State Series: Property & Casualty Insurance

Market dynamics driving regulatory actions

KPMG Regulatory Insights

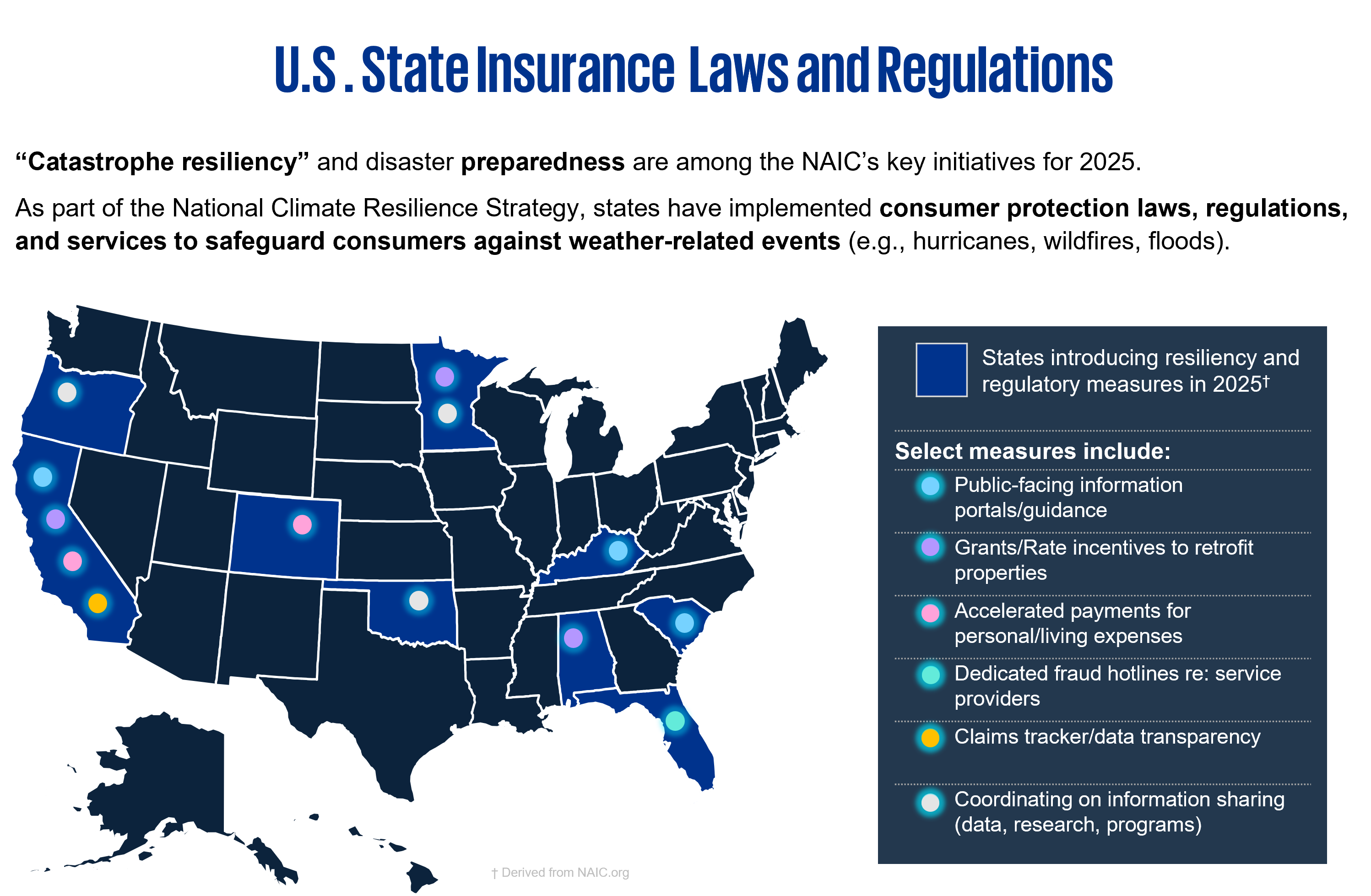

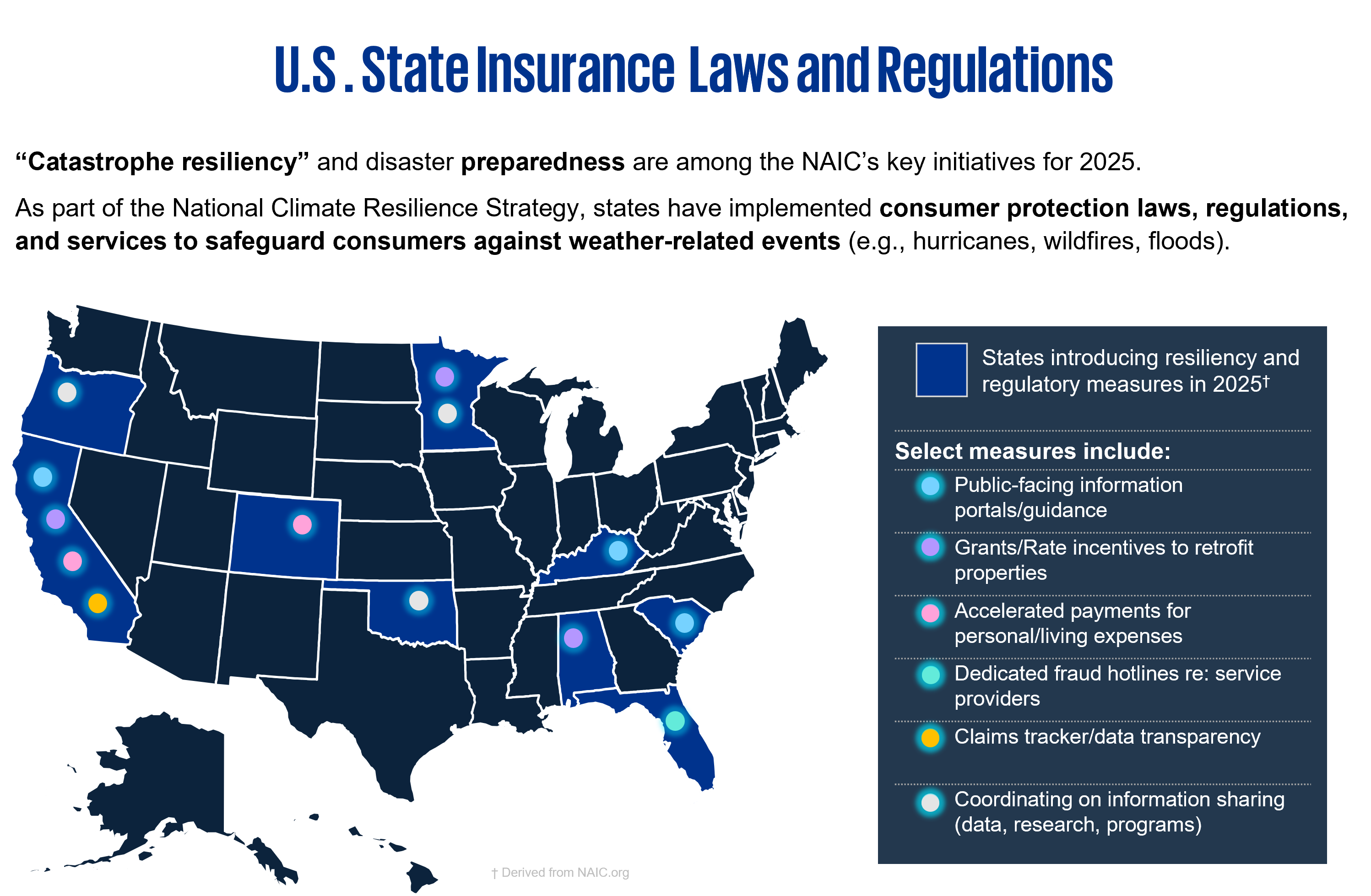

- State legislatures and insurance regulators are responding to rising weather-related events/risks, rising prices/costs, and advances in technology by introducing or enacting regulatory reforms that aim to enhance transparency, affordability, and consumer protections.

- The NAIC’s 2025 initiatives are driving states to collectively focus efforts around “catastrophe resiliency” and pre-disaster mitigation, cybersecurity, and data privacy in addition to fraud prevention, market stability, and price transparency.

_______________________________________________________________________________________________________________________________

August 2025

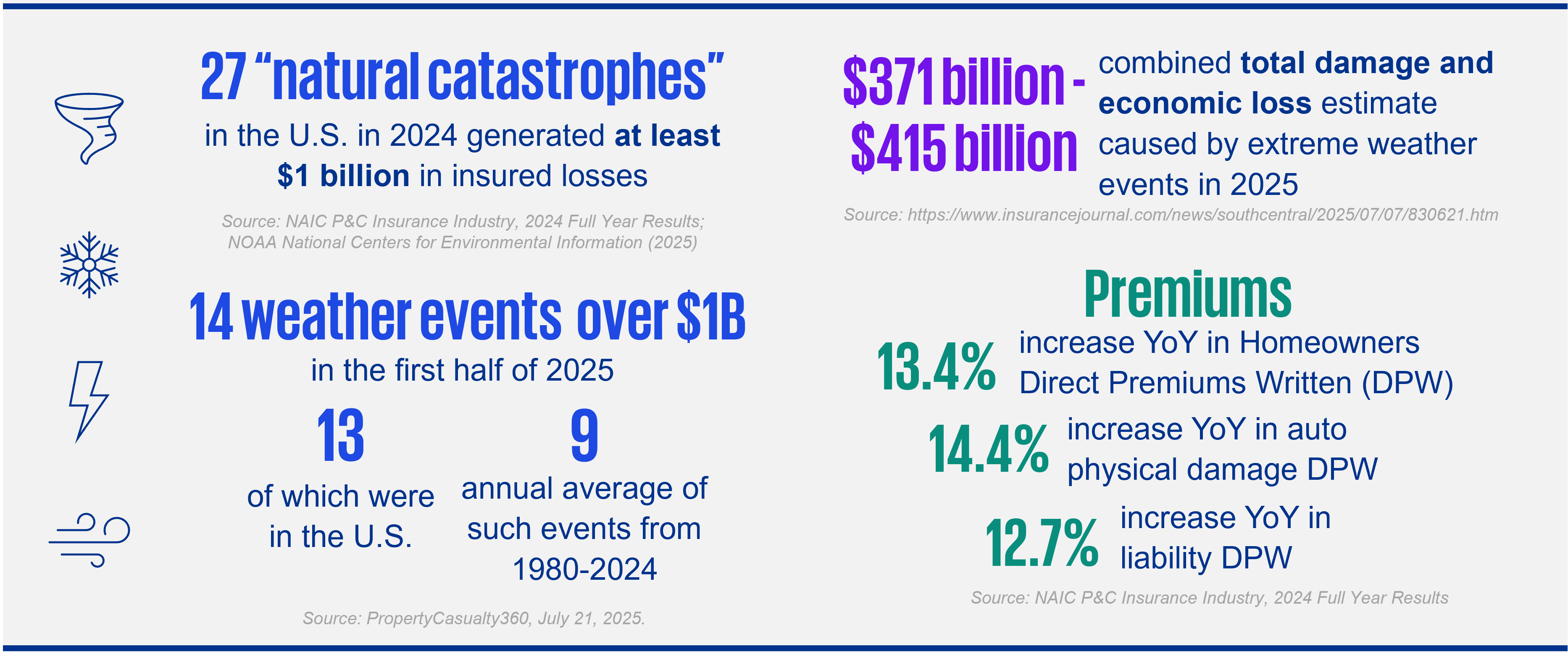

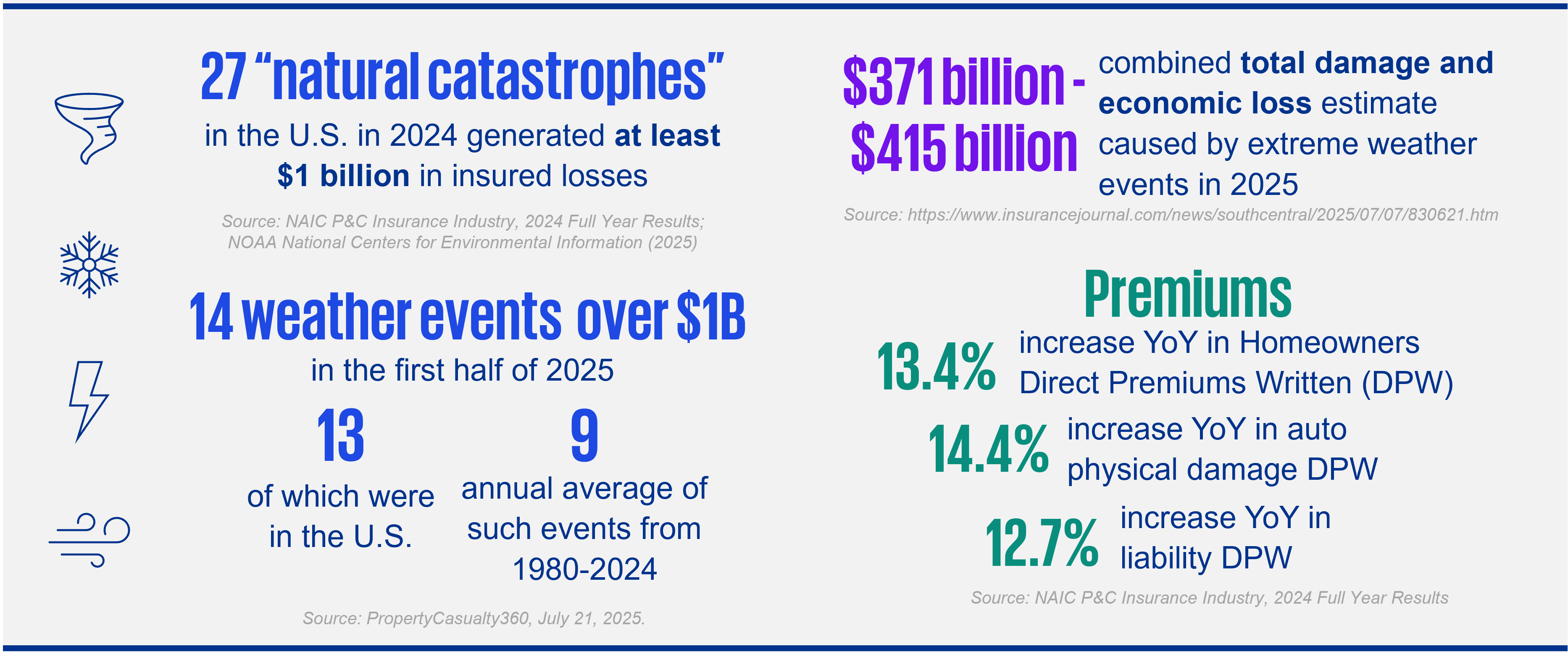

State Property and Casualty (P&C) insurance laws and regulation are undergoing a transformation. Numerous weather-related events—including hurricanes, wildfires, and floods—have raised public awareness of policy coverages, claims processes, valuations, and premiums/rates on a broad scale. Advancing new technologies, including AI, further focus attention on decision-making in the context of claims and rates.

In the 2025 legislative session, states have individually and collectively introduced and/or enacted legislation consistent with the NAIC’s announced 2025 initiatives, including enhanced consumer protections across key areas related to losses/claims from weather events (referred to as “natural catastrophes”, technology/ cybersecurity/ data privacy, and rate setting. Their efforts are reinforced by enforcement activities undertaken by state insurance commissioners and state attorneys general (AGs).

Notable state activity in 2025 includes:

- Regulatory Transparency & Oversight (e.g., rate setting, AI Use, reporting)

- Affordability & Availability (e.g., consumer protection, weather & disaster risk, minimum liability coverage)

- State Coordination & Enforcement (e.g., NAIC initiatives, multistate licensing, fraud prevention)

1. Regulatory Transparency & Oversight

Recent legislation (introduced and/or enacted) looks to provide consumers with more information about the costs of and changes to their policies. Key features of these bills can include:

Key Features | |

|---|---|

Key Feature | Description/Examples |

Rate Setting |

|

AI Use |

|

Policy Change |

|

Reporting |

|

Enforcement Policy | Establish penalties for violations relating to:

|

2. Affordability & Availability

State legislative activity in 2025 targets consumer protections, including issues of affordability and fair access, with measures directed toward risk factors in rate setting, premium relief, minimum coverages, and protections against cancellations in disaster zones. Key features may include:

Key Features | |

|---|---|

Key Feature | Description/Examples |

Consumer Protection |

|

Weather & Disaster Risk |

|

Minimum Liability Coverage |

|

3. State Coordination & Enforcement

States are taking legislative and regulatory action individually and collectively to align with the NAIC’s announced 2025 initiatives, which, at a high level, include strengthening state-based regulation, enhancing consumer protection, and monitoring industry solvency. Key features of example actions in 2025 related to P&C insurance, including introduced and/or enacted legislation, include:

Key Features | |

|---|---|

Key Feature | Description/Examples |

NAIC Initiatives | Across states and working through NAIC committees, coordination and implementation of key NAIC initiatives, including:

|

Fraud Prevention |

|

Multistate Licensing |

|

Enforcement |

|

Dive into our thinking:

State Series: Property & Casualty Insurance

Legislative activity to enhance transparency and protections

Download PDFExplore more

Get the latest from KPMG Regulatory Insights

KPMG Regulatory Insights is the thought leader hub for timely insight on risk and regulatory developments.

Meet our team