Equity-method investees: IFRS impairment compared to US GAAP

Impairment testing of investments in joint ventures and associates can be challenging under IFRS.

From the IFRS Institute - May 31, 2018

Investments in joint ventures and associates accounted for under the equity method are tested periodically for impairment. Determining the what, when and how of this test is not always straightforward. The IASB recently clarified the interaction between the financial instruments standard and equity method accounting. This is a good opportunity to revisit the overall impairment requirements for investments in equity-method investees under IFRS and compare them to US GAAP.

Applying the equity method to joint ventures and associates in accordance with IAS 281 requires an investor to recognize its share of the investee’s comprehensive income or loss. This includes the investor’s share of any impairment loss recorded by the investee on its own underlying assets.

Separately, the investment may be impaired and the investor is required to test the carrying amount for impairment if objective evidence of impairment exists. IAS 28 identifies situations that may trigger the impairment test and refers to IAS 362 for recognition and measurement. Impairment testing for associates and joint ventures also requires significant judgments and estimates to be made.

Further complications arise when the investor not only has equity interests in the investee, but has also made loans to the investee, for example, or when the investee is loss-making. In such cases, recent amendments3 clarify how the standards apply to a mixture of interests in the investee.

In this article, we explain the process of accounting for the net investment in an equity-method investee step by step.

Step 1: Determine the net investment in the investee

The net investment in an equity-method investee comprises two main components.

- First, the carrying amount of the investor’s equity interest in the investee that will be equity accounted.

- Second, any long-term interests (LTIs), such as preferred shares or loans to the investee for which settlement is neither planned nor likely in the foreseeable future. Those are common financing structures in the extractive and real estate sectors. The net investment excludes trade receivables and payables, or other long-term receivables for which collateral exists.

Step 2: Apply IFRS 9 to LTI component of net investment in the investee

The investor applies IFRS 94 to financial instruments included in the net investment to which the equity method is not applied (i.e. the LTIs). This requirement may sound obvious because IFRS 9 provides measurement guidance, including the expected credit loss impairment model for loans (read more here). However, it creates a loss-recognition ordering challenge in certain situations, which we explain in the example below.

Step 3: Apply the equity method to the equity interest in the investee

The investor applies the equity method in the usual way, but complications arise when the investee is loss-making. In that case, the investor recognizes its share of the losses until its equity interest is reduced to zero. Any further share of losses is allocated to the LTIs in the investee in the reverse order of seniority (after applying IFRS 9 in Step 2).

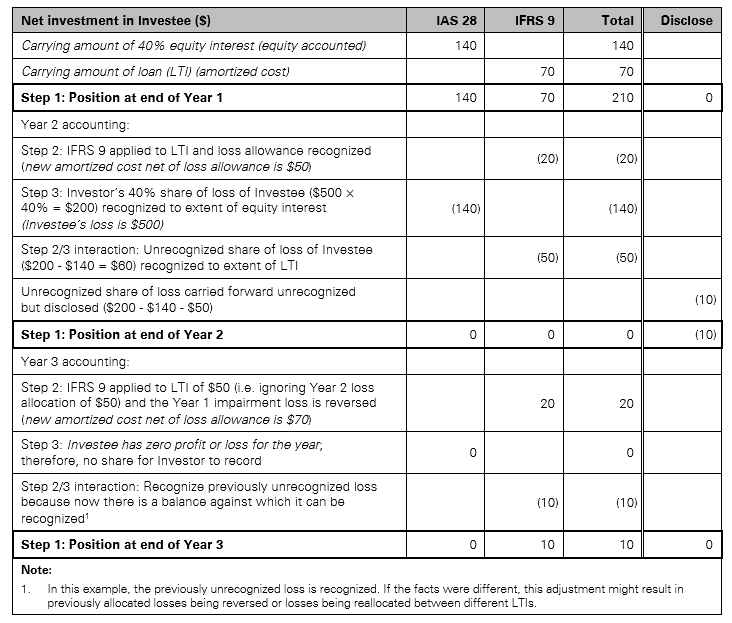

Example: Interaction of Steps 2 and 3 for a loss-making investee

The IASB’s amendments clarify how the conceptually different IFRS 9 and IAS 28 apply to the same instrument. Here we present a simplified example, in which Investor has a 40% interest in Investee, and has also given Investee a long-term loan that is not collateralized.

Assumptions are shown in italics.

| Comparison to US GAAP | |

|---|---|

Unlike IFRS, under US GAAP an investor first allocates its share of the investee’s losses to its long-term interests in the investee. Then the investor applies the financial instruments guidance (including the current expected credit loss approach) or other relevant GAAP. In the example, this means that in Year 2 the accounting for the LTI would be: | |

| Balance of LTI at end of Year 1 | $70 |

| Less unrecognized share of loss of Investee ($200 - $140) | (60) |

| Less impairment loss ($20 but limited to carrying amount) | (10) |

| Balance of LTI at end of Year 2 | $ 0 |

Step 4: Test net investment in investee for impairment

An investor assesses whether there is an indication that its net investment in the associate or joint venture is impaired. IAS 28 provides potential indicators, including significant financial difficulty of the investee, and significant adverse changes in the technological, market, economic or legal environment in which the investee operates.

If objective evidence of impairment exists, the investor performs an impairment test. The net investment (as determined in Steps 1 to 3) is tested as one single asset under IAS 36, by comparing its carrying amount to the recoverable amount. This includes any fair value adjustments and goodwill arising from the acquisition of the investment – i.e. the goodwill is not allocated to a larger cash-generating unit.

Recoverable amount is the higher of value in use and fair value less costs to sell. An investor may determine the value in use of the investment by calculating either:

- its share of the present value of the estimated future cash flows that the investee is expected to generate, including cash flows from the operations of the investment and any proceeds from its ultimate disposal; or

- the present value of the expected future dividend cash flows, together with any proceeds from the ultimate disposal of the investment.

| Comparison to US GAAP |

|---|

Like IFRS, an equity-method investment is tested for impairment whenever events or changes in circumstances indicate that the carrying amount of the investment may not be recoverable. Indicators of impairment under both IFRS and US GAAP are similar. However, under US GAAP, the investment is subject to an impairment model that is different from the IFRS impairment model. Any impairment loss under US GAAP is generally only recognized if the impairment is ‘other than temporary.’ Once an investment is other than temporarily impaired, the measurement of the impairment loss is based on the investee’s fair value. |

Challenges of applying the impairment approach

Testing the net investment in an equity-method investee for impairment in accordance with the requirements of IAS 28, IAS 36 and IFRS 9 requires discipline and judgment. Limited access to cash flow projections of the investee may also present challenges for impairment testing at the investment level. Estimates should be reasonable and supportable – an investor may consider performing a sensitivity analysis to validate key assumptions.

Investors should be aware of the potential pitfalls, and ensure that the underlying impairment process and controls adequately address challenges associated with assessing net investment in equity-method investees for impairment.

- IAS 28, Investments in Associates and Joint Ventures

- IAS 36, Impairment of Assets

- Long-term Interests in Associates and Joint Ventures (Amendments to IAS 28), effective for annual periods beginning on or after January 1, 2019. Early adoption is permitted. There are transitional reliefs.

- IFRS 9, Financial Instruments

KPMG Executive Education

CPE seminars and customized training

Explore more

Contributing authors

Subscribe to the IFRS® Perspectives Newsletter

Subscribe to receive timely updates on the application of IFRS® Accounting and Sustainability Standards in the United States: our latest thought leadership, articles, webcasts and CPE seminars.