Footnotes

- KPMG LLP, “Who’s on first, what’s on second: How can companies score on ESG reporting?,” March 2023, https://info.kpmg.us/news-perspectives/advancing-the-profession/esg-reporting-maturity-2023.html.

authored by:

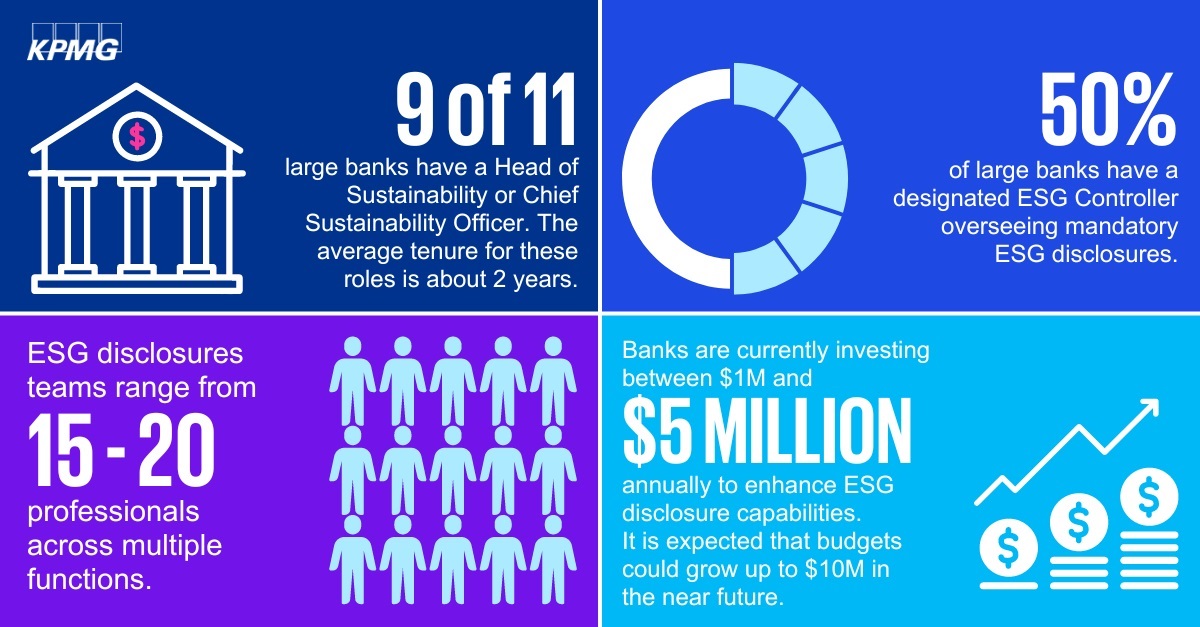

Half of large banks have designated an ESG controller responsible for overseeing mandatory ESG-related disclosures, according to recent findings from a KPMG U.S. peer benchmarking analysis. Gathering information across 11 large banks with at least $350 billion in assets through environmental, social and governance (ESG) public disclosures, news releases, company websites, social media and interviews with banking senior leaders, the analysis found a growing focus on sustainability in the sector. Banks are establishing dedicated leadership roles, increasing investments in ESG disclosures and implementing new processes and tools to enhance ESG data management.

In our experience, the organizational structure of an ESG program is often driven by two key factors: the maturity of a company’s ESG strategy and the maturity of its ESG reporting program.[1] And with a final rule from the U.S. Securities and Exchange Commission (SEC) on climate-related disclosures expected in the coming months, as well as fast-approaching implementation timelines from the Corporate Sustainability Reporting Directive (CSRD) and International Sustainability Standards Board (ISSB), it is not surprising to see banks increasing their ranks in both strategy and reporting roles.

According to the analysis, nine out of 11 large banks have a head of sustainability or chief sustainability officer (CSO) responsible for overall ESG strategy and implementation, along with stakeholder engagement and climate risk management. Voluntary ESG disclosures, such as those related to the Task Force on Climate-Related Financial Disclosures, Global Reporting Initiative and Sustainability Accounting Standards Board, have historically been within the purview of the CSO as well. Now as mandatory ESG reporting comes into view, large banks are increasingly standing up an ESG controller role to round out the leadership team.

Supporting these dedicated leaders is a small but mighty group. According to the analysis, the size of a typical team ranges from 15 to 20 professionals across multiple functions and departments. Importantly, defining exact roles and responsibilities is an area for improvement. Unclear reporting lines, fragmentation of roles and a lack of governance structure were cited in the analysis as top challenges related to banks’ organizational charts.

Today, banks are investing anywhere from approximately $1 million to $5 million annually to enhance their ESG disclosure capabilities. With mandatory reporting on the horizon both in the U.S and internationally, it is expected that budgets could grow up to $10 million in the near future.

Banks’ investment priorities over the next 12 months span a number of key areas related to ESG disclosures, including improving climate data and technology infrastructure and mobilizing resources to prepare for the implementation of the SEC climate rule and, where applicable, the CSRD and the ISSB final standards. Adopting technology solutions that facilitate ESG reporting will be particularly beneficial as banks work to disclose absolute financed emissions for priority sectors.

Aggregating both quantitative and qualitative ESG information across a large bank and its investment portfolio is no easy feat, let alone synthesizing that data into a digestible format for timely, precise and rigorous reporting. For example, let’s say a large bank is reporting on 1,500 metrics. Those 1,500 metrics require many thousands of inputs and calculations on the back end. Furthermore, the data behind those metrics may originate from well over 100 data providers, each providing its unique, and sometimes conflicting, data points and commentary. And finally, the metrics and commentary that the bank will ultimately report on include a combination of financial and nonfinancial information, the latter requiring different processes and controls from traditional financial reporting.

In short, collecting and reporting on ESG data in the banking sector is highly complex. Appreciating this challenge, banks are prioritizing data management in their efforts to prepare for widespread reporting requirements. Several data management efforts are already underway at large banking institutions. According to the analysis, these include forming ESG disclosure committees and working groups, standing up centralized data governance structures, contracting with external data management vendors, conducting climate data mapping and reporting readiness assessments, instituting processes and controls for data disclosure and verification, and creating inventories of ESG metrics based on materiality. And for banks that are particularly mature in their ESG reporting journey, obtaining assurance for reported greenhouse gas emissions data is common as well.

Despite the progress in improving data management, several obstacles remain. For example, banks cited difficulties in maintaining consistent measurement, management and reporting of emissions data across sectors, as well as in aggregating data from a multitude of sources. These challenges are frequently seen in other industries, particularly with respect to Scope 3 greenhouse gas emissions. However, the banking sector has the added complexity of navigating these challenges in the context of financed emissions as well.

The efforts large banks are undertaking today to enhance their ESG leadership, investment and data management illustrate a larger change management trend that we are seeing across industries. As companies prepare themselves for the ESG reporting era, they are taking a hard look at whether their people, processes and systems are truly ready for a change of this magnitude. Significant progress has been made, but the ESG regulatory space moves quickly. So too must the companies that will soon be subject to rigorous requirements. As banking institutions and other organizations fine-tune their strategies, it is critical to remember that ESG reporting is not simply a check-the-box exercise. When done right, it is an opportunity to engender trust with key stakeholders, drive value creation and build a competitive advantage.

Banking sector leans into ESG

Downloaf PDFBanking and ESG - Infographic

Download PDF

Who’s on first, what’s on second: How can companies score on ESG reporting?

KPMG Advisory, Audit and Tax leaders discuss ESG reporting, strategy and how to assemble a winning team.