The M&A Dance: Orchestrating synergies and value creation in public company acquisitions

A decade of data driven insights into the choreography of successful M&A

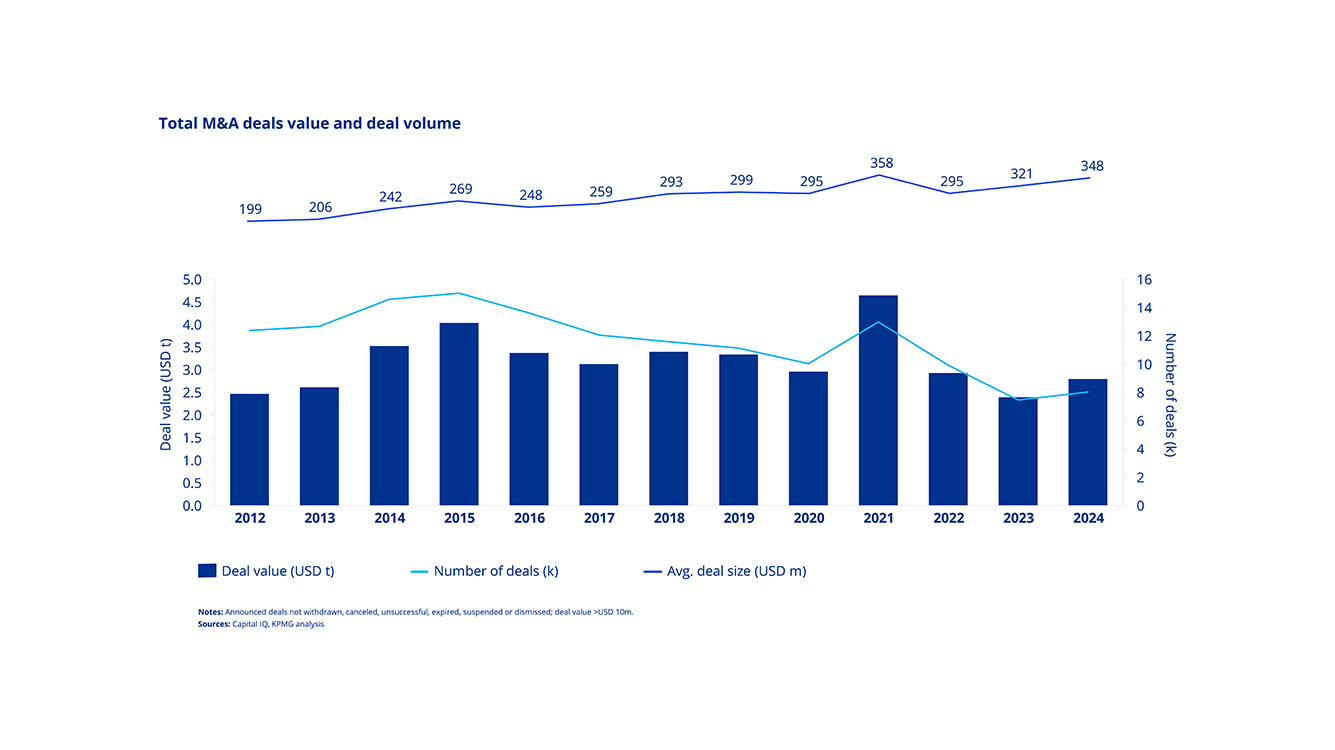

Acquisitions can be considered a potent lever for strategic growth, and companies are spending more per mergers and acquisitions (M&A) deal than ever before1. Yet, capturing sustainable value from M&A can be as challenging as ever.

This report examines value creation in public company mergers and acquisitions by analyzing total shareholder return (TSR) relative to the relevant index (e.g. S&P) — a market-adjusted metric that isolates deal performance from broader sector trends.

TSR movement is driven by a range of factors and deal specific characteristics. Synergies — financial benefits arising directly from combining companies, such as revenue growth, cost reductions, or financing efficiencies — are a cornerstone of M&A value creation. Additional drivers include strategic positioning (e.g. acquiring undervalued assets during market dislocations), unlocking latent value in a target’s standalone operations, and fulfilling corporate strategic objectives such as market entry or competitive insulation.

There were more than 3,000 public-to-public M&A deals over US$100 million in value between 2012 and 20221. Our research finds that 57.2 percent of acquirers ultimately destroyed shareholder value. Although many deals looked promising in the months leading up to closing — generating an average 13.2 percent in TSR above the relevant S&P sector index — TSR dropped an average of 7.4 percent in the two years following. The brutal reality: most of the initial gains evaporated soon after the ink dried.

This sobering data aligns with KPMG LLP’s ongoing research, which shows a consistent struggle to realize and maintain post-merger synergies. Deals that destroy value often do so for two key reasons: acquirers overestimate the benefits, resulting in overpayment, and they fail to operationalize the gains they projected — particularly because integration and execution complexities are underestimated. These findings are intended to encourage greater accountability: capital allocators should provide clear, quantified evidence that an acquisition can create value pre-deal — and rigorously track and communicate realized benefits to stakeholders post-deal.

Yet success is achievable: approximately 42.8 percent of deals succeed in unlocking meaningful synergies, underscoring that M&A can indeed be a path to sustained growth — when done right.

In this report, ‘The M&A dance: Orchestrating synergies and value creation in public company acquisitions’, we set out to unpick these findings, revisit why so many deals underdeliver and — most importantly — how certain acquirers beat the odds.

We feel the macro environment for the second half of the 2020s is likely to be characterized by deglobalization and technology acceleration. This could drive M&A in two directions: carve-outs along geographical lines and strategic M&A, which finds synergies between new economies and the old, for both disruptors and the disrupted. This evolving landscape underscores the need for strategic and disciplined dealmaking.

This report combines KPMG firms’ transaction support experience with data-driven insights to help equip leaders with actionable frameworks — from initial deal strategy through to post-deal value realization — all with the aim of ensuring M&A decisions align with long-term value creation.

Footnotes

- Source: Capital IQ, KPMG analysis

Dive into our thinking:

The M&A dance: Orchestrating synergies and value creation in public company acquisitions

A decade of data-driven insights into the choreography of successful M&A

Download PDFSubscribe to M&A Spotlight

KPMG Deal Advisory and Strategy distributes a wide selection of thought leadership that highlights the latest M&A issues and trends.

Meet our team