FRB Reports: Supervision and Regulation; Financial Stability

Semiannual reports highlighting supervisory and regulatory developments, supervisory priorities, and financial system risks

Regulatory Insights

- Regulatory Transparency: The FRB issues semi-annual reports on Supervision and Regulation and on Financial Stability in an effort to provide the market and banks continued regulatory transparency

- Heightened Risk Standards: Top supervisory findings include:

- Large bank governance and controls (approximately 2/3 of outstanding issues)

- IT and operational risks at community/regional banks (approximately 1/3 of outstanding issues)

- Financial Risk Management: Liquidity and interest rate management a focus in recent supervisory findings across large banks as well as community and regional banks

__________________________________________________________________________________________________________________________________________________

November 2023

The Federal Reserve Board (FRB) has published two semiannual reports: 1) the Supervision and Regulation Report and 2) the Financial Stability Report.

The Supervision and Regulation Report highlights the FRB’s assessment of banking system conditions, as well as regulatory and supervisory developments in 2023 and priorities for 2024. The Financial Stability Report presents FRB’s current assessment of the stability of the overall U.S. financial system.

The reports are outlined in detail below.

Supervision and Regulation Report

Highlights of the FRB’s Supervision and Regulation Report follow.

Banking System Conditions. The FRB states “The banking system remains sound overall. Banks continue to report capital and liquidity levels above regulatory minimums. Earnings performance has remained solid and in line with pre-pandemic levels, despite recent pressure on net interest margins. Deposit declines related to the March banking stresses have slowed. Loan delinquency rates remain low overall. However, delinquencies for CRE and some consumer sectors have increased from their low levels, and banks have increased credit loss provisions. Liquidity and interest rate risks also remain elevated for some banks, partially attributed to the increased funding costs and significant fair value losses on investment securities.”

Regulatory Developments. The report highlights regulatory developments since May 2023, including Interagency releases on proposed rules covering the Basel III capital framework and long-term debt requirements, guidance on liquidity risks and contingency funding planning and third-party risk management, and principles for climate-related financial risk management.

Supervisory Developments. The FRB states that it is “taking steps to enhance the speed, force, and agility of its supervision.” This includes assessing banks’ preparedness for managing liquidity, interest rate, and credit risks, conducting targeted reviews of banks exhibiting higher risk profiles, and engaging in focused training and outreach on supervisory expectations for banks and examiners. In some cases, the agency initiated continuous monitoring for a small number of firms with risk profiles that could result in funding pressures.

2024 Supervisory Priorities. The report outlines FRB’s 2024 supervisory priorities for large financial institutions (with $100 billion or more in total assets), community banking organizations (CBOs) (with less than $10 billion in total assets), and regional banking organization (RBOs) (with between $10 and $100 billion in total assets). These priorities are outlined in the table below.

Large Financial Institutions | CBOs & RBOs | KPMG Regulatory Insights |

|---|---|---|

Capital

Liquidity

Governance & Controls

Recovery & Resolution Planning

| Credit Risk

Liquidity Risk

Other Financial Risks

Operational Risk

|

|

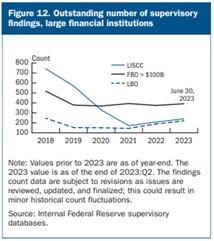

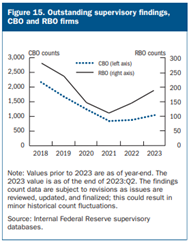

Report Figures. The report also provided the following data, indicating that the number of outstanding supervisory findings for large financial institutions, CBOs, and RBOs are increasing.

Financial Stability Report

FRB’s Financial Stability Report distinguishes between shocks to, and vulnerabilities of, the financial system, and primarily focuses on vulnerabilities across four categories, as well as several near-term risks to the financial system, each of which is highlighted below.

Overview of financial system vulnerabilities. The report provides an overview of financial system vulnerabilities in four areas:

- Asset Valuations: The report states that asset valuation pressures rose, including in residential and commercial real estate (CRE), equities, and Treasury securities since the May 2023 report.

- Borrowing by Businesses and Households: The FRB notes that vulnerabilities from business and household debt remain moderate, as measured by indicators for businesses and households (e.g., overall leverage, interest coverage ratios (ICRs), household debt, mortgage credit risk, and general consumer credit risk).

- Leverage within the Financial Sector: The FRB states that the overall banking system remains sound but declines in fair value of assets at some banks remain sizable and leverage at nonbanks remains elevated.

- Funding Risks: Overall, the report states that there remains a high level of liquidity in the banking industry. However, structural vulnerabilities (e.g., rapid outflows/runs) persist at money market funds, other cash management vehicles, and stablecoins, and liquidity risks persist in bond mutual fund asset holdings and with central counterparties amid interest rate volatility.

Near-Term Risks to the Financial System. The FRB highlights possible interactions between the existing vulnerabilities and the following near-term risks to the financial system:

- Potential slowdown in economic growth, which could pose risks to the financial system and precipitate strains in CRE.

- Persistent inflation in the U.S. and other advanced economies, which could pose risks to the global financial system.

- Further slowdown in Chinese economic growth, which could worsen financial stresses in China and strain markets worldwide.

- Worsening global geopolitical tensions, which could lead to broad adverse spillovers in global markets.

Dive into our thinking:

FRB Reports: Supervision and Regulation; Financial Stability

Download PDFExplore more

Get the latest from KPMG Regulatory Insights

KPMG Regulatory Insights is the thought leader hub for timely insight on risk and regulatory developments.

Meet our team