State Series: Financial Consumer Protections

Increasing state legislative and enforcement activity

KPMG Regulatory Insights

- Fair and Responsible: With federal policy and regulatory changes, there is growing uncertainty as to what/if a new standard will take shape or the role that states may have to help set/enforce it.

- Increased Lending Safeguards: Anticipate a continued state focus on lending products and services.

- Enforcement Efforts: State AGs are expected to intensify activity across a wider range of financial products and services and across an array of providers; Expect increased collaboration through multi-state investigations.

_______________________________________________________________________________________________________________________________

August 2025

With federal changes (inclusive of changes to the CFPB and the issuance of Executive Orders on "debanking" and "disparate impact"), states have introduced and pursued an array of consumer financial protections through legislative and regulatory actions, including unfair or deceptive acts or practices and safeguards for consumer credit.

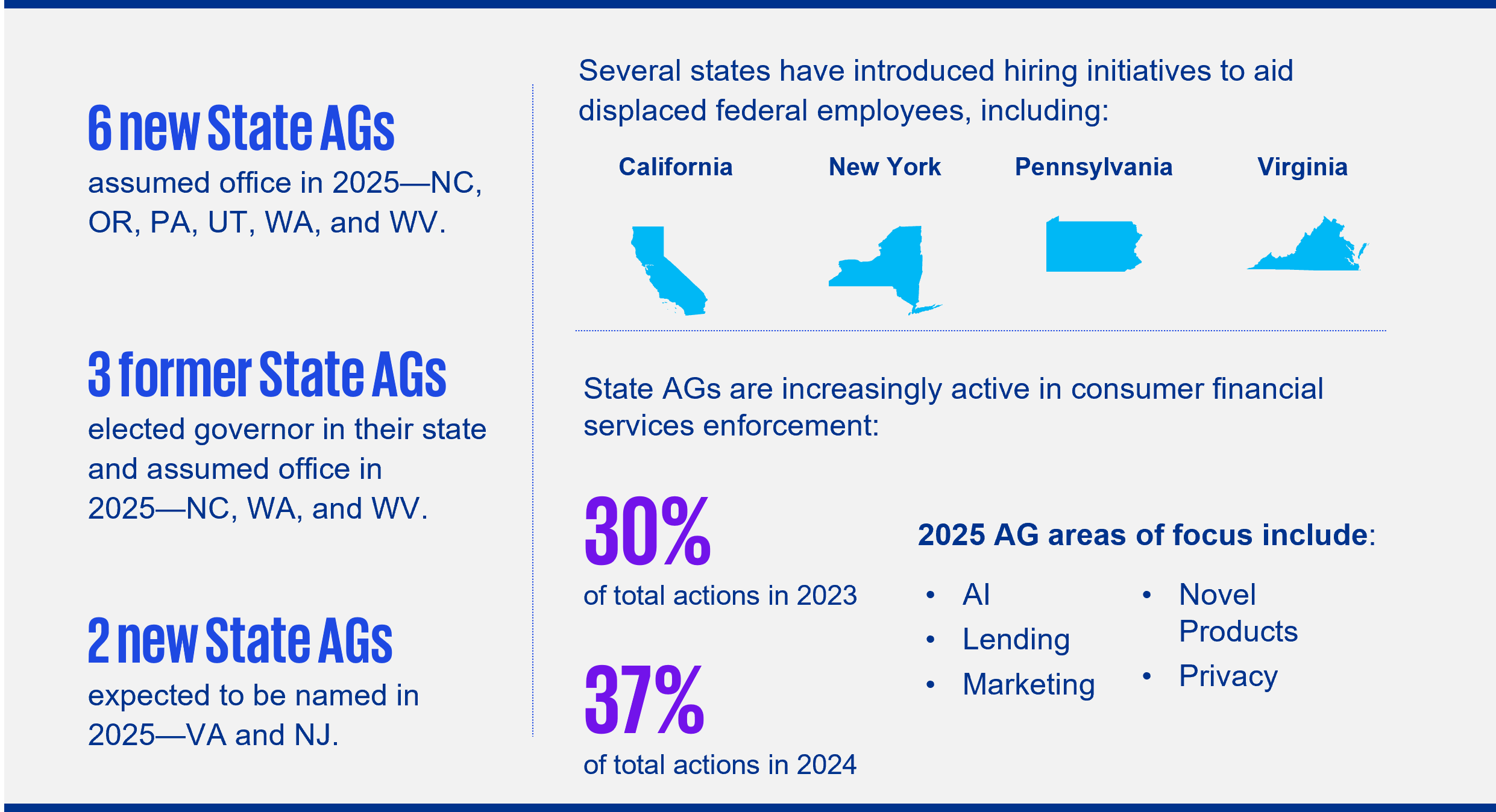

State attorneys general (AGs) are taking an increasing and more active role in the enforcement of consumer financial protections, including increased coordination among states and with federal agencies to share information and enhance efficiency and consistency.

Notable state activity in 2025 includes:

- Legislative Focus (e.g., usury laws, debt collection, and small-dollar lending)

- Enforcement Focus (e.g., novel products, algorithmic bias, multi-state coordination)

1. Legislative Focus

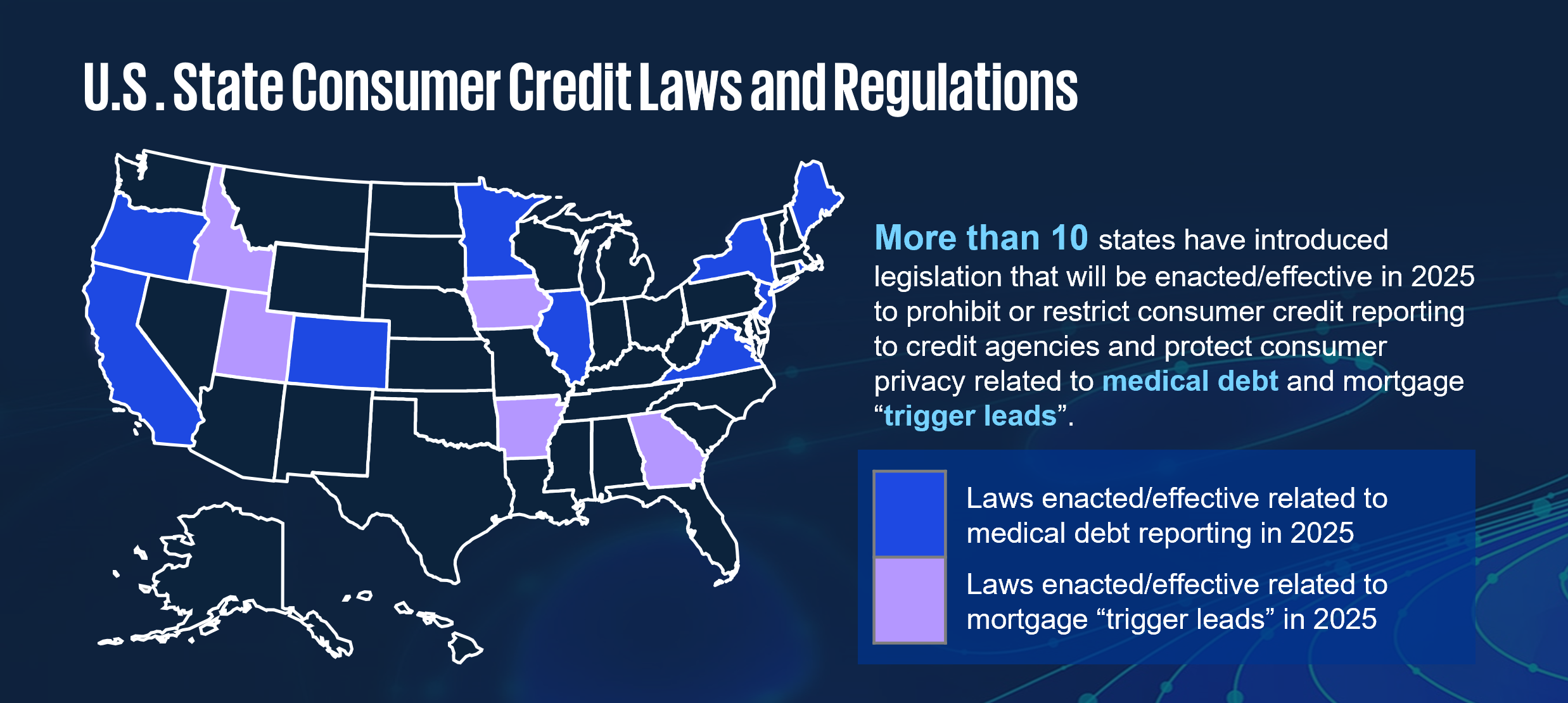

In 2025, states have introduced bills and/or enacted new laws and regulations to strengthen responsible practices in the offering and delivery of financial products and services to protect consumers. Examples of recent areas of focus include:

Areas of Focus | |

|---|---|

Area of Focus | Description/Examples |

Unfair or Deceptive Practices |

|

Usury Laws; Interest Rates |

|

Debt Collection |

|

Credit Reporting |

|

“Debanking” |

|

Small-Dollar Lending |

|

Use of AI |

|

2. Enforcement Focus

In 2025, state AGs have ramped up enforcement activity in financial services consumer protection, partly in response to shifts in federal priorities/activity as well as to influence policy at both the state and federal levels. Examples of recent areas of focus include:

Areas of Focus | |

|---|---|

Area of Focus | Description/Examples of Cases |

Novel Products and Services |

|

Elder Fraud |

|

Algorithmic Bias |

|

Multi-State; State-Federal Coordination |

|

Dive into our thinking:

State Series: Financial Consumer Protections

Increasing state legislative and enforcement activity

Download PDFExplore more

Get the latest from KPMG Regulatory Insights

KPMG Regulatory Insights is the thought leader hub for timely insight on risk and regulatory developments.

Meet our team