02 Adopting Disruptive Tech & AI

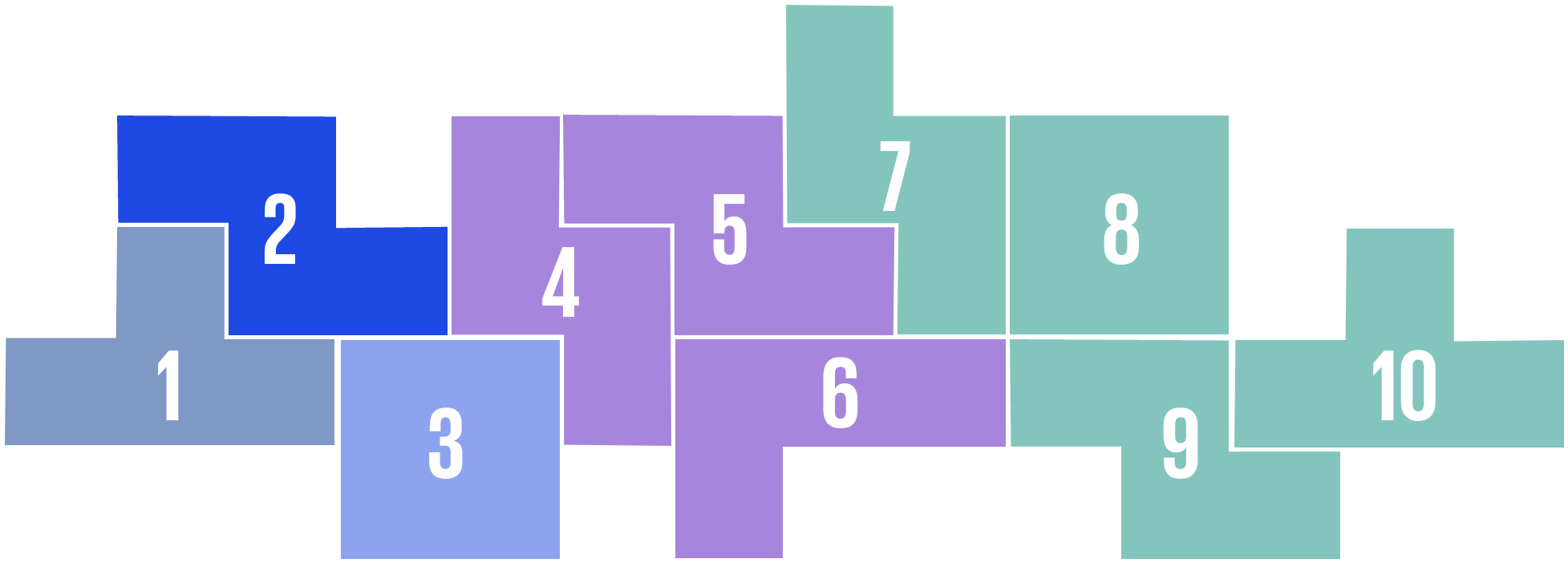

Ten Key Regulatory Challenges of 2026

Federal and state regulatory adaptation of existing risk frameworks and policies respond to complexities in evolving AI innovation, with increasing private sector participation.

“Embracing AI in banking levels the playing field and provides unparalleled opportunity to enhance efficiency and optimization. Innovation and regulatory guidance must align to maintain compliance and consumer trust. By doing so, we foster a future of compliance and growth that benefits everyone.”

Adam Levy

Principal

Advisory

“As regulations across the US continue to evolve and take shape in 2026, we expect a key focus area for organizations will be ensuring they have mechanisms in place to classify and validate that AI systems and guardrails are functioning as intended and are aligned with the regulations. As a result, we expect to see an uptick in the number of organizations conducting AI risk assessments, system testing, and other AI assurance activities in 2026.”

Bryan McGowan

Principal

Advisory

Model Risk Management

Federal banking regulators continue to reiterate that existing guidance and risk frameworks (e.g., SR 11-7 and OCC 2011-12) remain fit for purpose in supervising AI applications, but recent statements suggest some revisions may be needed as AI applications continue to evolve and are deployed across financial organizations.

Examples | What to Watch |

|

|

Complexity & Divergence

Divergent actions at the federal and state levels create risk and compliance challenges:

- Executive directives promote national security and innovation and the removal of regulatory barriers that may hinder it.

- Proliferation of state level laws and regulations, including broad frameworks aimed at developers and/or deployers and narrowly targeted safety and/or privacy laws (e.g., consumer protection, child protection, deepfakes, automated decision-making tools).

Examples | What to Watch |

|---|---|

|

|

1Derived from Multistate.ai

Public Private Partnership

Executive policy to create conditions for private sector-led innovation to flourish and enable AI adoption.

Examples | What to Watch |

|

|

02 Adopting Disruptive Tech & AI:

Read the document

Download the SectionDive into our thinking:

Explore more

Get the latest from KPMG Regulatory Insights

KPMG Regulatory Insights is the thought leader hub for timely insight on risk and regulatory developments.

Meet our team