Global Navigator from KPMG Economics

Tariffs stunt global growth: Financial system instability is showing

June 25, 2025

This edition of Global Navigator takes a closer look at the global economy through 2026. Tariffs levied by the United States have put downward pressure on growth across the globe. Geopolitical risk and economic policy uncertainty remain elevated, in addition to concerns about financial stability. These factors contribute to continued higher interest rates in the US, which have spillover effects abroad.

Global growth is forecast to slow to 2.7% in 2025 and 2.9% in 2026 from 3.2% in 2024. A global recession, defined as negative Gross Domestic Product (GDP) growth per capita, is avoided despite weakness from several major economies. Growth in Asia and North America has been marked down (Chart 1) to reflect the stress associated with the escalation of tariffs and trade conflicts.

Inflation is expected to continue to cool, allowing most major central banks to cut policy rates. Lower oil prices, due to muted demand and additional supply being released by the Organization of Petroleum Exporting Countries (OPEC), put a lid on energy prices. Chinese-made goods no longer headed to the US will add downward pressure on goods prices as they seek new destinations. If China were to pull back exports to the rest of the world, it would worsen its deflation.

The flare-up of tensions between Israel and Iran and recent entry of the US to the conflict increase the risk of global stagflation; although, the cooling over recent days has tempered concerns. Our forecast does not account for a prolonged disruption of trade due to the conflict or a spike in oil prices, either of which would cause global inflation to increase. That would slow the pace of central bank interest rate cuts.

We are forecasting one rate cut by the Federal Reserve (Fed) in 2025 and five additional cuts in 2026 ending in October. The Bank of England and European Central Bank cut rates early in the year, while the Bank of Canada has cut several times to stimulate its economy. Central banks across Asia and South America are looking to reduce rates as price pressures diminish.

The primary driver of the downgrade to our global forecast is tariffs. The uncertainties of tariffs, both threatened and implemented by the United States, are driving firms and consumers to pause. Reorganizing supply chains is costly and takes time. Tariffs levied by executive order can just as quickly be removed; that deepens uncertainty for firms.

Interest rates are structurally higher than in the 2010s. This will increase the cost of government debt servicing as fiscal stimulus is needed to blunt the economic slowdown prompted by tariffs. Ballooning government debt loads and sagging demand for sovereign debt put financial stability in the crosshairs.

Asia

Growth in Asia is expected to slow to 4.0% in 2025 and 4.1% in 2026 from 4.6% in 2024. Inflation remains low through 2026.

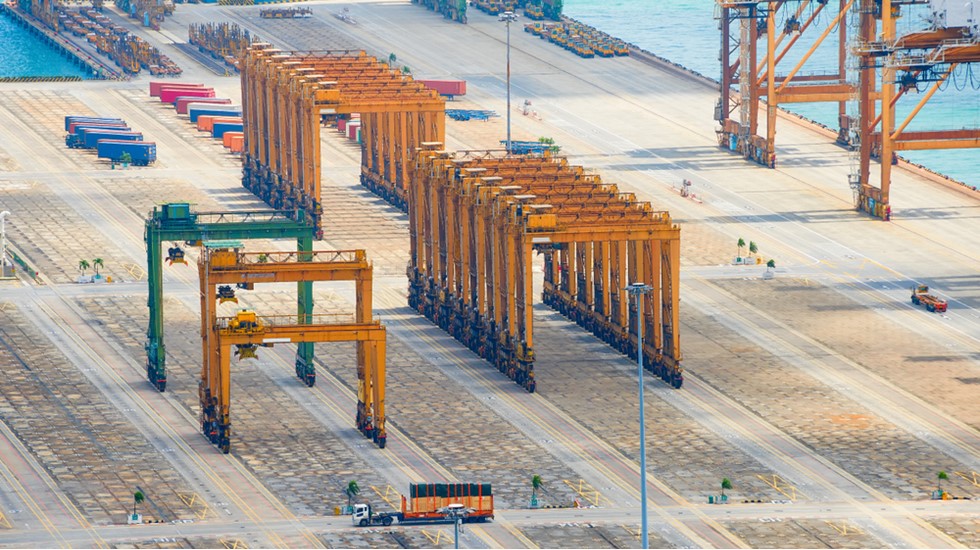

Regional growth will be impacted by US tariffs on China and other major manufacturing locations, especially if there is no resolution at the end of the 90-day pause on August 12. Uncertainty about country- and product-specific tariffs is hampering reconfiguration of supply chains.

Chinese growth is forecast to slow materially in 2025 and 2026. Strong consumption growth on the back of government stimulus propelled the economy at the start of the year. Domestic demand, sans government stimulus, remains subdued amid structural challenges.

Amid tariffs, goods formerly headed to the US will be rerouted to other destinations, essentially exporting disinflation stemming from manufacturing overcapacity. In turn, these new destinations may enact “anti-dumping” policies. Overcapacity has contributed to deflation, which provides the People’s Bank of China room for additional rate cuts to stimulate cautious consumers.

Manufacturing activity that had ground to a halt with workers being furloughed is restarting with the new US-China trade deal. This will provide a boost to the Chinese economy and save the government from funding additional stimulus with debt.

Tariffs have not just affected China. “Reciprocal” tariffs on some of the largest or fastest growing manufacturing countries put a damper on regional growth. Assuming no changes to proposed tariff rates after the 90-day pause slated to end August 11, Vietnam and Cambodia each face tariffs greater than 45%. It could be worse for Singapore where exports are more than 100% of the country’s GDP. China, which as of 2024 accounted for about 30% of global manufacturing value-add, is currently subject to an effective tariff rate of 55%. Trade negotiations between the US and China are bumpy but ongoing.

Two established manufacturing giants, Japan and South Korea, have been assigned “reciprocal” tariffs of 24% and 25%, respectively. If the 90-day pause ends without a tariff reduction, then both countries remain competitive relative to other manufacturing economies based on their tariff rates.

Europe

Growth in Europe is forecast to decelerate to 1.2% in 2025 and 1.4% in 2026 from 1.7% in 2024. Inflation continues to cool through 2026.

The European Union has been reluctant to retaliate against US tariffs. A big retaliatory response would likely elicit a stagflationary shock, hampering the European Central Bank (ECB).

The ECB cut its policy rate earlier this month; President Christine Lagarde indicated that was the end of the central bank’s cutting cycle. Imported disinflation from Chinese goods rerouted away from the US and sagging energy prices will help keep a ceiling on inflation. Anti-dumping duties by the EU to counter the inflow of cheap Asian goods are on the table.

Germany is forecast to deliver positive annual growth figures for the first time in two years. Manufacturing lines were paused or shuttered with the Russian invasion of Ukraine. Some sectors like chemicals have yet to recover. Defense spending will provide a boost but could incite inflationary pressures. Other countries in Europe don’t have the ability to undertake such spending programs.

Three years have passed since Russia attacked Ukraine. Its economy is showing signs of wear. Growth is expected to drop to its slowest since the year of the invasion. Inflationary pressures are anticipated to keep the central bank on hold.

Central and Eastern European countries were spared the worst of tariffs, but levies on cars, steel and aluminum will be challenging. The region’s aging demographics are offset by a highly educated workforce and strong productivity growth.

Middle East and Africa

Growth in the Middle East and Africa region is predicted to accelerate to 3.7% in 2025 and 3.9% in 2026 from 2.6% in 2024. Inflation is returning to pre-pandemic levels. The growth forecast is contingent on containment of conflict in the region.

Slower global growth expectations have weighed on oil prices. This will further be exacerbated by the removal of production curbs by OPEC. The group is unwinding 2.2 million barrels per day of voluntary production cuts that started in November 2022. Subsequent lower global energy prices will aid central banks’ inflation containment.

The Gulf Cooperation Council countries were subject to the lowest “reciprocal” tariff rates. During the trade conflict, the region’s focus has been more on geopolitical relations.

Ongoing conflicts strain geopolitical stability. The conflict involving Israel, Iran and, of late, the US, caused oil prices to pop.

Middle Eastern countries are attempting to diversify away from oil into trade, transportation and tourism. A large air carrier made a massive purchase of US-made airplanes, which improved transportation capacity. In tourism, a major entertainment company has announced a new amusement park in Abu Dhabi.

North America

Growth in North America is expected to drop to 1.1% in 2025 and 1.7% in 2026 from 2.6% in 2024. Inflation is forecast to head higher as tariffs bite and the dollar depreciates; it is then expected to fall back to 2024 levels in 2026.

The United States is forecast to experience a mild bout of stagflation, a period including rising inflation and unemployment. Growth is expected to slow as firms and consumers pull back amid tariff stress. This environment puts the Fed in a difficult situation; it is stuck between anticipated price increases due to tariffs and the threat of rising unemployment. We expect the Fed to carry out six rate cuts of ¼ point by the end of 2026. The US dollar has depreciated about 10% against a broad basket of currencies, which will worsen inflation.

The trade deal between the United States and China decreased the new tariffs on Chinese goods from 145% to 30% (10% reciprocal and 20% fentanyl) and American goods from 125% to 10%. That deal moved our forecast from a shallow US recession to weak growth with stagflation.

Canada and Mexico each face 25% tariffs on non-USMCA-compliant exports to the United States. Major exports affected by tariffs include manufactured goods, agricultural products and automobiles, which have parts that cross the border to the US during production up to 38 times, according to industry analysts.

Canada’s economy is expected to enter a technical recession in 2025 as exports are expected to dip due to cooling global demand. The Bank of Canada has cut 225 basis points since mid-2024 to stimulate its economy. It is likely to take a cautious approach as it evaluates the effects of tariffs. The short-term boost to exports in early 2025 was likely driven by US importers buying ahead of tariff implementation. Curbs to immigration are expected to cause a contraction in the country’s population later this year, reducing the number of both producers and consumers.

Mexico is forecast to skirt a recession during the next two years. Like Canada, it experienced a boost to manufacturing ahead of tariffs; that is expected to dissipate. Mexico opted for a non-retaliatory stance, which seems to have aided in keeping some tariffs at bay. More than 70% of Mexico’s exports go to the US so tariffs are detrimental. Fixed capital formation has fallen year-over-year as businesses weigh investments more judiciously.

Remittances, which are funds sent home by migrants to another country, are a key component of Central American economies. They make up nearly 34% of private consumption in Nicaragua and are at risk of being taxed by the US’s “One, Big, Beautiful Bill.” If the bill passes the Senate, there may be a flood of remittances south-bound ahead of the 2026 tax implementation date.

Oceania

Growth in Oceania is forecast to accelerate to 1.6% in 2025 and 2.2% in 2026 from 0.9% in 2024. Inflation is expected to cool in 2025 before rebounding higher in 2026.

Australia, the primary economy of the region, started the year off with a weak first quarter after a strong finish to 2025. Private sector demand was the main driver of growth as both the public sector and trade were drags. The Reserve Bank of Australia has cut rates twice this year and is expected to do so once more before year-end. Easing price pressures have brought inflation within the bank’s target band. Geopolitical and trade tensions could cause a rebound in inflation that may delay another cut.

South America

Growth in South America is forecast to remain steady at 1.9% annually between 2024 and 2026. Inflation is expected to be relatively low outside of Argentina and Venezuela.

The region has largely been spared from the worst tariffs allowing for relative stability. Tariffs on copper may weigh on Chile and Peru, the world’s top producers. Additional global electric vehicle production has caused a step up in mining production, supporting early-year economic growth in Chile.

Brazil, Colombia and Argentina have significant export overlap to the US with China. Assuming Chinese production is uncompetitive due to tariffs, these economies will provide additional support to South American growth.

The reshuffling of trade due to tariffs is unlikely to move much manufacturing to South America in the short term, but the shifting of Chinese demand for agricultural products away from the United States has already benefited Brazil. That provides a buffer to Brazil’s economic slowdown. The Central Bank of Brazil is weighing additional rate hikes due to worsening inflation.

Risks

- Trade wars escalate. The end of the 90-day pause could arrive without resolution, putting countries back on their heels. That could cause an escalation in trade tensions and retaliation, which would further suppress global growth.

- Geopolitical conflicts intensify. Hot conflicts have become more common over the last decade. Tariffs are a larger threat to relations with the rest of the world. These conflicts could harm oil and commodities trade, cut off more shipping lanes and reallocate resources to defense. The US’s action against Iranian nuclear facilities initially heightened the risk to energy markets before a cooling of tensions ensued; the Middle East remains a tinder box.

- Financial system. US government debt was downgraded by a major rating agency from the highest rung. Amid a flood of government debt issuances, there may not be enough demand to satisfy the supply. That would send interest rates higher and possibly restrict the role of government as a stabilizer.

The end of the 90-day pause could arrive without resolution, putting countries back on their heels.

Benjamin Shoesmith

KPMG Senior Economist

Bottom Line:

The breadth and swift application of tariffs is set to slow global growth in 2025 before recovering some ground in 2026. The uncertainty itself is impossible for firms and consumers to ignore. Even if tariffs were eliminated, they can be reinstated with the stroke of a pen.

The world was just regaining its footing coming out of the pandemic. Now, economic policies have aggravated headwinds. Government debt burdens and geopolitical relations will be strained as countries attempt to navigate this opaque trading environment.

Global Outlook Forecast - June 2025

Subscribe to insights from KPMG Economics

KPMG Economics distributes a wide selection of insight and analysis to help businesses make informed decisions.

Explore more

Global Navigator from KPMG Economics

Higher rates impede private investment and worsen fiscal outlook.

KPMG Economics

A source for unbiased economic intelligence to help improve strategic decision-making.

Trade deficit narrowed in April

April revealed the largest one-month narrowing of the deficit on record.

Meet our team