Intelligent Insurance:

A blueprint for creating value through AI-driven transformation

Agentic AI is revolutionizing insurance with dynamic policies, instant claims, and 24/7 personalized service. However, legacy systems and data challenges hinder adoption.

Navigating the future: AI-driven transformation in insurance

AI has been a part of the insurance industry for some time, but its adoption varies significantly based on insurance type, geography and the distinction between legacy insurers and insurtech disruptors. The emergence of generative AI (GenAI), along with the next wave of autonomous and agentic AI systems, is unlocking entirely new possibilities for innovation across the sector.

As the insurance sector evaluates how advancing technologies like AI can enhance their business operations, the industry is undergoing rapid transformation. With AI leading technological advancements, changing customer expectations, and ongoing challenges from climate related events, insurers must adapt and innovate to stay competitive.

The integration of AI in the insurance industry is not just a technological shift but a strategic imperative.

Scott Shapiro

US Sector Leader, Insurance

Insurers at crucial AI crossroads: Balancing competitive edge with immediate ROI and workforce challenges

The findings from this survey highlight a critical juncture for insurers on their AI implementation journey. While a significant number of insurance executives recognize the competitive advantages AI can offer, many are also under considerable pressure from shareholders to demonstrate immediate returns on their investments. However, a notable portion of these leaders reveal that their organizations currently lack the necessary tools or metrics to measure this return effectively. Additionally, despite the potential of GenAI to improve efficiency by automating mundane tasks, a substantial challenge remains in the form of a skills gap within the workforce, hindering seamless AI integration.

Key findings at a glance

Key findings are highlighted below. Detailed findings are available in the full report.

Widespread AI use in US insurance companies fuels high expectations among executives

AI spending for US insurance companies will likely increase significantly

Data concerns and lack of skills emerge as top challenges

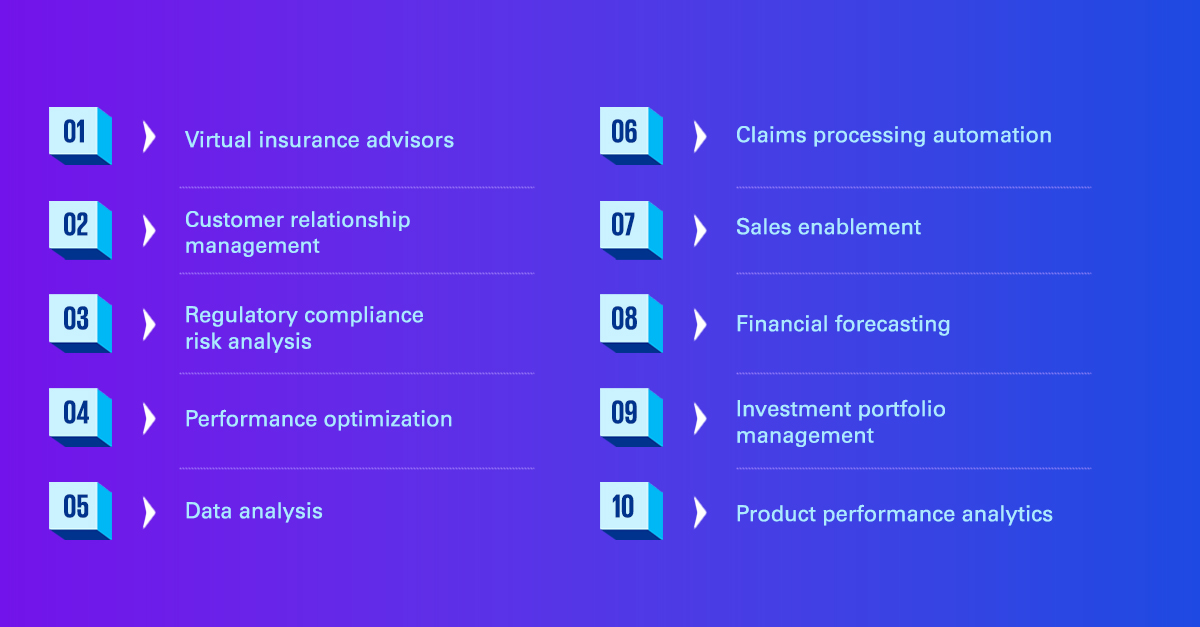

Top 10 areas of opportunity: Insurance

Download the full report

Discover the pivotal insights from our latest survey, revealing the opportunities and challenges insurers face with AI adoption. Learn how industry leaders are navigating competitive pressures, ROI measurement hurdles, and workforce skill gaps. Download the full report now!

Unlocking AI potential: GenAI sector value reports

"The intelligent enterprise: A blueprint for creating value through AI-driven transformation" reports provide a detailed guide for organizations to implement AI, optimize operations, and enhance market impact. Released in a series, the reports will cover eight critical industry sectors and outline a three-phase AI transformation process: Enable, Embed, and Evolve. Insights stem from in-depth interviews with AI experts, sector-specific KPMG professionals, and a survey of 1,390 decision-makers across eight global markets, including Australia, China, Germany, the UK, Canada, France, Japan, and the US. This research offers actionable strategies tailored to each industry sector.

Our latest AI insights

Explore our latest thinking on how to realize the many benefits of integrating AI across your Insurance enterprise.

From experimentation to execution

How insurers are moving beyond AI hype

From cost center to competitive asset

Transforming insurance data strategy

Top of mind insurance industry issues

Gain insights from KPMG on the issues that are top-of-mind for the insurance industry.

You Can with AI U.S.

Discover how KPMG can help your business harness the power of AI. Explore our AI strategy framework and see the impacts of AI innovation

Get in touch

Start the conversation. Connect with our team today to learn how we can help you realize the full potential of GenAI.