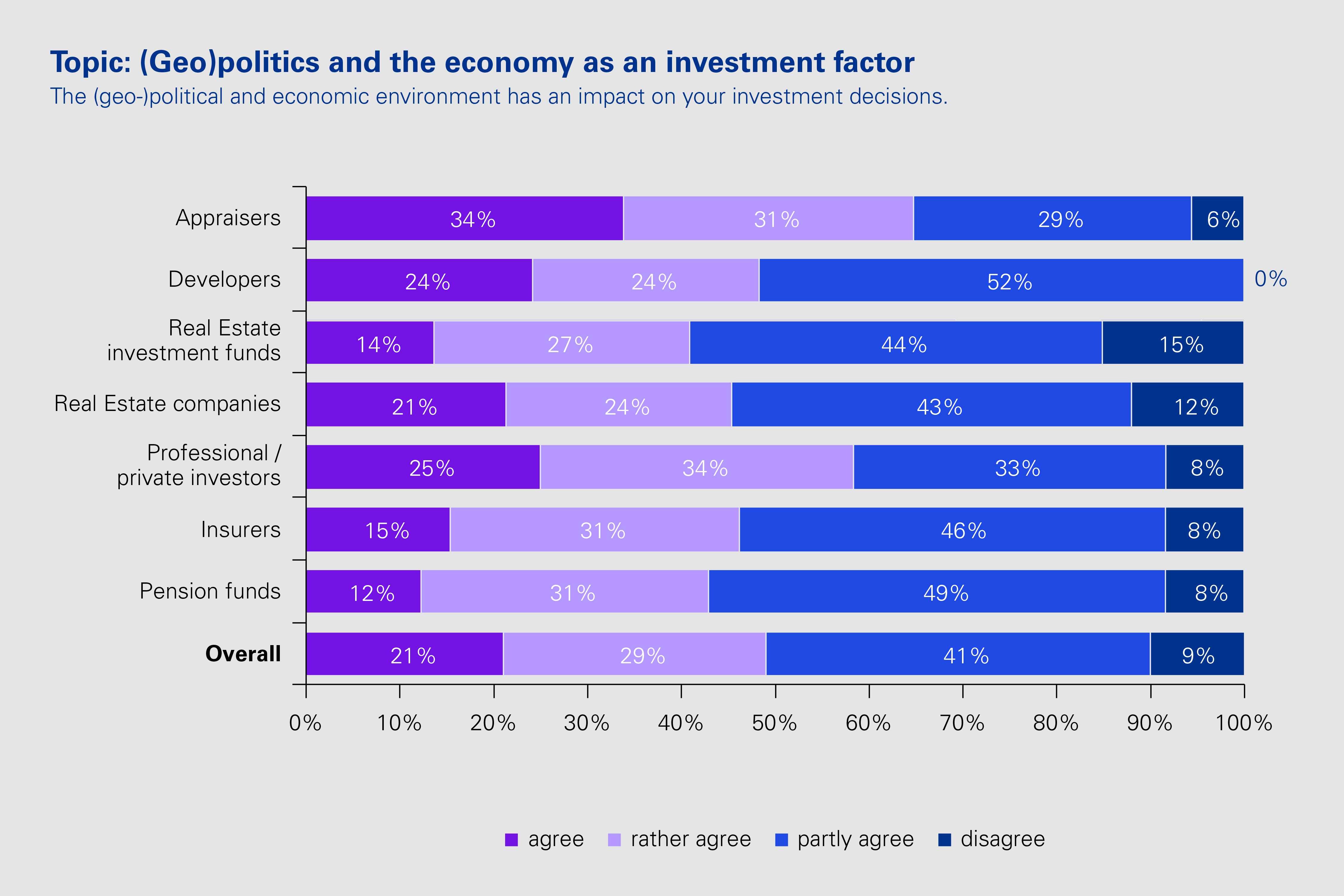

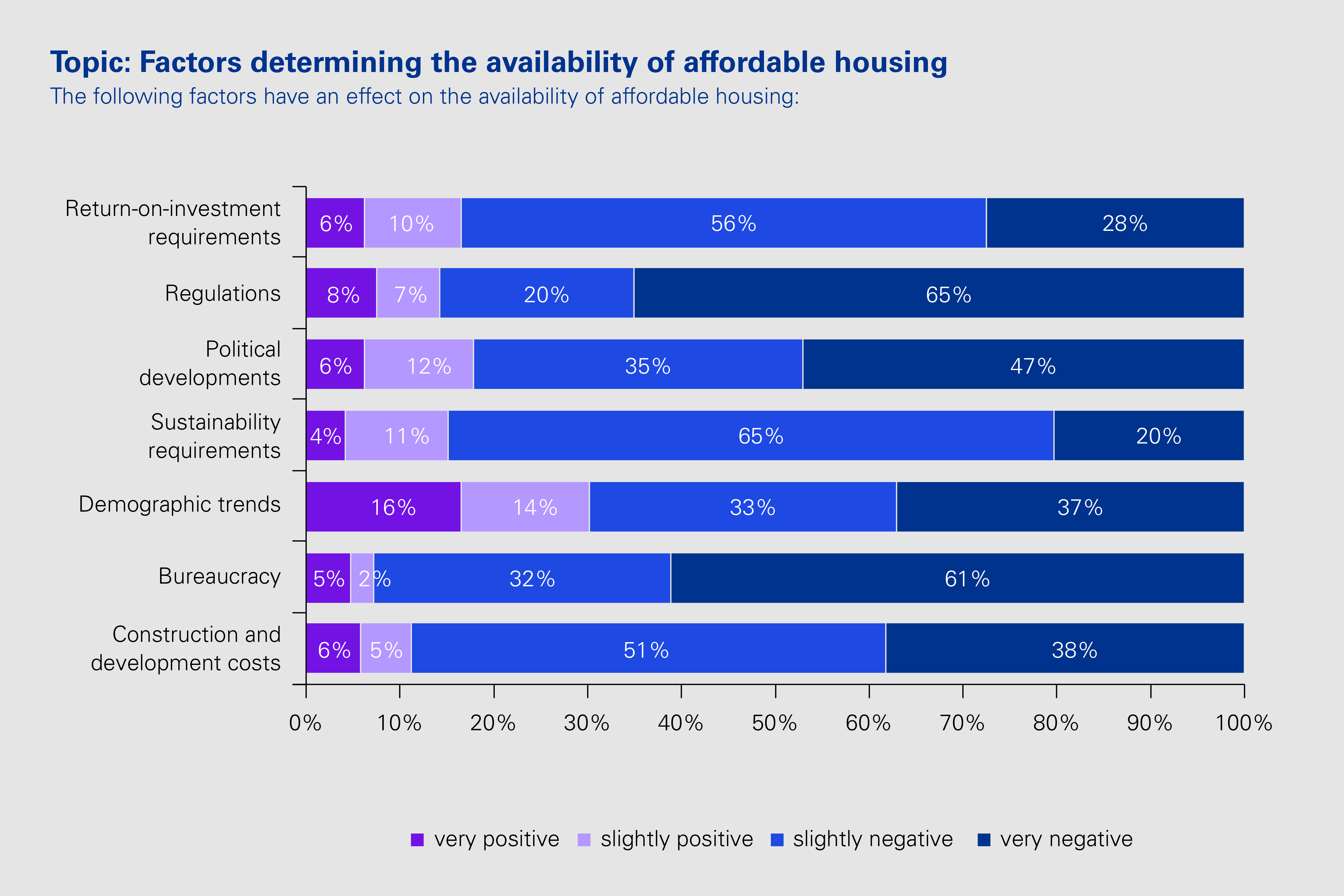

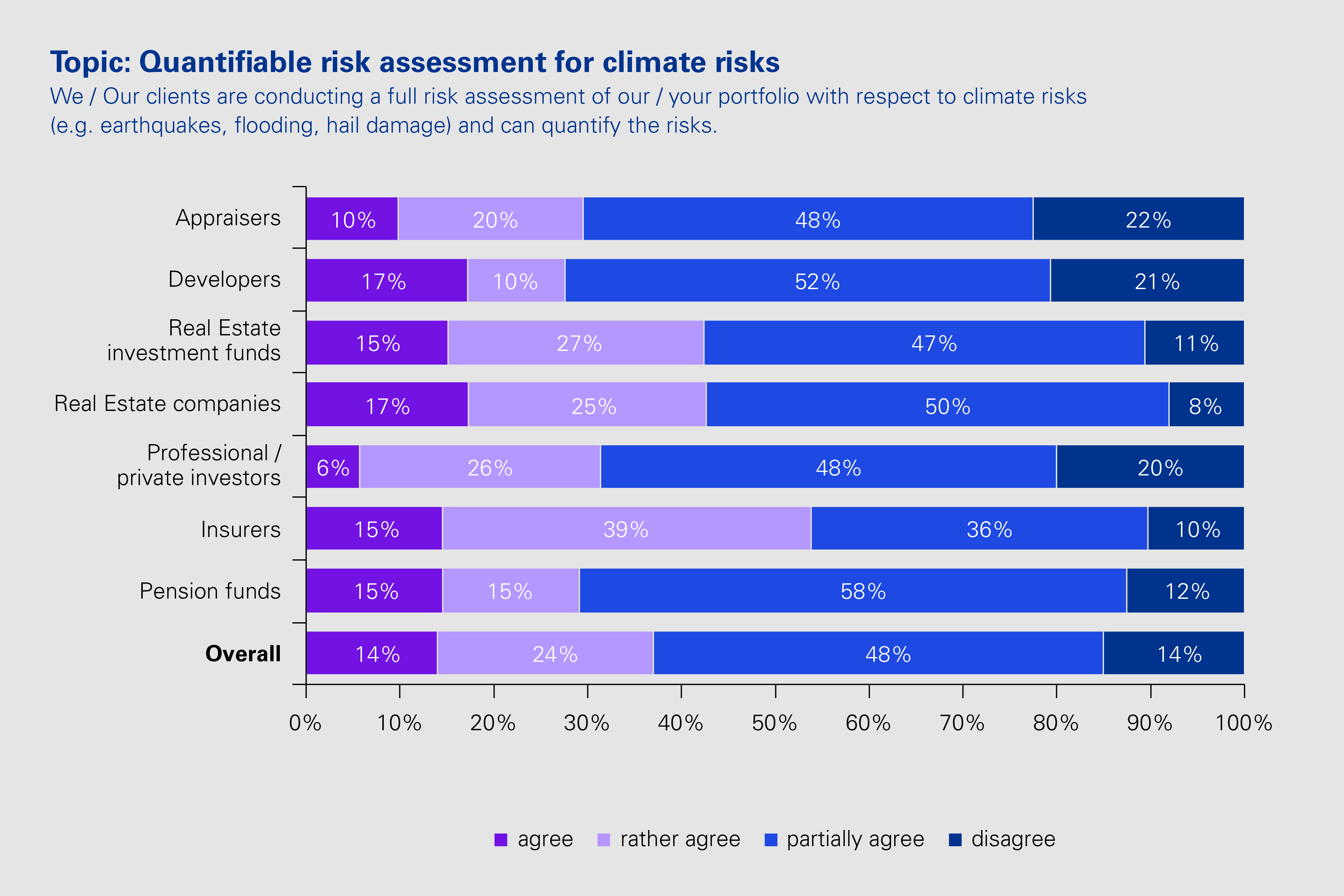

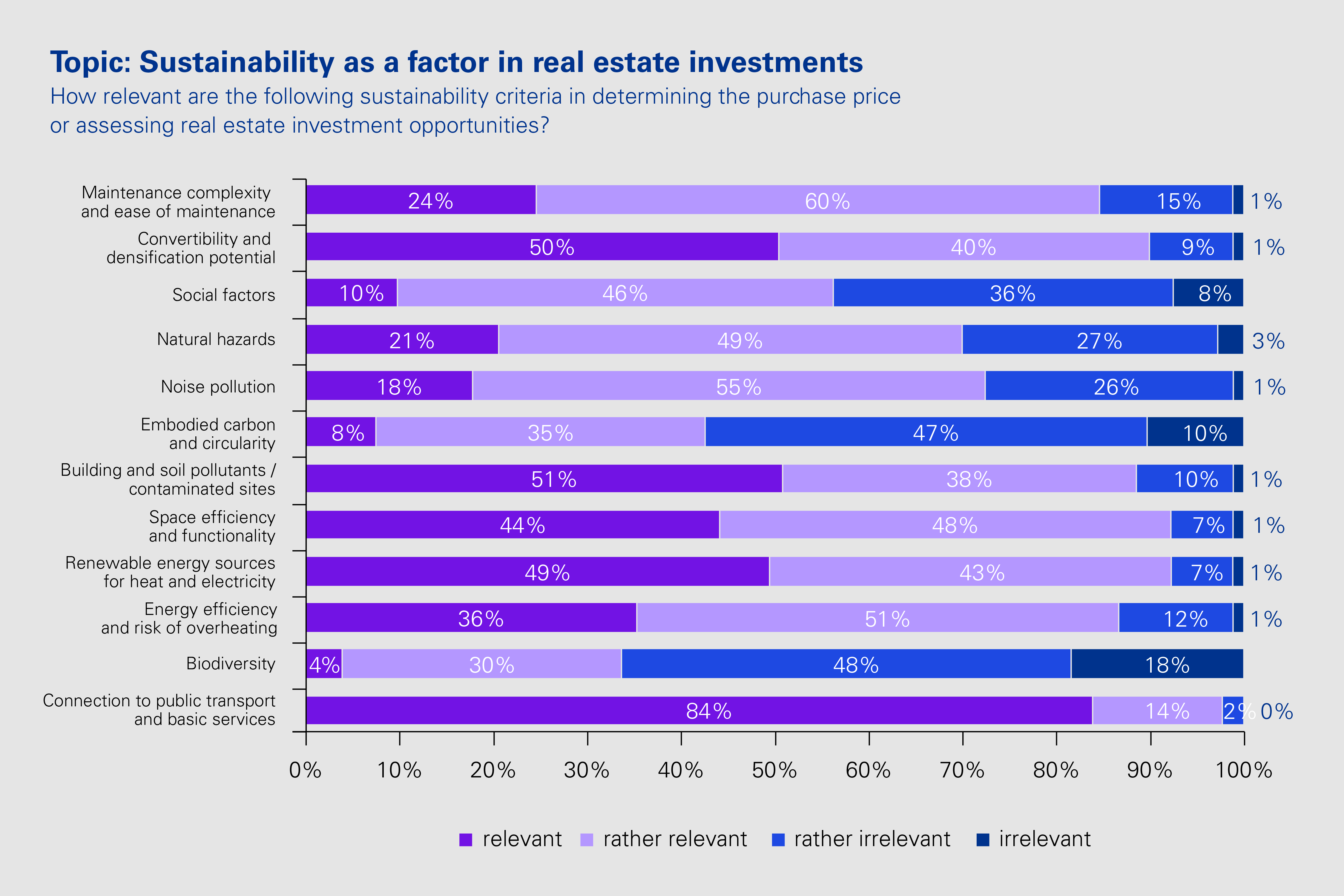

KPMG surveyed roughly 400 real estate experts from across Switzerland about their expectations for economic and price developments in the real estate investment market over the next twelve months. This year’s sresi® also examines the significance of the geopolitical and economic situation as an investment factor. It analyzes factors determining the availability of affordable housing, the implementation of risk analyses of portfolios regarding relation to climate risks and natural hazards, and sustainability factors relevant to returns.

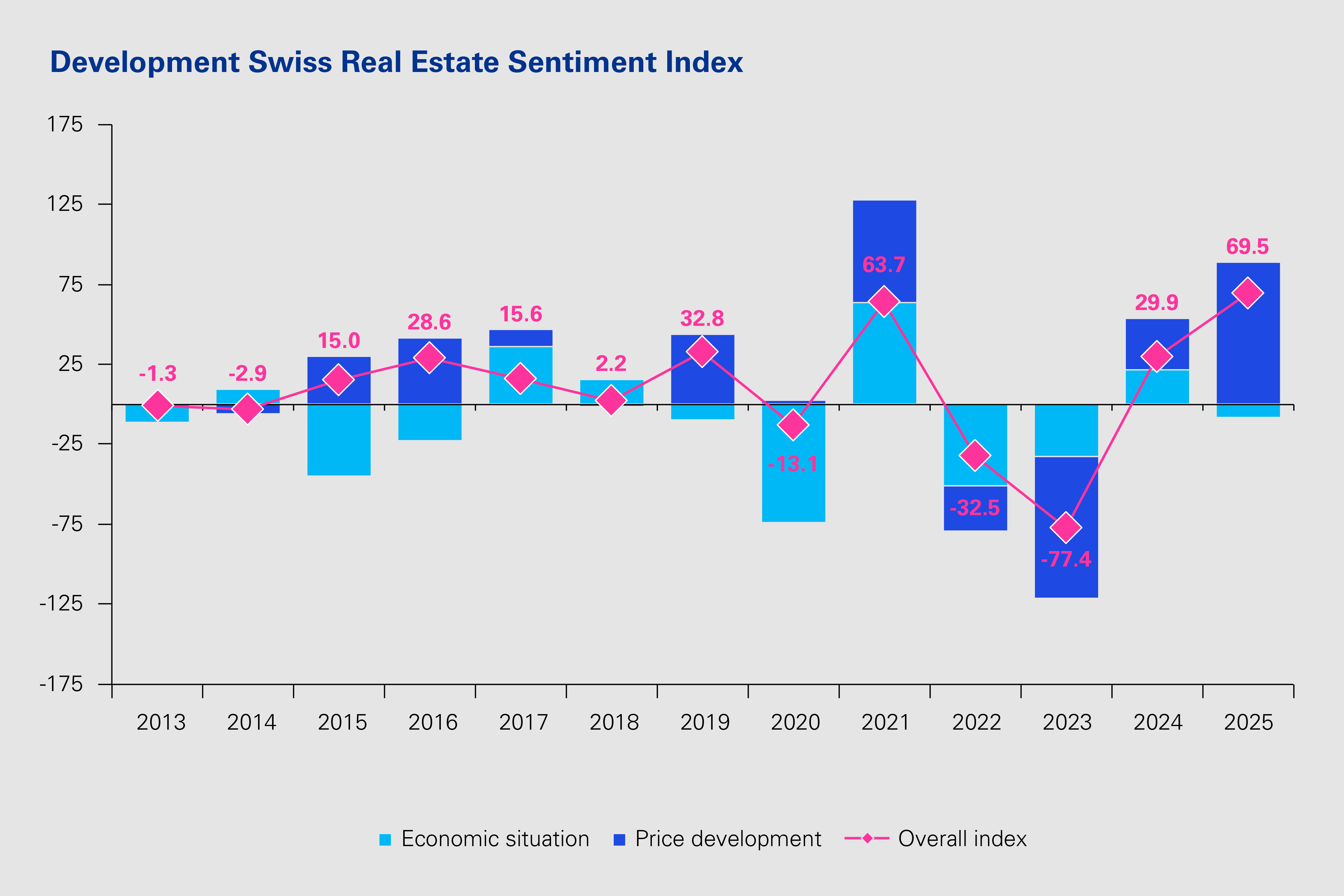

The Swiss Real Estate Sentiment Index (sresi®) 2025 shows that the Swiss real estate sector is optimistic about the future despite a cautious assessment of the economic situation. Within two years, the index has risen from its record low of -77.4 points to a new high of +69.5 points.

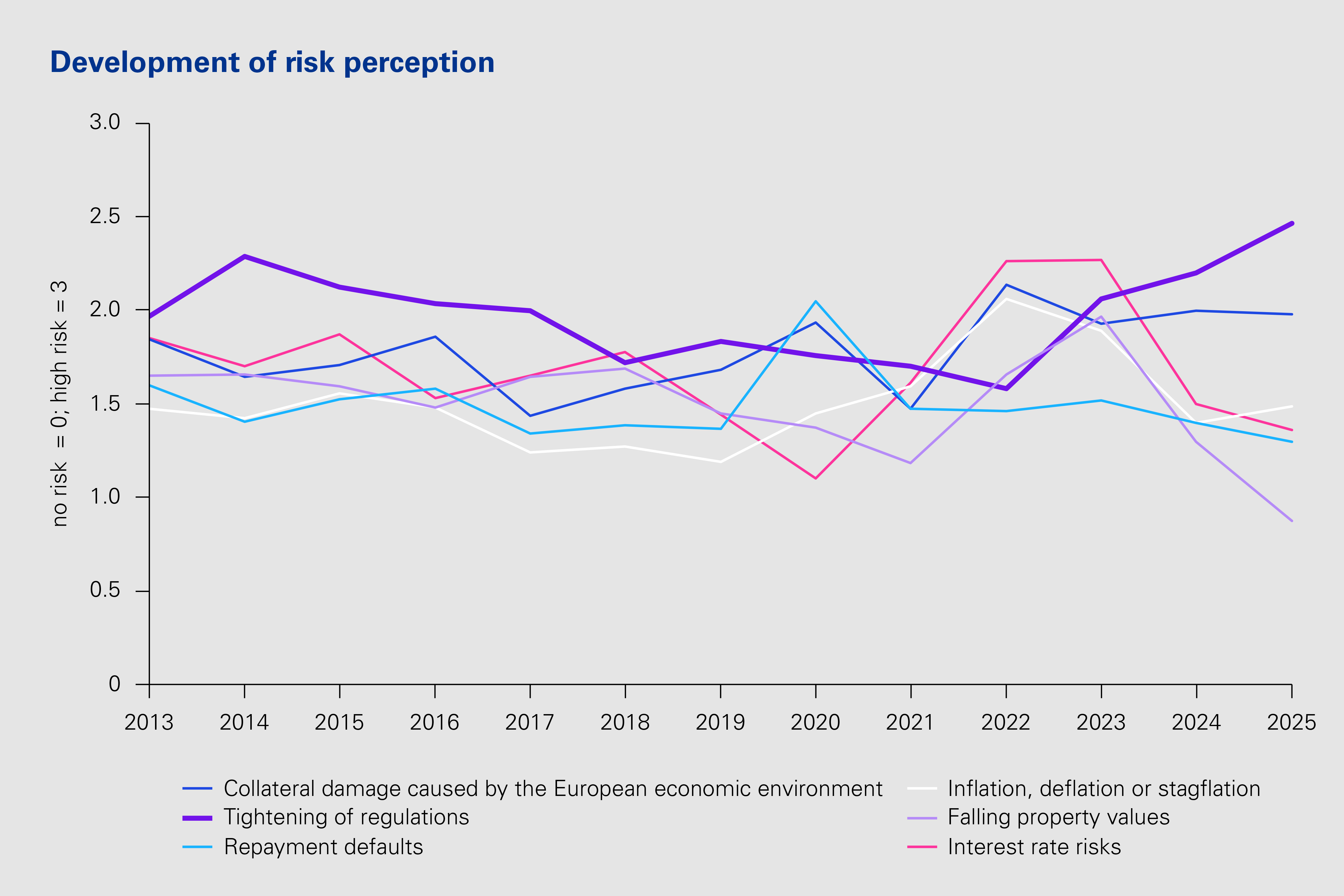

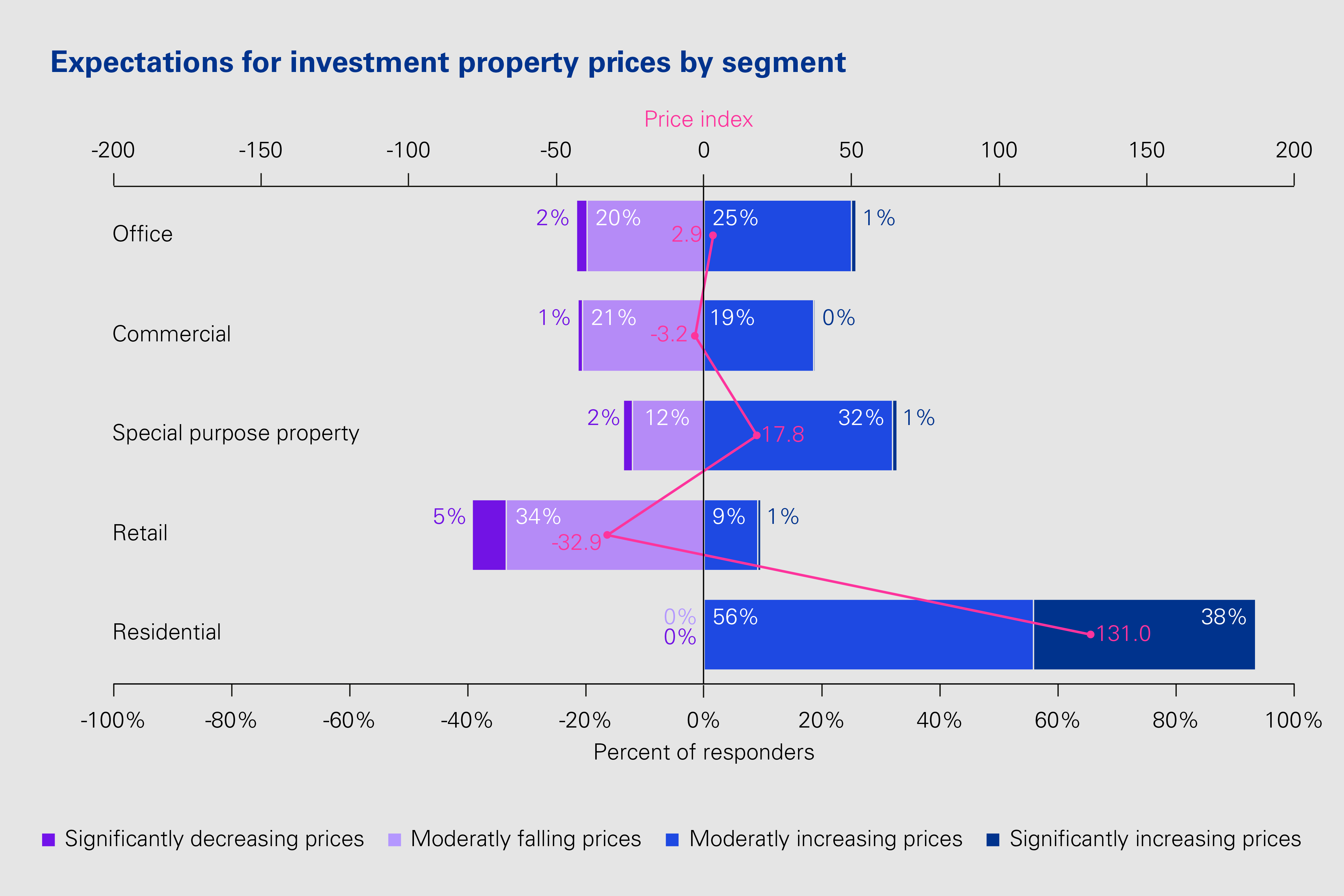

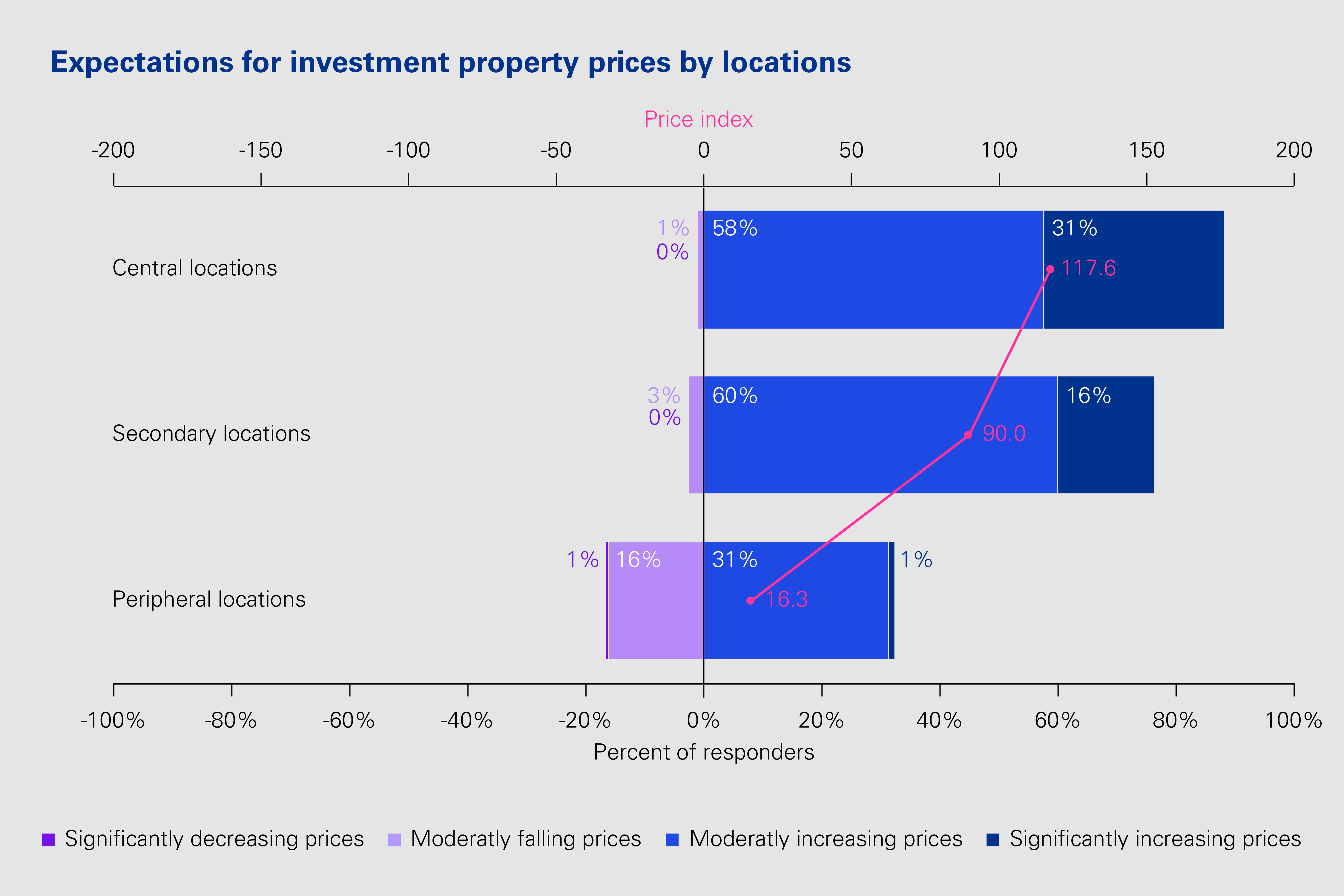

Market players’ price expectations are the main drivers of this record high, with all participant groups anticipating rising real estate prices, particularly in the residential segment but now also for office and special-purpose properties. The price trend for commercial and retail properties continues to be viewed negatively. For the first time since the real estate index's inception, sentiment regarding price expectations for peripheral locations is also positive. Tighter regulation and the economic environment in Europe are once again viewed as the biggest risk factors.