Life sciences sector adapts to US tariffs with strategic shifts

Companies pursue domestic investment, reshoring

A KPMG LLP survey of senior executives in September 2025 reveals a complex landscape marked by uncertainty and strategic pivots as organizations confront evolving tariff regimes.1 Shortly after the survey was conducted, the Trump administration announced a temporary pause on the implementation of pharmaceutical tariffs, adding another layer of unpredictability to the trade environment.2 Prior to this pause, the US tariff structure included a 100 percent tariff on branded or patented pharmaceutical products imported into the US, effective October 1, 2025, with exemptions for companies actively building manufacturing plants domestically, defined as “breaking ground” or “under construction.” Generic medicines remained exempt, as did imports from countries with trade agreements (such as the European Union and Japan).3 The US also maintained a 10 percent reciprocal tariff with China until November 10, 2025, while negotiations with other trade partners continued.4 Additionally, medical devices faced tariffs of up to 25 percent on imports from Canada and Mexico.5

Shifting costs and stable exports

Life sciences companies rely heavily on international supply chains and are therefore highly sensitive to tariff changes. Analysts estimate that with roughly $200 billion in drug products imported into the US in 2024, a 10 percent across-the-board tariff represents about a $20 billion annual cost increase for the pharmaceutical sector.4 According to survey respondents, the top three import sources are Europe (averaging 29 percent of imports), China (19 percent), and Canada (11 percent). Tariffs have led to notable cost increases: 33 percent of respondents reported a 6 percent to 15 percent rise in import costs from Europe and 38 percent from Canada, while 57 percent of those importing from China saw a higher 16 percent to 25 percent increase. These cost pressures are reshaping procurement strategies and supplier relationships.

On the export side, Europe remains the leading destination (40 percent of respondents), followed by Canada (19 percent) and the United Kingdom (10 percent), respondents reported. Interestingly, exports to these regions have remained relatively unchanged despite retaliatory tariffs, suggesting that demand for life sciences products is resilient and that companies are finding ways to maintain their market presence abroad.

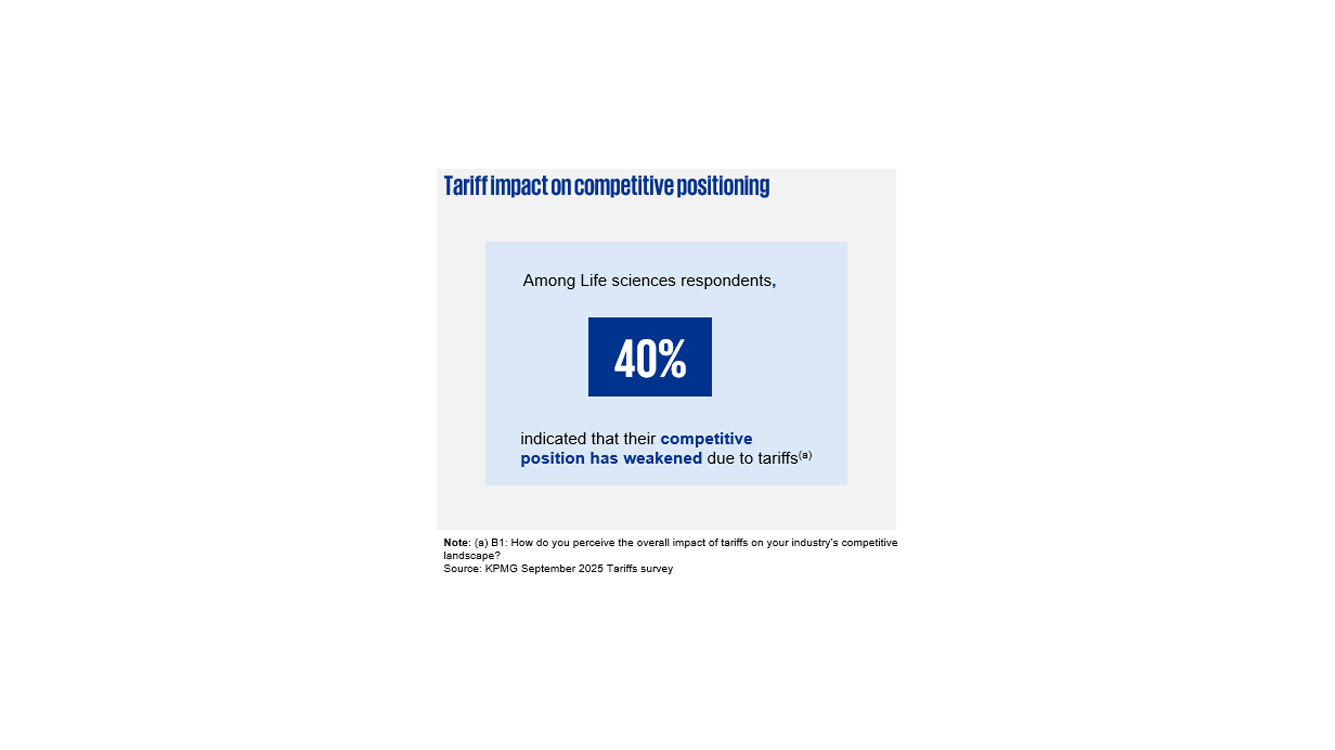

Competitive pressures and portfolio impact

Tariffs are eroding competitiveness for a significant portion of the sector. The impact is widespread: 30 percent of respondents reported that 26 percent to 50 percent of their product portfolio has been affected, while about 10 percent said nearly all products were impacted. Among life sciences respondents, 40 percent indicated tariffs had weakened their competitive position.

Domestic investment focus and cautious planning

More than half of the executives surveyed (52 percent) stated that they would increase investment in domestic markets to address tariff-related disruptions. But capital investment decisions are delayed as companies reassess their long-term strategies. Among respondents, 43 percent said they had postponed major new investments by up to 12 months. Among life sciences respondents, 72 percent—higher than any other sector—said their most affected projects are expansions or upgrades of manufacturing facilities.

Capital investment decisions are delayed as life sciences companies reassess their long-term strategies.

Rajesh Mishra

Principal, Advisory C&O Commercial, KPMG US

No job losses in US, but hiring weakens

Tariffs have had a mixed impact on workforce decisions. Among respondents, 60 percent reported no job losses in the US workforce. However, 40 percent paused hiring, citing economic uncertainty.

Formal plans for reshoring

Reshoring—bringing operations back to the US—is gaining traction in the life sciences sector, but the process is complex and lengthy, with 29 percent of respondents (the highest among all sectors) expecting it to take more than three years to complete. Still, 27 percent of life sciences respondents, again the highest among all sectors, said they have begun formal planning for reshoring. The biggest hurdles to reshoring are high labor costs (67 percent of respondents), high operating costs (67 percent), and trade policy uncertainty (50 percent).

Negative view of tariffs amid resilience

Life sciences organizations predominantly expressed a negative sentiment toward the US trade and tariff environment, as reflected by 73 percent of respondents, compared to 53 percent overall. Nevertheless, the sector is demonstrating resilience and adaptability. Among respondents, 33 percent believe their organizations can pivot within 7 to 12 months if tariffs increase, consistent with trends observed in previous surveys.

Conclusion

In response to US tariffs, life sciences companies are shifting toward domestic investment, formal reshoring plans, and implementing proactive workforce management—reflecting a sector that is adapting to new realities while maintaining its global reach. As trade policies continue to evolve, these organizations will need to balance cost management, operational flexibility, and strategic investment to thrive in an uncertain environment.

Footnotes

1. In September 2025, KPMG LLP surveyed 300 US senior executives in various industries and functions about their views on the proposed US tariffs and their effects on their company. Of the total surveyed, 30 were in the life sciences sector.

2. “President Trump and White House Announce New Overseas Pharmaceutical Tariff,” Baker Donelson, October 1, 2025

3. Mathini Ilancheran, “100% U.S. Drug Tariffs: Implications For Pharma And Outsourcing,” Clinical Leader, October 17, 2025

4. “Fact Sheet: President Donald J. Trump Continues the Suspension of the Heightened Tariffs on China,” The White House, August 11, 2025, “Tariffs and Turmoil: Impact of 2025 Trade Policies on the U.S. Life Sciences Sector,” hubXchange, 2025

5. Navigating U.S. Tariffs in 2025: Impacts and Strategies for Pharma and Healthcare,” DelveInsight, April 30, 2025

Explore more

Tariff Pulse Survey: U.S. Businesses Grapple with Tariff Fallout Six Months In

In the latest KPMG survey of 300 senior executives, businesses report pausing hiring and raising prices, while a significant majority begin to consider reshoring to the U.S.

Policy in Motion: Insights for navigating with confidence

Your resource for the latest on trade, tariff and regulatory policy changes.

Meet our team