Insights into recent SBSD and SD examinations

KPMG LLP has identified common compliance challenges, solutions, and industry insights in NFA and SEC exams

Exam regulatory priorities

KPMG LLP (KPMG) has assisted swap dealers (SDs) and security-based swap dealers (SBSDs) with their National Futures Association (NFA) and Securities and Exchange Commission (SEC) examinations, through which we have identified common compliance challenges, solutions, and industry insights.

Key takeaways

- The SEC is well into its first cycle of examinations of SBSDs.

- In advising our clients, we note that the SEC’s approach to SBSD examination has been markedly different than the approach employed by the NFA to examine Commodity Futures Trading Commission (CFTC) registered swap dealers. Specifically:

- Scope – SEC examinations are generally full scope, whereas NFA began its examinations of SDs by reviewing more discrete areas of rules (e.g., risk management program)

- Duration – The duration of SEC examinations is generally longer than NFA examinations, with one client’s examination lasting nearly a year and a half.

- Knowledge – SEC examiners are still coming up the curve of market practices, which means that SBSDs must communicate clearly how they comply with relevant regulations.

- SEC has also begun to look behind substituted compliance, asking SBSD management how they know they are in compliance with relevant home country regulations. It remains to be seen whether NFA follows suit with SDs.

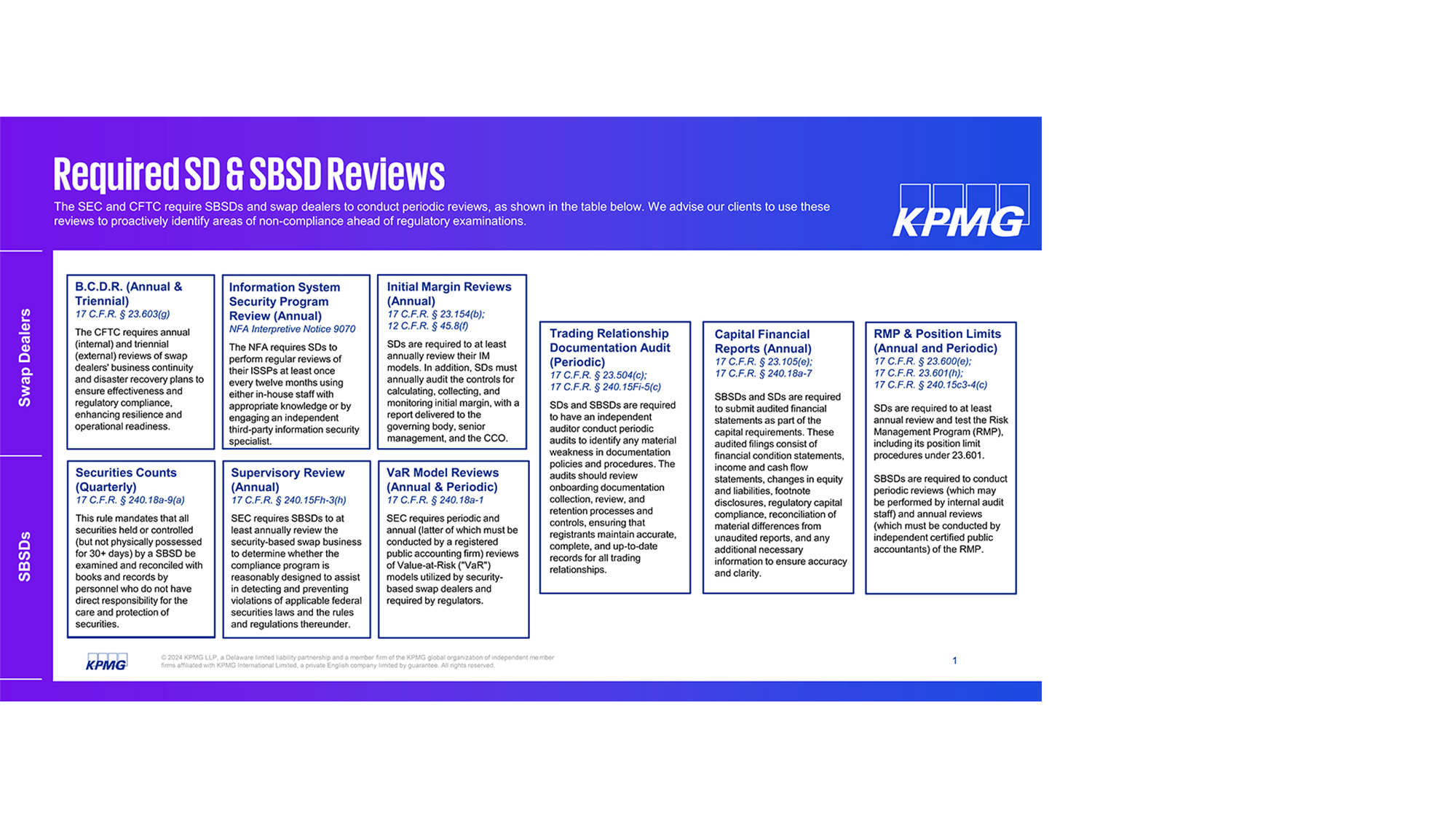

- Required reviews – Lastly, SEC has inquired about SBSDs’ practices for undertaking independent reviews required by regulation. For ease of reference, we list these required reviews for both SDs and SBSDs below.

Shared regulatory focus areas:

1

2

3

4

5

Dive into our thinking:

Insights into recent SBSD and SD examinations

Download PDFRevolutionize trade reporting reviews with AI insights

In the rapidly evolving regulatory landscape, maintaining accuracy and compliance in trade reporting is more critical than ever. KPMG goes beyond traditional trade reporting reviews, offering innovative AI-supported testing and review services for your trade reporting programs. As areas under close scrutiny by the CFTC and NFA, the accuracy and comprehensiveness of these reports are paramount.

Leveraging the power of AI, our approach not only identifies compliance gaps but also anticipates potential areas of concern, helping ensure your trade reporting processes are both efficient and ahead of regulatory curves.

With our AI capabilities, you can transform your trade reporting from a regulatory requirement to a regulatory advantage.

Meet the team