09 Expanding Digital Assets

Ten Key Regulatory Challenges of 2026

Accelerating and widespread actions designed to structure markets and develop regulatory frameworks that will facilitate and expand digital and other alternative asset offerings in the U.S.

“Digital assets have once again taken center stage, spotlighted by the rescission of regulatory guidance and the passage of the GENIUS Act which will give rise to payment stablecoins. Banks must develop digital asset strategies for a new asset class and technology that have not historically been part of their business model, along with identifying what products/services to offer and related risk considerations and mitigation controls.”

Brian Consolvo

Principal

Advisory

“The regulatory environment has shifted radically in 2025, and many financial institutions are moving quickly to offer digital asset products and services. Given the rapid pace of change, it’s more important than ever for organizations to assess and enhance their compliance and risk management programs.”

Conway Dodge

Principal

Advisory

“As barriers to broader adoption of digital assets abate, and competition and demand significantly increase, banks will need to quickly evolve business models, product/ service offerings, and risk management practices to take and grow market share in a safe and sound, consumer-centric manner.”

Todd Semanco

Partner

Advisory

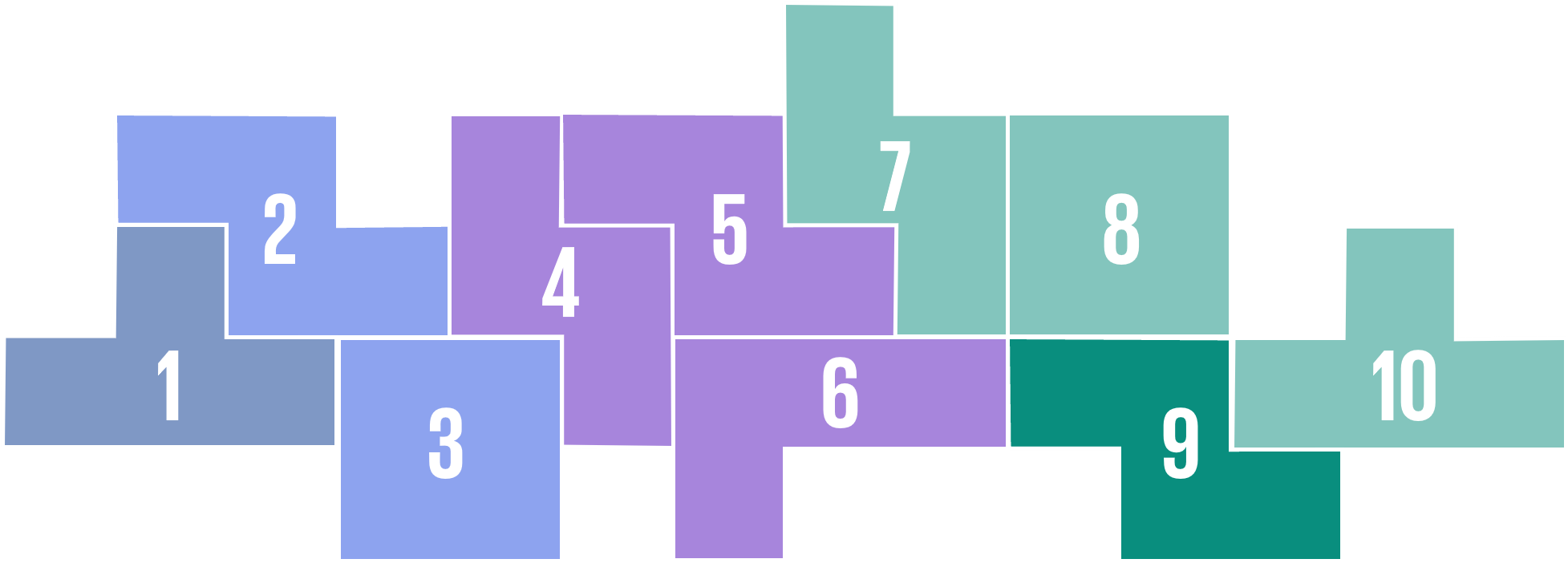

Frameworks

Executive and legislative steps to establish/build-out frameworks governing digital assets.

Concurrent agency initiatives to update existing rules/requirements to promote digital assets markets.

Examples | What to Watch |

|

|

Risk Considerations

Identification of a full spectrum of risks to manage new digital asset products/frameworks, including market, capital/liquidity, operational (e.g., cybersecurity, technology), fraud/BSA/AML, and consumer/investor protections, including education/disclosures.

Examples | What to Watch |

|

|

Licensing/Chartering

Expressed executive and regulatory support for flexibility/openness to novel/innovative business models, including:

- De novo banks focused on digital assets.

- Non-financial companies to issue payment stablecoins.

- Fintechs and crypto-native companies obtaining a Federal Reserve master account.

Examples | What to Watch |

|

|

Access

Executive directives to expand customer/investor access to alternative assets, including digital assets, through:

- Retail investor access to alternative asset investments in ERISA plans.

- Regulatory changes to encourage market participation (e.g., “self-custody,” “super-app” trading) and/or promote capital formation (e.g., accredited investor qualifications).

Examples | What to Watch |

|

|

09 Expanding Digital Assets

Read the document

Download the SectionDive into our thinking:

Explore more

Get the latest from KPMG Regulatory Insights

KPMG Regulatory Insights is the thought leader hub for timely insight on risk and regulatory developments.

Meet our team