Ten Key Regulatory Challenges of 2024

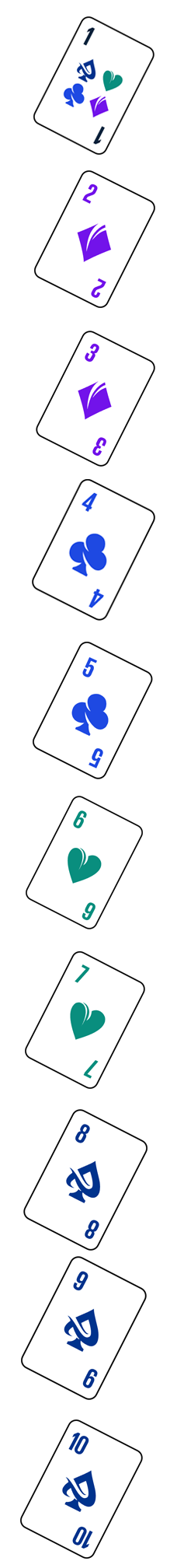

Strengthen the cards you hold

Introduction

We are experiencing a level of regulatory intensity rarely seen—not the simple effect of “net-new” regulations but the combination of a high-volume of regulatory issuances, the complexity and breadth of regulatory supervision, and the impact that these changes impose across the organization.

Key takeaways:

- A return to heightened risk standards - Demonstrate sustainability

- Prudential regulators “level-up” expectation - Show strength and resiliency

- Data, models, and “model-like” risks gain focus - Drive security, privacy, and fairness

- Strong supervisory and enforcement action - Prove accountability and stakeholder trust

- “Old regulations” apply, even to new areas

The “Key Ten” offers actions to consider and key “big rock” regulations to watch. Regulatory intensity will be felt across all areas of regulatory challenge—with our Regulatory Barometer, KPMG Regulatory Insights quantifies the regulatory intensity, giving a predictive indicator of the regulatory landscape.

Expect 2024 to be a year of continued economic fluctuations, election-year uncertainties, and legal actions giving fuel to already elevated levels of regulatory intensity.

Strengthen the cards you hold!

Explore the Ten Key Regulatory Challenges:

Regulatory Intensity

Given continued economic fluctuations, election-year discord and legal actions, high regulatory intensity particularly in the areas of risk management/governance, financial risk, and data

Risk Standards

Supervisory intensity and enforcement, a focus on agility and mitigation of risk and compliance “shocks”, and expectations for robust (and demonstrable) risk accountability and governance combine to heighten risk standards.

Risk Sustainability

Demonstrating "sustainability" in Risk functions will transcend across regulatory areas, requiring it to be embedded across risk pillars and into financial analysis and business as usual.

Growth & Resiliency

Expanding regulatory scrutiny of “too big to manage” (TBTM), including firms’ ability for M&A activity or portfolio growth in the context of sound liquidity management, resolution planning, and demonstration of strong financial controls.

Capital & Valuations

Escalating regulatory attention on risk calculations, stress testing, capital planning, and broad risk management – across financial risks as well as operational risks.

‘Threat Actors’

Expanding regulatory expectations around the detection, mitigation, tracking and remediation of ‘threat actors’ – perpetrators of financial crime, fraud, and misconduct - all while maintaining consumer protections

Fairness

Multi-agency focus on fairness principles, including access, treatment, and product risks - “say what you do, do what you say.”

Responsible Systems

Regulators are applying existing rules to “automated systems”, “predictive analytics”, and other “innovative new technologies”, across a wide array of risks and across the entirety of the firm. As the rules and technologies evolve, risk management will be critical to innovating while maintaining trust.

Security & Privacy

In tandem with all things “Data”, broad regulatory concerns around data security, management, and privacy will include, but expand beyond, cybersecurity and IT risk to all facets of regulatory coverage.

Data

Regulators see data as the potential "soft underbelly" for heightened risk and compliance standards, particularly around quality data governance, data risk and controls, and data lifecycle management.

Explore more

Points of View

Insights and analyses of emerging regulatory issues and their impact.

Regulatory Alerts

Quick hitting summaries of specific regulatory developments and their impact.

Regulatory Insights View

Series covering regulatory trends and emerging topics

Meet our team