“Who’s on first?” Some commentators have said that companies need an environmental, social and governance (ESG) controller or chief sustainability reporting officer to contend with an increasingly scrupulous environment in which regulators and other stakeholders are demanding heightened transparency and accelerated progress around ESG-related risks.

In the past, we’ve seen SOX controllers stood up—some faded away, some became permanent fixtures in their organizations and still others remain but are siloed in the controllership with limited sight into internal audit, tax and the non-financial, strategic arm of ESG. Today, chief sustainability officers, chief financial officers, controllers and risk management and compliance officers each have a seat at the table for ESG strategy, operations and, soon enough, reporting.

And yet, the confusion inherent in Abbott and Costello’s famous sketch is not too dissimilar to the challenges companies and their players are facing today. Everyone wants to know who is managing ESG and what falls within their purview. And with mandated ESG reporting on the horizon, I don’t know is no longer a viable response.

Who leads today will depend on a company’s specific circumstances. Some will embed ESG into existing organizational charts, while others may stand up a Center of Excellence to provide near-term structural support and/or long-term guidance. The destination is what’s important as companies figure out who’s on first today.

It’s almost game time. Is your line-up ready?

We are at a pivotal moment for the ESG movement. Most companies now agree that ESG and business strategy are inextricably linked. And they recognize that reporting on ESG criteria enhances trust among stakeholders, drives value creation, promotes resiliency and helps build a competitive advantage. This understanding, coupled with mandated climate-related reporting in the near future, means that companies are no longer questioning the importance of ESG as a business objective.

In fact, according to the KPMG Global Survey of Sustainability Reporting, all of the top 100 U.S. companies by revenue already report on ESG or sustainability matters to some extent.[1] And 70% of U.S. CEOs believe their ESG programs improve their financial performance, per KPMG’s 2022 CEO Outlook.[2] So, instead of questioning if they should embed ESG into strategy, companies are considering how to do so efficiently and effectively. And, importantly, they are deciding if they will lead on ESG or simply follow the pack.

In a textbook scenario, companies would start with a blank slate and have ample time to construct a well-thought-out ESG program.

- First, they would conduct a materiality assessment to identify and internalize the ESG factors most closely aligned with their business objectives.

- From there, they would develop an ESG strategy that would, over time, inform the establishment of a data collection and measurement program.

- And finally, with a robust ESG strategy and comprehensive data program in place, they would have the tactics, technology and talent they need to report on ESG with confidence.

Importantly, this is not a linear path, but rather a continuous feedback loop, as companies are always assessing materiality, enhancing strategy and striving to create efficiencies.

But…the regulatory clock is ticking. Generally, compliance should never dictate an ESG strategy, or any strategy for that matter. However, with potentially just two years until mandated SEC disclosures come due,[3] there needs to be flexibility in this process to meet accelerated timelines.

Who’s on first?

Central to solving the ESG implementation puzzle is putting the right talent in place. Luckily for most companies, that talent already exists, and further upskilling is a very viable strategy. But while global conversation around ESG strategy and reporting is moving at full steam, the organizational chart has not had an opportunity to catch up. At some companies, sustainability roles are deeply integrated and have a direct line to the chief executive officer and the board, while at others these roles reside deep within compliance, risk management, finance or another department. Some companies have instituted an ESG controller responsible for reporting and controls, while others have opted for a sustainability CFO-like role with oversight of ESG targets, forecasting, impact measurement and valuation. Still, others are at the very beginning of their ESG journeys and have not yet formally created sustainability roles—instead, they are ad hoc responsibilities tacked on to existing functions.

Study the playbook, but deviate as needed

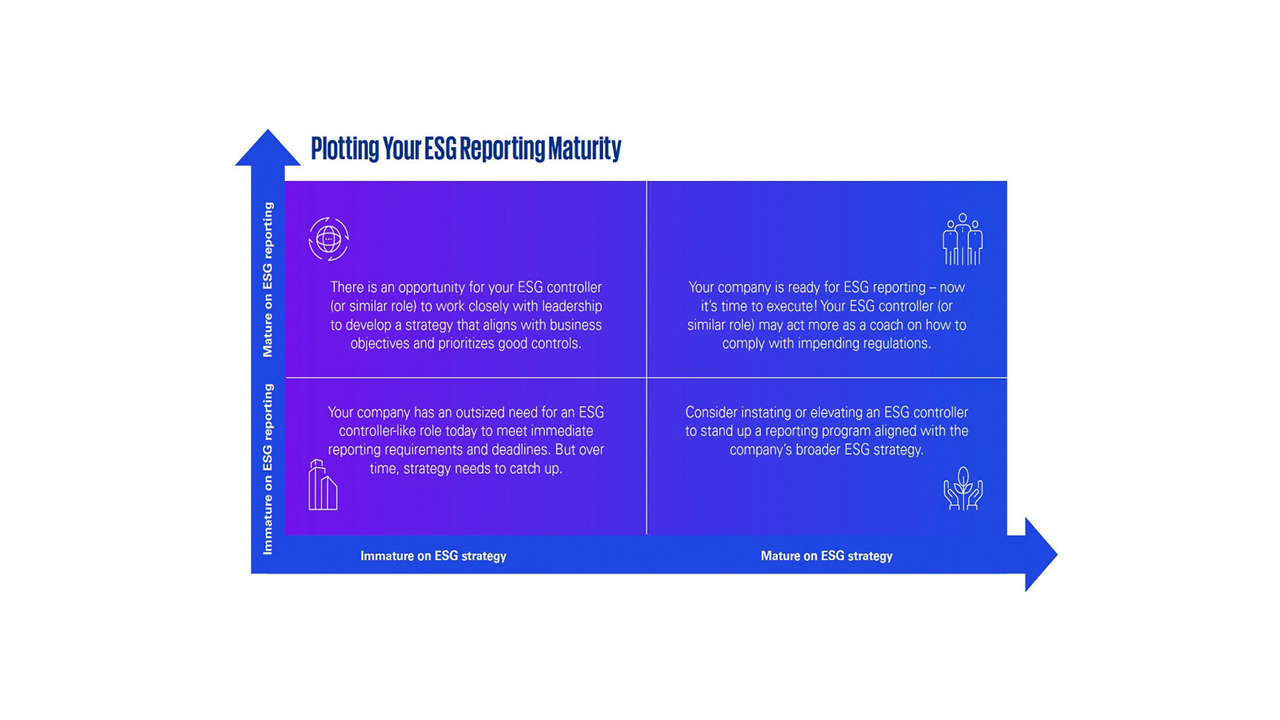

There is no one-size-fits-all solution to assembling an ESG team, and every company’s organizational structure will look different. But in considering where to start, we view maturity of ESG strategy and maturity of ESG reporting as the key drivers.

What does this mean exactly? Let’s take, for example, a company that has committed to becoming net zero by 2030. They have had their target validated by the Science Based Targets initiative (SBTi) and announced their roadmap to achieving their goal. Yet, greenhouse gas emissions are calculated annually, the data collection process is via email and calculations are performed in spreadsheets by one person with “all knowledge of the process in their head.” In this instance, the company is mature on ESG strategy—it has well-informed targets and a comprehensive plan for achieving them—but is immature on ESG reporting due to insufficient infrastructure.

This is not uncommon. In fact, in a KPMG survey of professionals with either leadership or influence over ESG programs, less than 15% of respondents said their program has attained maturity in timely regulatory reporting compliance, controls on ESG data, integrated ESG risk analysis or clearly defined oversight. And only 9% said they are close to completion on implementing processes and controls to ensure the consistency of their ESG policies, activities and reporting.[4]

The company in our hypothetical scenario has different organizational needs than, say, a company with comprehensive ESG data processes and controls but a lack of clear and cohesive strategic direction.

If we delve deeper, we can think of ESG strategy maturity vs. ESG reporting maturity as a matrix: