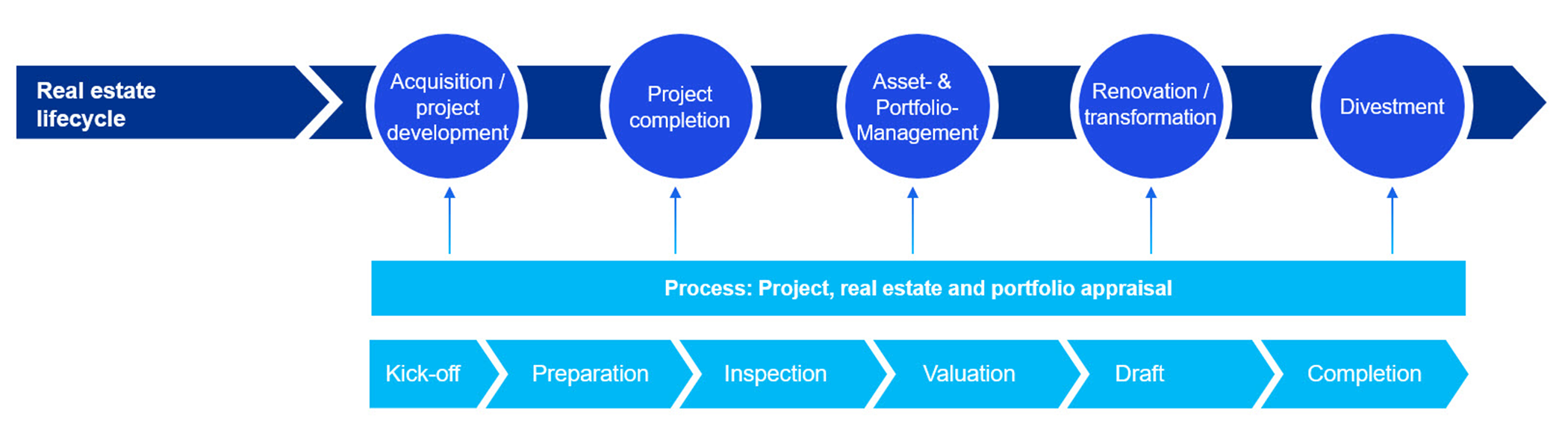

We support you in determining the market value of your real estate portfolio and prepare independent appraisals that can be used for accounting or financing purposes, or to evaluate and assess various scenarios.

We do so using standard valuation approaches and setting out the methodology and sources of information used and the assumptions made, clearly and transparently.

In addition to deriving the market value of your portfolio at a specific point in time, we can also demonstrate the impact of possible strategic decisions. Such decisions can involve the implementation of development or redevelopment projects or the acquisition or disposal of assets, increasing the quality and resilience of your portfolio.