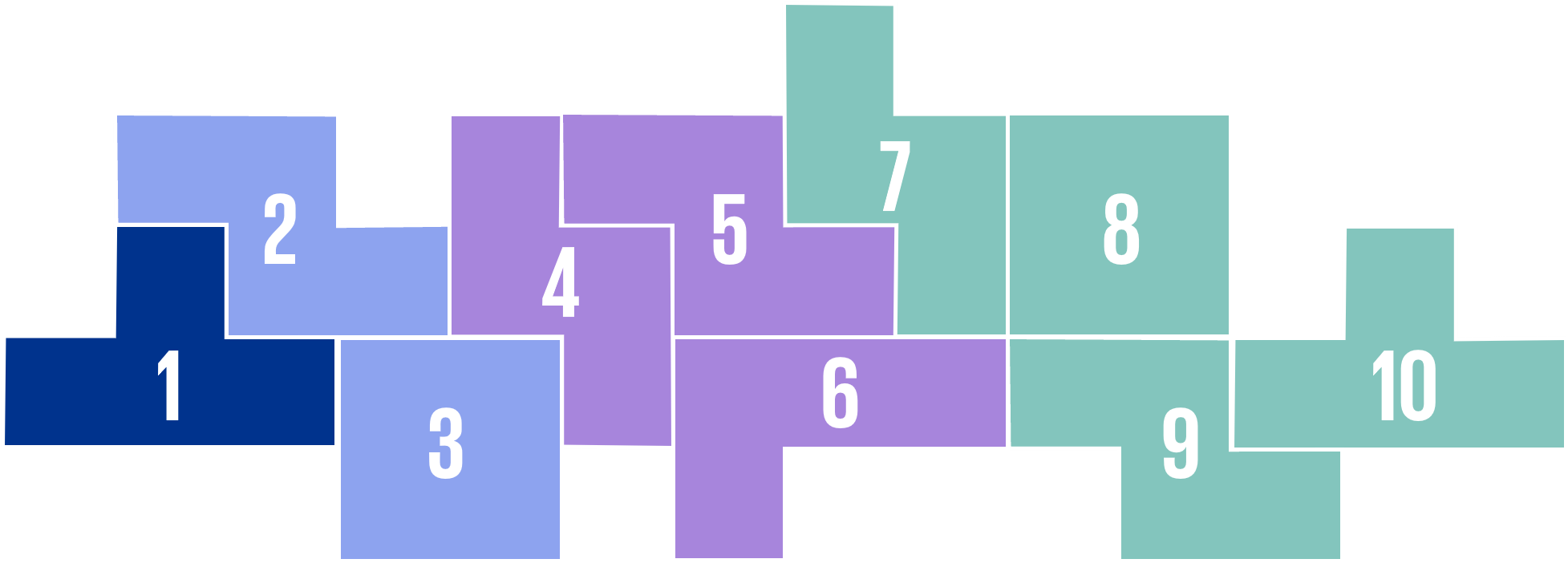

01 Executing Mandates

Ten Key Regulatory Challenges of 2026

Aligning with the Administration’s priorities to reduce complexity, encourage innovation, and promote growth, regulators have narrowed supervision and enforcement to core statutory authorities; organizations must be cognizant of maintaining compliance with existing laws and regulations and growing regulatory divergence.

"As the U.S. regulatory landscape evolves, regulators appear to be returning to fundamentals—core missions, statutory mandates—even as they embrace implementation of the digital financial technologies, like digital assets and AI applications, that are reshaping the financial system. This approach may signal a lighter supervisory touch in some areas and a growing reliance on market-driven discipline. For all organizations, the overarching challenge in 2026 will be to balance the regulatory stack.”

Laura Byerly

Managing Director

Regulatory Insights

Core Mission

Federal agencies have focused resources on supervising and enforcing regulations based on their statutory authorizations, and in a manner consistent with the Administration’s priorities of reducing complexity, encouraging innovation, and promoting economic growth. Related actions include modified enforcement focus, rule recissions/withdrawals, and cross-agency coordination.

Examples | What to Watch |

|

|

“Self-Regulation”

Through the withdrawal/recission of regulations, narrowed enforcement priorities, and increased reliance on guidance, regulators are exercising a “lighter touch” with regard to supervision and enforcement while simultaneously encouraging/incentivizing companies to identify, mitigate, remediate, and self-report misconduct.

Examples | What to Watch |

|

|

Regulatory Divergence

The regulatory landscape continues to grow in complexity as federal and state laws and regulations diverge due to differences in supervisory and enforcement priorities. In many instances, state activity (e.g., legislative, regulatory, enforcement) has increased to fill perceived gaps at the federal level (e.g., consumer/investor protections, data privacy, AI, climate/sustainability). Differences in global regulations and supervisory frameworks create divergent requirements by geography or jurisdiction.

Examples | What to Watch |

|

|

01 Executing Mandates:

Read the document

Download the SectionDive into our thinking:

Explore more

Get the latest from KPMG Regulatory Insights

KPMG Regulatory Insights is the thought leader hub for timely insight on risk and regulatory developments.

Meet our team