FRB Reports: Supervision and Regulation; Financial Stability

Declines in supervisory findings; changes to the supervisory action framework

KPMG Regulatory Insights

- Supervisory Findings: Declines in the number of supervisory findings for all institutions – though outstanding supervisory findings reflect ongoing areas of concern, including governance and controls, risk management and internal controls, and IT and operational risk.

- Tailoring: Efforts to tailor supervisory approaches based on an entity’s risk and business profile will continue.

- Rulemaking: Anticipated rulemakings to ease regulatory expectations are coming to life in issuances related to large bank capital requirements and community bank capital requirements and supervisory priorities (e.g., credit and liquidity risk).

December 2025

The Federal Reserve Board (FRB) issued its reports on Supervision and Regulation and Financial Stability. Typically, these reports are issued semiannually, however, this is the first and only issuance of the Supervision and Regulation Report in 2025.

1. The Supervision and Regulation Report assesses current banking system conditions, details regulatory developments, and provides transparency into the FRB's supervisory priorities and actions. Highlights include:

- An assessment that the U.S. banking system continues to maintain strong capital and liquidity levels.

- A supervisory focus on risks to safety and soundness, particularly core and material financial risks, including an update to the supervisory ratings framework and changing examination priorities.

- Efforts to tailor supervision based on size, complexity, business model and risk profile.

- Ongoing evaluation of the current capital framework with potential for reforms.

2. The Financial Stability Report presents FRB's current assessment of the stability of the overall U.S. financial system, noting:

- Elevated asset valuations, moderate vulnerabilities due to household and business debt, “notable” vulnerabilities associated with financial leverage, and continued moderate funding risks.

- Industry stakeholder concerns around policy uncertainty, geopolitical risks, higher long-term rates, persistent inflation, artificial intelligence, and asset prices.

Issues identified in the reports were reiterated and reinforced in recent testimony provided by agency leadership before House Financial Services Committee hearing on Oversight of the Prudential Regulators.

1. Supervision and Regulation Report

The FRB's Supervision and Regulation Report highlights the following:

Banking System Conditions. The FRB states, “In the first half of 2025, the vast majority of banking organizations continued to report capital levels well above applicable regulatory requirements. As of the second quarter, over 99 percent of all banks were well capitalized. 2025 stress test results showed that large banks are well positioned to weather a severe recession while maintaining minimum capital requirements and the ability to lend to households and businesses.”

Regulatory Developments. The report highlights proposed and final rulemakings, statements and other regulatory developments since Fall 2024 including a(n):

- Interagency (FRB, FDIC, OCC) final rule modifying the enhanced supplementary leverage ratio (eSLR) standards (see KPMG Regulatory Alert here)

- Interagency (FRB, FDIC, OCC) proposal to change the community bank leverage ratio (CBLR) framework (see KPMG Regulatory Alert here)

- FRB final revisions to the LFI (Large Financial Institution) Rating System and Framework (see KPMG Regulatory Alert here)

- FRB request for comment (RFC) on proposals to enhance the transparency and public accountability of its annual stress test (see KPMG Regulatory Alert here)

Supervisory Developments. The FRB states that its’ “supervisory approaches and priorities differ based on a financial institution’s size and complexity” and that it conducts “examinations to evaluate a banking organization’s activities, risk management, and financial condition.”

The report notes that the FRB “is reviewing its supervisory approaches and is making necessary program changes, including adjusting certain asset thresholds, reducing, and streamlining reporting requirements, improving the communication of supervisory conclusions, and increasing transparency into the supervisory process.” These changes are consistent with the new Statement of Supervisory Operating Principles (see KPMG Regulatory Alert here).

It is also noted that the FRB has “restored the practice of issuing non-binding supervisory observations” to firms that do not meet the threshold for a matter requiring attention (MRA) allowing for enhanced communication.

Supervisory Priorities. Acknowledging that supervisory practices and the supervisory action framework are being reformed, the report outlines FRB's supervisory priorities for the near term for LFIs (with $100 billion or more in total assets, including G-SIBs, and FBOs with combined U.S. assets of $100 billion or more), community banking organizations (CBOs) (with less than $10 billion in total assets), and regional banking organization (RBOs) (with total assets of $10 billion or more and less than $100 billion). The core material and financial risks prioritized for supervision are outlined in the table below.

LFIs | CBOs and RBOs |

|---|---|

|

|

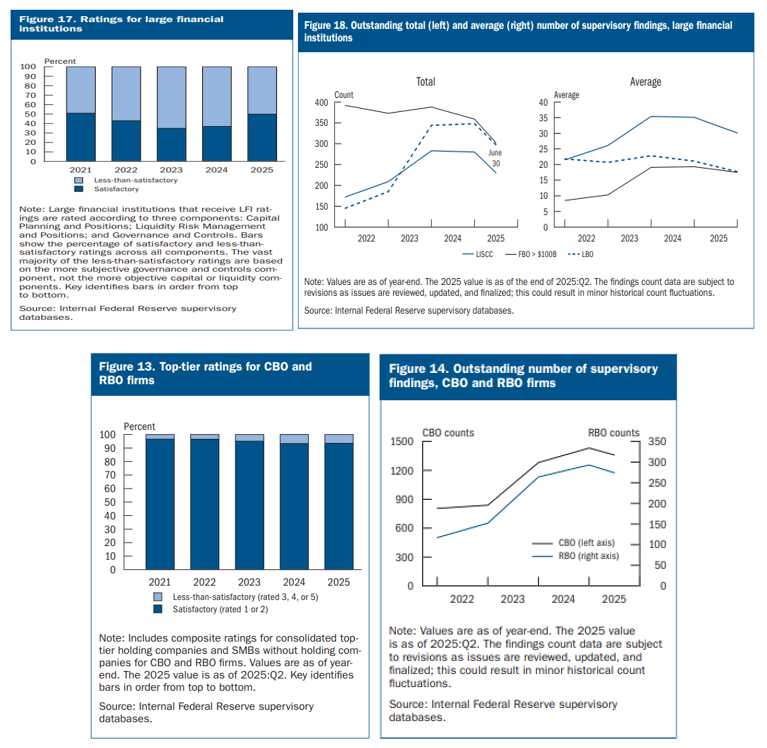

Trends in Supervisory Findings and Ratings: The report states that supervisory findings for large financial institutions, CBOs, and RBOs decreased in the first half of 2025 (see figures 17 and 18). As of June 30, 2025, about half of LFIs maintained satisfactory ratings across all three LFI rating components (capital planning and positions; liquidity risk management and positions; and governance and controls). The remaining LFIs were rated less-than-satisfactory in at least one component – and the FRB notes that the “vast majority” of these less-than-satisfactory ratings were related to governance and controls.

For CBOs and RBOs, the FRB reports that most remained in satisfactory condition as of June 30, 2025 (see figure 13) and that supervisory findings declined in the first half of the year (see figure 14). For these firms, the top categories of outstanding supervisory findings included risk management practices and IT and operational risk.

2. Financial Stability Report

The FRB's Financial Stability Report provides an overview of financial system vulnerabilities since the last report issued in April 2025, across four areas:

- Asset Valuations: The report indicates that asset valuations have increased to elevated levels, the ratio of equity prices to earnings has returned to near the high end of historical range, and the estimate of the equity premium remained well below average.

- Borrowing by Businesses and Households: The FRB notes that vulnerabilities from business and household debt remained moderate. Total debt of businesses and households as a fraction of gross domestic product (GDP) continued to trend slightly down to the lowest level in the past two decades. Further, delinquencies on credit cards and auto loans remained above pre-pandemic levels.

- Leverage within the Financial Sector: The report states that overall, the banking sector remained sound and resilient, and most banks continued to report capital levels well above regulatory requirements. Additionally, fair value losses on fixed-rate assets declined but were still sizable and continued to be sensitive to changes in long-term interest rates. However, vulnerabilities associated with financial leverage remained notable – with leverage at life insurers at the top quartile of its historical distribution.

- Funding Risks: As funding risks remained moderate, assets in cash-management vehicles continued to grow – driven by government money market funds (MMFs) as a main contributor. The report also notes that banks’ reliance on uninsured deposits was well below the peaks in 2022 and early 2023.

Near-Term Risks to the Financial System. The FRB highlights potential near-term risks, based in part on topics cited in its market outreach, “Survey of Salient Risks to Financial Stability.” Respondents cited policy uncertainty, geopolitical risks, higher long-term rates, persistent inflation, artificial intelligence, private credit, and sharp declines in asset prices as near-term risks. The FRB highlights possible interactions between the four existing vulnerabilities with three potential near-term risks to the financial system:

- Further increases in term premiums could lead to higher-than anticipated long-term interest rates.

- Slowdown in global economic growth could exacerbate existing financial vulnerabilities.

- Cyberattacks and other cyber events could disrupt market functioning and the provision of financial services.

Dive into our thinking:

FRB Reports: Supervision and Regulation; Financial Stability

Declines in supervisory findings; changes to the supervisory action framework

Download PDFExplore more

Get the latest from KPMG Regulatory Insights

KPMG Regulatory Insights is the thought leader hub for timely insight on risk and regulatory developments.

Meet our team