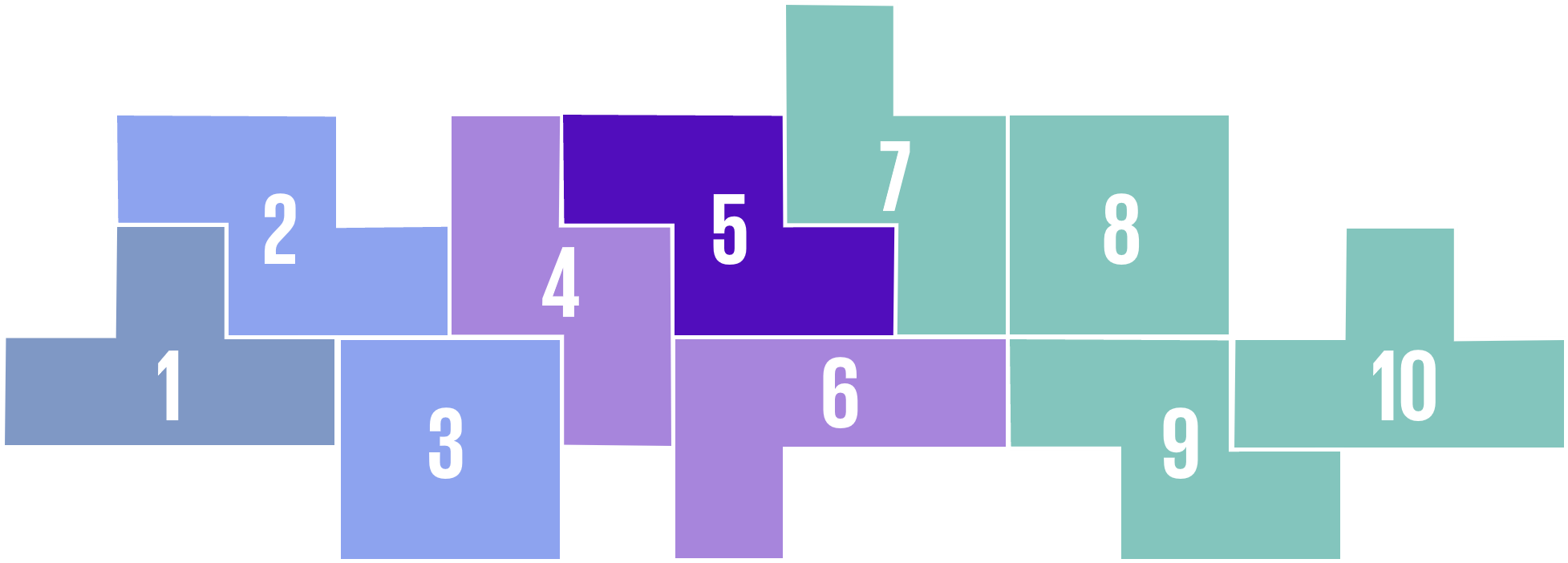

05 Averting Fraud and Scams

Ten Key Regulatory Challenges of 2026

Traditional frauds and scams are giving way to a new generation of rapidly evolving AI-enhanced activities carried out at scale, significantly raising the importance of effective risk management and reporting.

“The speed and sophistication with which fraudsters are now able to exploit AI and emerging technologies is outpacing traditional defenses. To effectively mitigate these threats, regulators, companies, governments, and law enforcement must break down silos and collaborate more openly—sharing the data they sit on and coordinating responses in real time. Fragmented efforts are no longer sufficient in a world where fraud evolves faster than policy.”

Steve D'Antuono

Partner

Advisory

“Emerging market dynamics, including open banking, digital assets, and M&A activity, are reshaping financial services and creating novel fraud risks. Financial institutions must guard against fragmentation and ensure cross-functional coordination to stay ahead of fraudsters and protect consumers.”

Chad Polen

Principal

Advisory

“Fast & Furious”

Attributable largely to technology innovation (and primarily AI and GenAI), the speed, scale, and complexity of frauds and scams have significantly increased, rising to historic levels of volume and cost. These tools “turbocharge” sophisticated frauds and scams (e.g., impersonation, instant payment, deepfakes and social engineering), driving the need for a cohesive regulatory approach across functions within the organizations to detect, prevent, and mitigate these crimes.

Examples | What to Watch |

|---|---|

|

|

12024 FTC Data Book (most recently available information as of 11/2025)

2FBI 2024 IC3 (most recently available information as of 11/2025)

Reprioritizing Enforcement

To carry out executive directives, federal agencies are prioritizing fraud investigation and enforcement related to healthcare; procurement; trade, tariffs, and customs evasion; sanctions evasion and support for cartels and TCOs; securities and other market manipulations; and vulnerable persons (e.g., elders, servicemembers).

Examples | What to Watch |

|

|

Trends

Financial institutions, organizations, and consumers are facing a myriad of frauds and scams, exacerbated by digital assets, open banking and M&A activities. Key among them are:

- Impersonation scams, including business email compromise scams

- Deepfake/AI enabled scams

- “Faster” payments and “instant” payments scams (and relatedly increased attention to liability/consumer reimbursement)

- Synthetic identity fraud, identity theft and account takeovers

- Check fraud

- Elder abuse/vulnerability exploitation

Examples | What to Watch |

|---|---|

|

|

3Derived from Multistate.ai

05 Averting Fraud and Scams

Read the document

Download the SectionDive into our thinking:

Explore more

Get the latest from KPMG Regulatory Insights

KPMG Regulatory Insights is the thought leader hub for timely insight on risk and regulatory developments.

Meet our team