State Series: Drug Pricing

Oversight, reporting, and access/affordability

KPMG Regulatory Insights

- Intensity: States have intensified legislative efforts to boost transparency in the pharmaceutical industry, including updates aligning with the federal 340B Drug Pricing Program as well as reforms to Pharmacy Benefit Manager practices (e.g., rebate pass-throughs, compensation, and “fiduciary duty”).

- Collaboration: Both federal and state government bodies are individually and together focused on potentially anti-competitive behaviors within pharmaceutical markets, including drug prices and reimbursement practices.

- Planning: Companies should engage in strategic and quantitative planning to effectively navigate the current legislative/regulatory environment given the efforts to reduce drug prices and increase transparency.

_______________________________________________________________________________________________________________________________

September 2025

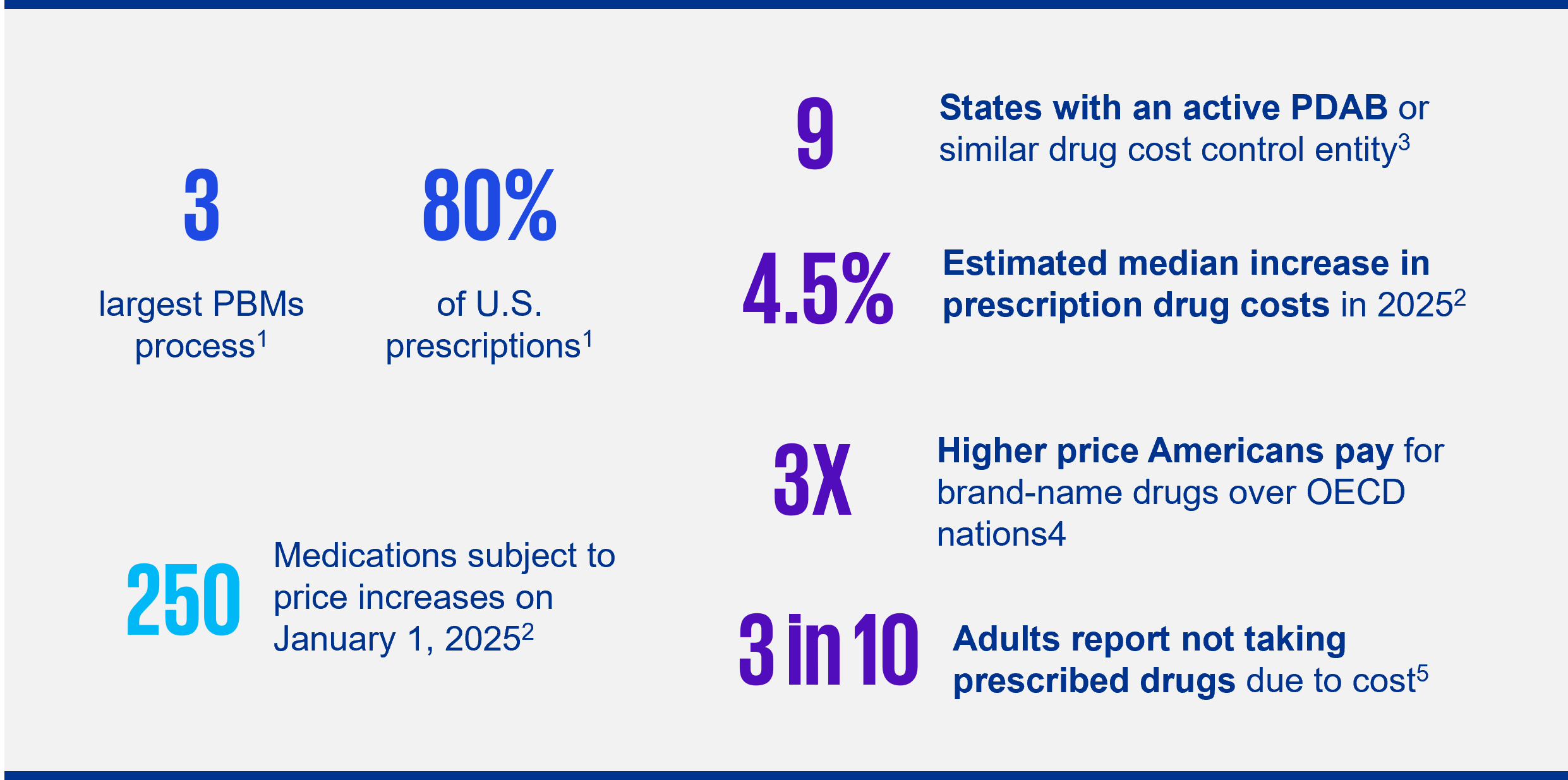

As prescription drug prices continue to rise, attentions are focusing on transparency and affordability at both the federal and state levels.

At the federal level, the current administration is focused on policies intended to lower U.S. prescription drug prices. Executive Order 14273, “Lowering Drug Prices by Once Again Putting Americans First,” focuses on three main policy areas: price reduction, transparency, and competition. Executive Order 14297, “Delivering Most-Favored-Nation Prescription Drug Pricing to American Patients,” in part, directs the DOJ and the FTC to pursue enforcement against potentially anti-competitive practices in pharmaceuticals markets. A recent memorandum directs HHS and FDA to ensure transparency and accuracy in direct-to-consumer prescription drug advertising.

At the state level, legislative activity is meant to enhance oversight of market participants, including Pharmacy Benefit Managers (PBMs), and price transparency through disclosure/reporting.

State attorneys general (AGs) are actively investigating billing, rebate, and discount practices as well as collaborating on multistate enforcement actions targeting anti-competitive conduct and unfair practices. Recently, a majority of state AGs jointly asked Congress to pass legislation to mitigate PBM conflicts of interest and prohibit PBMs from owning or operating pharmacies citing increased horizontal consolidation, vertical integration, and impacts to access and price.

Notable state activity in 2025 includes:

- Oversight & Drug Price Transparency (e.g., PBM oversight, disclosures, reporting)

- Drug Costs & Affordability (e.g., fair pricing, direct price control, PDABs)

1. Oversight & Drug Price Transparency

Recent state legislation (introduced and/or enacted) aims to enhance price transparency within the pharmaceutical industry, including pricing models under the federal 340B Drug Pricing Program for manufacturers and other covered entities. Further, concerns over PBMs’ perceived ability to influence drug pricing or control access has spurred numerous states into legislative action. Key provisions of bills introduced in 2025:

Key Features | |

|---|---|

Key Feature | Description/Examples |

PBM Oversight |

|

Disclosures |

|

Reporting |

|

2. Drug Costs & Affordability

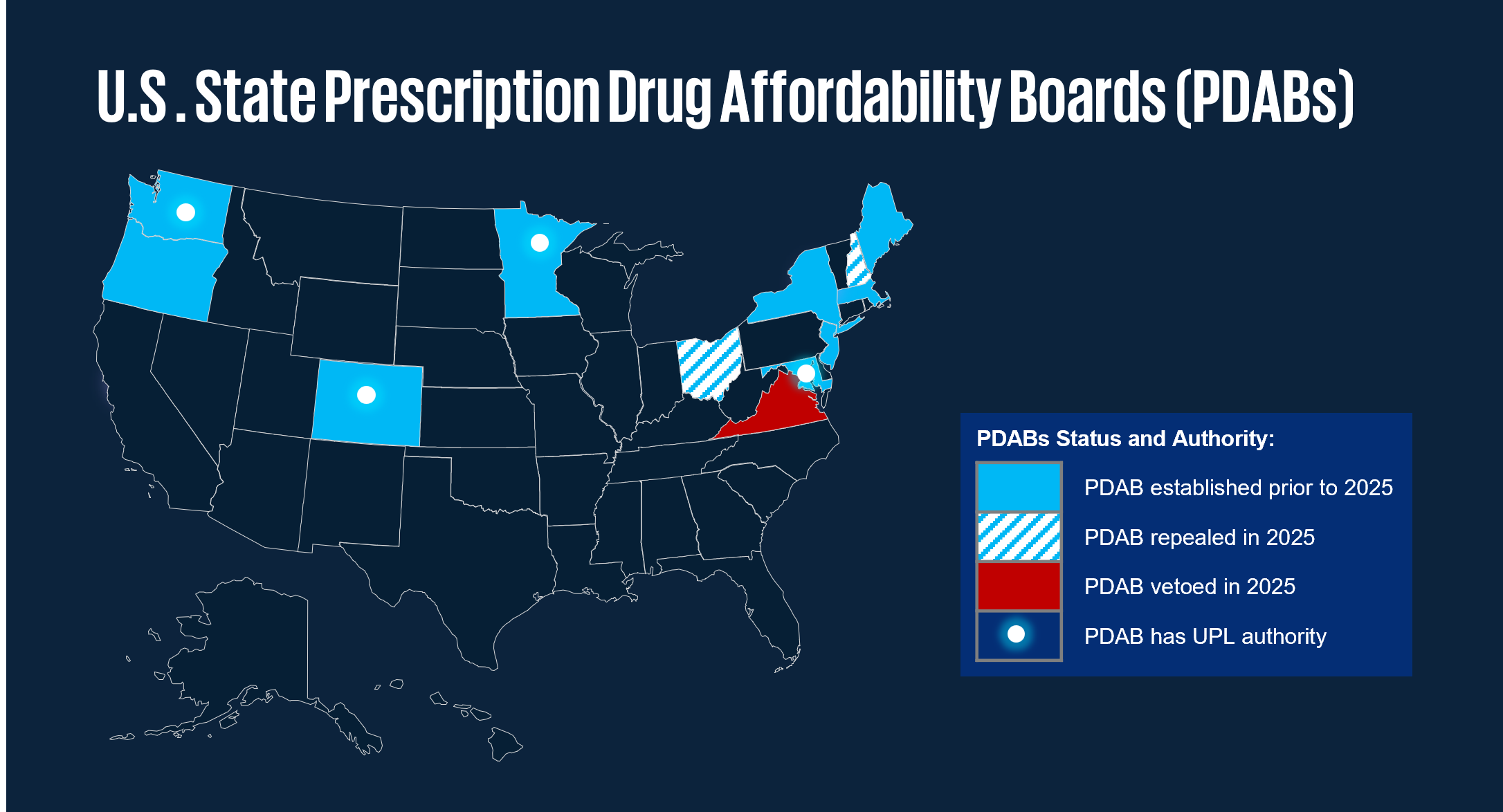

In 2025, various states have introduced/enacted legislation aimed at ensuring that prescription drugs remain affordable, through fair pricing and prohibitions on discriminatory practices. A number of states have established Prescription Drug Affordability Boards (PDABs) as independent bodies to review drug prices with the intent to make medications more affordable for consumers and public health systems. In 2025, several states expanded or refined the authority of their PDABs. Key features of state activity include:

Key Features | |

|---|---|

Key Feature | Description/Examples |

Fair Pricing |

|

Direct Price Control |

|

Prescription Drug Affordability Boards (PDABs) |

|

Footnotes:

1 National Association of Attorneys General, Letter to Congress RE: Pharmacy Benefit Managers, April 14, 2025

2 Reuters.com, Drugmakers to raise US prices on over 250 medicines starting Jan. 1, Decembers 31, 2024

3 Multistate.us, PDABs and UPLs: What They Are and Why They Matter for Drug Pricing Policy, May 15, 2025

4 WhiteHouse.gov, Fact Sheet: President Donald J. Trump Amends Duties to Address the Flow of Illicit Drugs Across our Northern Border, July 31, 2025

5 NCSL.org, 5 Prescription Drug Policy Trends to Watch in 2025, January 27, 2025

Dive into our thinking:

Explore more

Get the latest from KPMG Regulatory Insights

KPMG Regulatory Insights is the thought leader hub for timely insight on risk and regulatory developments.

Meet our team