State Series: Antitrust and M&A

Potential Impacts to Deals and Mergers

KPMG Regulatory Insights

- Expansion: States have broadened their antitrust powers and oversight of mergers and acquisitions, introducing pre-merger notification laws, especially healthcare transactions. Anticipate merger submissions to become more complex as companies consider state submissions and reviews in addition to federal HSR filing requirements and address questions from reviewers at both federal and state levels.

- Action: State AGs are expanding antitrust enforcement through multiple channels including collaborating with federal antitrust agencies (e.g., FTC, DOJ), joining multistate task forces (e.g., BRACE), introducing laws and regulations (e.g., pre-merger notification, noncompete restrictions), and building capacity (e.g., establishing antitrust units, adding staff).

_______________________________________________________________________________________________________________________________

August 2025

In 2025, states are actively pursuing antitrust legislation and regulation, both individually and collectively, seeking to take a larger role in regulating competition and scrutinizing potential mergers.

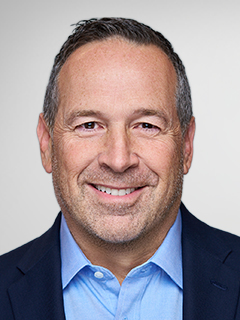

This activity includes the passage of new laws, and the consideration of others aimed at expanding state antitrust authority, particularly regarding pre-merger notification for certain transactions that may impact businesses operating within the state. The 2024 release of the Uniform Law Center’s Model Law, the Uniform Antitrust Pre-Merger Notification Act, has served to prompt states to consider legislation that would set broad pre-merger notification requirements for transactions in all industries.

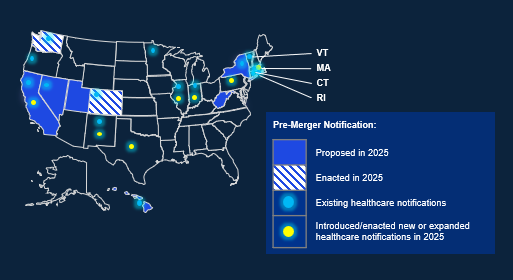

States are also actively continuing to consider legislation aimed at non-compete agreements even as the FTC’s rule establishing a nationwide ban on non-competes is subject to legal challenge.

At the same time, state attorneys general (AGs) actions in antitrust continue and may include multistate actions.

Notable state activity in 2025 includes:

- Antitrust (e.g., pre-merger notifications, non-compete agreements, algorithmic pricing)

- State AG Actions (e.g., proxy voting, workers/employment, joint action)

1. Antitrust

States have taken action to introduce and/or enact expanded antitrust laws and regulations, including new broad, industry agnostic pre-merger notification requirements. Other antitrust areas that have recent activity include non-compete agreements and algorithmic pricing. Key areas and features of these bills include:

Key Features | |

Key Feature | Description/Examples |

Pre-Merger Notifications (Figure 1) | |

Contemporaneous Notifications of HSR Reportable Transactions | Based on the Model Law, “Uniform Antitrust Pre-Merger Notification Act” (e.g., CO, WA)

Other similar legislation (e.g., NY)

|

Expansion of Healthcare Transaction Reviews |

|

Non-Compete Agreements (Figure 2) | |

Non-Compete Agreements |

|

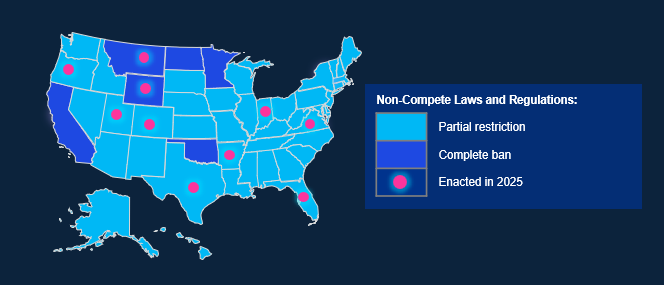

Algorithmic Pricing (Figure 3) | |

Algorithmic Pricing |

|

U.S.State Laws & Regulations

2. State AG Actions

In 2025, state AGs have sought to expand their antitrust enforcement through a variety of channels including collaborating in investigations with federal antitrust agencies, participating in multistate task forces to coordinate state-level action, introducing/enacting new laws and regulations (e.g., pre-merger notifications, algorithmic pricing, criminal penalties), and building capacity (e.g., establishing antitrust units, adding staff). Key features of recent actions include:

Key Features | |

Key Feature | Description/Examples |

Proxy Voting |

|

Employment and Workers |

|

Federal Joint |

|

Multistate Action |

|

Dive into our thinking:

Explore more

Get the latest from KPMG Regulatory Insights

KPMG Regulatory Insights is the thought leader hub for timely insight on risk and regulatory developments.

Meet our team