Retailers recalibrate to meet the tariff challenge

Retailers respond by adopting new technologies, repositioning supply chains, and adjusting pricing strategies

The retail sector is suffering profound effects from the current US tariff regime, with organizations grappling with rising import costs, evolving sourcing strategies, and the challenge of maintaining competitiveness in a volatile market, according to a recent KPMG survey of senior executives—including retail leaders.1

While tariff policy remains in flux, the administration has generally imposed sweeping new tariffs on virtually all trading partners, under a so-called “reciprocal” tariff plan.2 This introduced a minimum 10 percent import duty on goods from all countries and steeper rates in cases of large trade imbalances.3 For retailers, these policies translate into higher costs on a broad array of consumer goods, which are being passed on to consumers in the form of higher prices.

Our survey reveals how retailers are responding to the changing tariff environment, highlighting the impact on imports, investment decisions, workforce strategies, and pricing.

Shifting trade patterns and cost pressures

Although tariffs have raised the costs for imported goods, retailers generally have experienced an increase in imports from trading partners. The survey reveals that most respondents have seen a 26 percent to 40 percent increase in imports from China (the largest import source), while 77 percent noted a 16 percent to 25 percent rise in import costs from Association of Southeast Asian Nations countries.

Tariffs have raised the costs for imported goods, but retailers have nevertheless experienced an increase in imports from trading partners.

Market positioning: Mixed effects and competitive challenges

Tariffs have also created a complex competitive environment for retailers. Among respondents, 33 percent felt that tariffs had weakened their competitive position. Notably, 27 percent of retail organizations indicated that 76 percent to 90 percent of their product portfolio was impacted by tariffs—a figure significantly higher than the overall average of 6 percent across industries.

Sales have also been affected, though less severely than in other sectors. Among respondents, 30 percent cited an up to 5 percent decrease in foreign sales, and 23 percent reported a 6 percent to 15 percent decrease. Half of the respondents observed a decline in customer demand, and 40 percent reported decreased gross margins. The sector’s respondents anticipate worsening conditions, with 40 percent expecting a further drop in future gross margins.

Investment strategies: Caution and delay

Tariffs have forced retail organizations to rethink their investment strategies. Notably, 63 percent of respondents have delayed capital investments by up to 24 months, with 64 percent stating that market expansion investments were most affected.

Workforce and hiring: Mixed impact and strategic adaptation

The impact of tariffs on retail hiring and workforce planning has been mixed. While 40 percent said tariffs didn’t significantly affect their strategy or employment levels, 37 percent paused hiring due to economic uncertainty. High labor costs (63 percent) and lack of domestic suppliers (57 percent) are the primary challenges in shifting production and employment.

Strategic response and risk management

Retailers are actively seeking ways to mitigate tariff risks. Adjusting pricing and cost structures (83 percent) and repositioning supply chains (60 percent) are the top strategic levers. Also, 63 percent have changed sourcing strategies, while 50 percent have moved production to different countries. However, the effectiveness of these strategies is mixed: 37 percent rate their tariff response as neutral, 30 percent as effective, and 33 percent as ineffective.

Technology and supply chain adaptation

Retailers are turning to technology—such as predictive analytics (37 percent of respondents), artificial intelligence (AI)-powered logistics optimization (33 percent), and generative AI for scenario modeling (33 percent)—to support their tariff response.

As for supply chains, strategies are evolving, with 80 percent of respondents diversifying suppliers from low-tariff regions and 63 percent renegotiating supplier contracts.

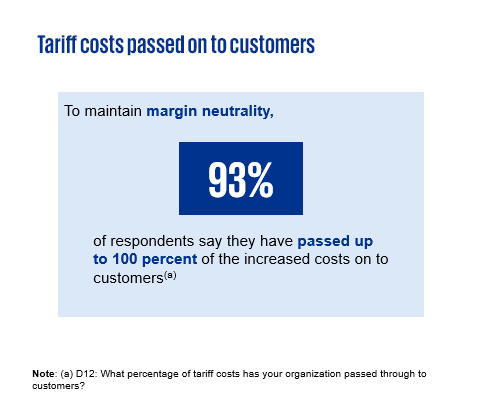

Pricing strategies: Passing costs to customers

Retailers are adjusting prices to maintain margin neutrality, with 93 percent of respondents saying they have passed up to 100 percent of the increased costs on to customers. The typical price increase falls in the 6 percent to 15 percent range, reflecting the direct financial pressure of tariffs and the need for agility in a volatile trade environment.

***

While uncertainty remains high, retailers are leveraging a mix of short-term and long-term responses to navigate the evolving trade landscape. The road ahead will require continued agility, resilience, and a willingness to embrace new models for supply chain management, workforce development, and pricing strategy.

Footnotes

1. In September 2025, KPMG surveyed 300 US senior executives in various functions about their views on the proposed US tariffs and their effect on their company and industry. Of the total surveyed, 30 were in the retail sector.

2. National Retail Federation, “Import Cargo Levels to Drop Sharply Amid New Tariffs and Uncertainty,” April 9, 2025.

3. Ibid.

Explore more

Tariff Pulse Survey: U.S. Businesses Grapple with Tariff Fallout Six Months In

In the latest KPMG survey of 300 senior executives, businesses report pausing hiring and raising prices, while a significant majority begin to consider reshoring to the U.S.

Policy in Motion: Insights for navigating with confidence

Your resource for the latest on trade, tariff and regulatory policy changes.

Meet our team

With special thanks to: Sam Rajakumar