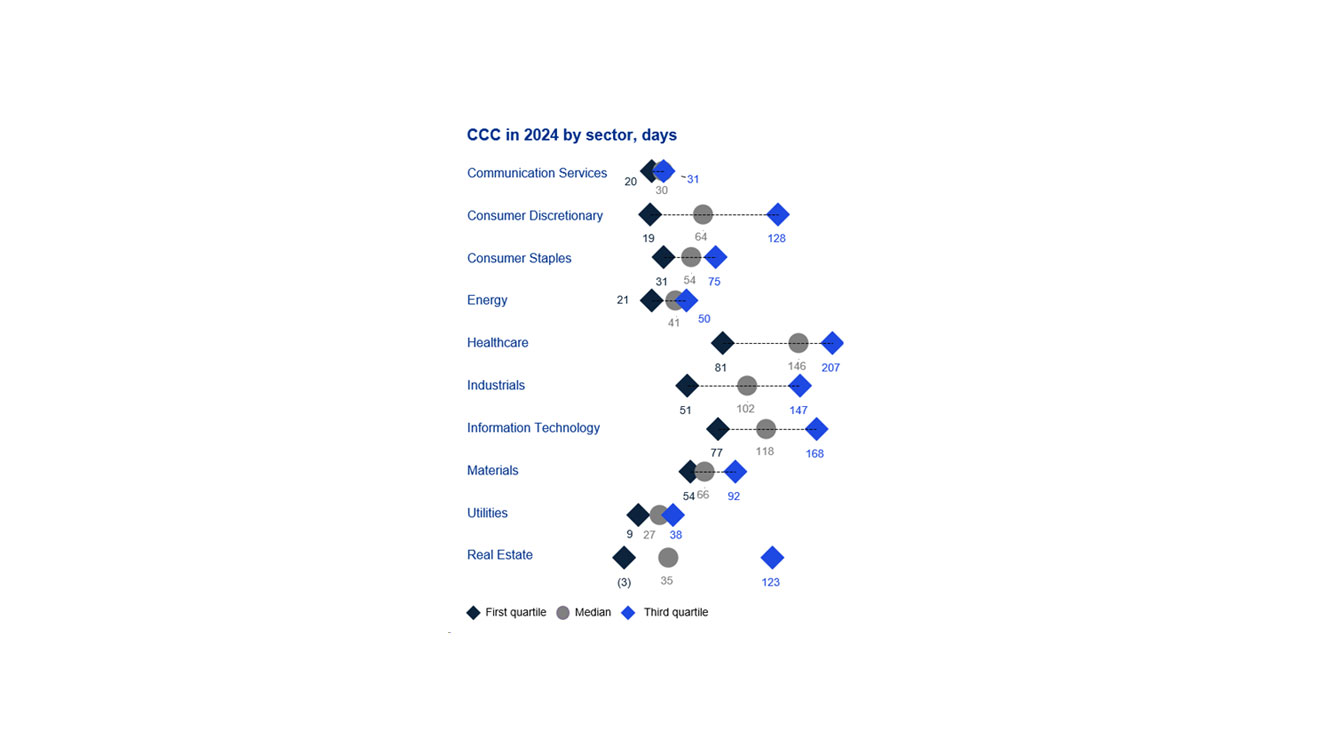

Insights by sector

In 2024, the median CCC varied significantly across US sectors. The Healthcare (146), Information Technology (118), and Industrials (102) sectors reported the highest median CCCs, reflecting longer cash cycles and potential inefficiencies. The wide interquartile ranges in sectors such as Consumer Discretionary (19 to 128), Real Estate (-3 to 123), and Healthcare (81 to 207) highlight the diversity in business models and working capital practices, pointing to opportunities for targeted improvements.

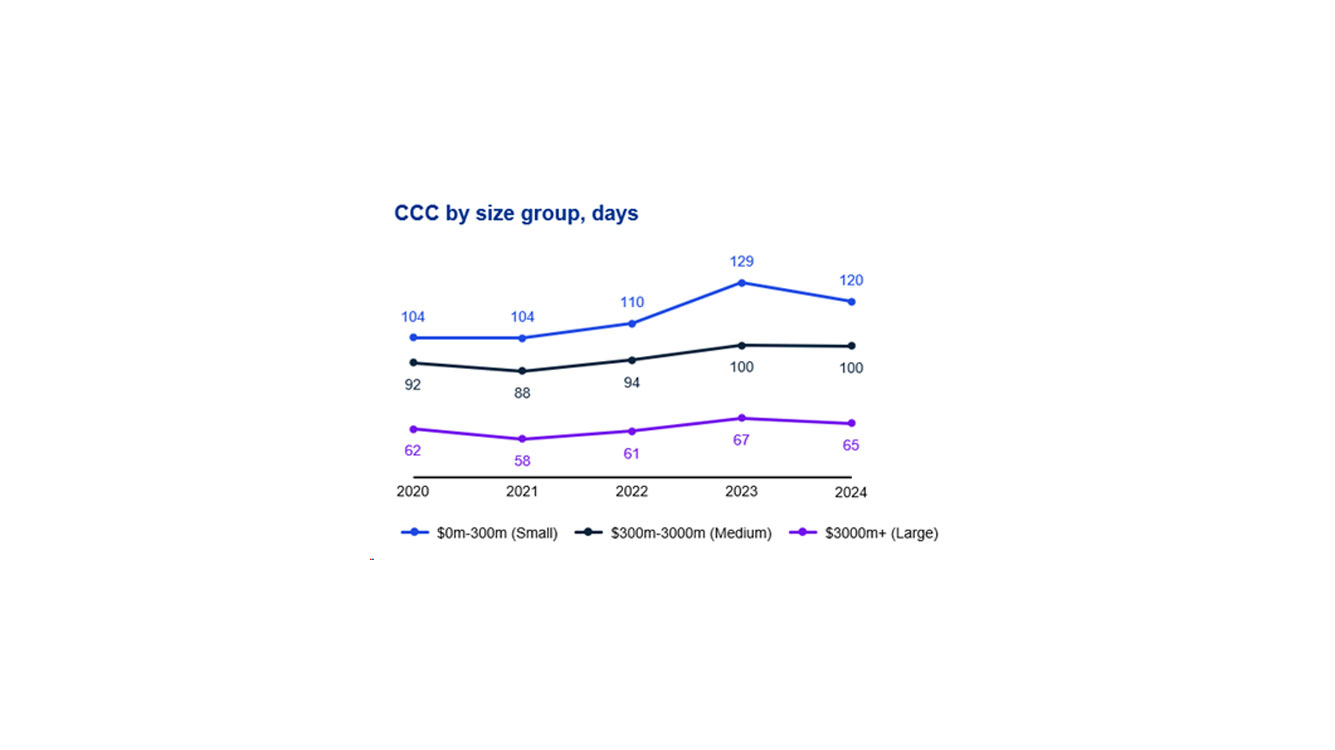

Insights by size

In 2024, small US companies (revenues < $300m) had the highest CCC at 120 days, down from 129 in 2023. Medium-sized companies (revenues between $300m and $3.0bn) maintained their CCC at 100 days, showing stabilization. Large companies (revenues > $3.0bn) saw a slight improvement in CCC from 67 to 65 days, suggesting continued focus on working capital efficiency.

Working capital remains vital and maintaining consistent focus is essential. It presents an opportunity to unlock liquidity, lower the cost of capital, and support strategic investments—especially in times of economic uncertainty.

Sign-up to receive Performance Improvement insights

Stay ahead with insights and actionable strategies designed to elevate your business performance across your organization.

How we can help

We help organizations to rapidly identify and deliver quick wins and sustainable working capital improvement, for example through:

- rapid cash and working capital improvement diagnostics that quickly identify sources of upside and the steps needed to achieve this value;

- implementation support to help our clients define, develop and implement practical changes to their business; and

- a suite of digital tools that can help our clients proactively identify and address working capital issues.

Contact one of our specialists to discuss how we can help your organization elevate its working capital management.

Meet our team

How can KPMG help you realize value?

KPMG's goal is to help you through your transformation or crisis so you can focus on delivering on your business objectives. Find out how KPMG firms use our global expertise, a multidisciplinary approach and wide-ranging experience to support your organization.