E-invoicing and digital reporting services

A strategic approach to navigating e-invoicing and digital reporting with confidence

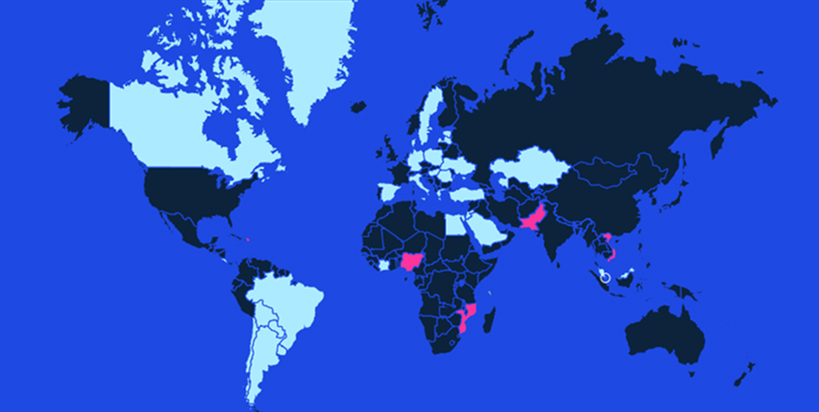

Tax administrations are increasingly adopting e-invoicing and digital reporting mandates to automate the tax reporting process. This trend is leading to a more digitalized world of taxation and compliance, providing tax authorities with real-time visibility into end-to-end supply chain transaction data and the ability to use advanced data interrogation tools for audit purposes. The introduction of new e-invoicing and digital reporting requirements and the evolution of technologies used by tax administrations to implement these requirements in recent years is disruptive not only for a business’s tax department but also for the business operation as a whole. Added to this comes a lack of harmonization, a demanding compliance calendar, and a constantly changing regulatory environment, which further increase the challenges encountered by businesses to comply with these requirements.

As a result, there is an increasing need for businesses to adopt a proactive approach to address these changes, starting with a clear understanding of where they are obliged to comply with these requirements and upcoming changes that may impact their business, along with a defined tax technology strategy that includes having an e-invoicing and digital reporting implementation plan.

Non-compliance risks include:

1

Customer and supplier relations

- Inability to issue compliant invoices may lead to nonpayment

- Invalid AP functionality may make it impossible to receive invoices and pay vendors

2

Tax Deductibility

- Not having compliance e-documents may impact the ability to deduct taxes or request refunds

- Noncompliance could lead to inability to correctly adjust returns and/or increase audit exposure

3

Penalties and Fees:

- Penalties and interest may apply on a "per noncompliant" e-document basis

- In some jurisdictions, criminal charges are applied

Stay informed on e-invoicing developments

Dive into our thinking

E-invoicing and digital reporting services

Implementing a global e-invoicing and digital reporting compliance strategy involves a multi-phased approach and touchpoints throughout the organization. See how we can support you.

Download nowSTAY UP-TO-DATE

Inside Indirect Tax

A monthly publication featuring global indirect tax updates from around the world.

Meet our team