KPMG consumer pulse survey I Summer 2023

Consumers budget for summer

KPMG polled more than 1,000 consumers across the United States to learn about their expected spending habits for the year, as well as shifts in buying behaviors across categories and channels. Additionally, we asked respondents more about the impact of inflation, their travel plans for the summer, means of transportation and their return to office.

Living expenses continue to climb

Given fast-rising inflation, consumers expect to spend 10 percent more of their income on housing, utilities, insurance, and other monthly living expenses in summer 2023 than they did just two years ago.

10%

Consumers are expected to spend

more for regular monthly living expenses in May 2023 compared to May 2021.

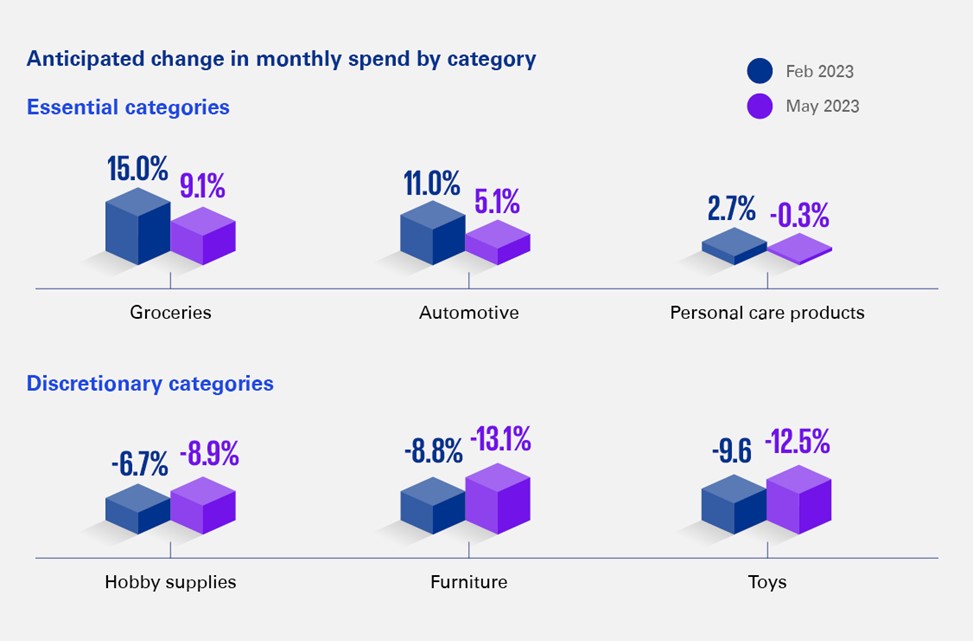

Consumers pull back across all categories, but especially in discretionary spending.

The larger cutbacks this summer could come in spending on furniture, toys, and hobby supplies, as well as for larger and historically financed purchases such as home improvement and electronics and appliances.

Summer travel is heating up… but has a tighter budget

The number of consumers interested in summer travel has continued to climb over the last two years. Although more consumers have travel plans, they expect to decrease discretionary spending overall. Their dollars can’t go as far this year when everything they need for a vacation—transportation, accommodations, clothing, food, and fun—costs more.

18%

International travel is heating up

plan to visit international destinations in 2023 compared to

13%

who crossed borders in 2022

32%

...especially for younger generations.

of Gen Z consumers plan overseas trips more than the

12%

of baby boomers

Explore more

Meet our team