From the IFRS Institute – September 6, 2024

Authors: Valerie Boissou, Amit Singh, Kayla C Molaro

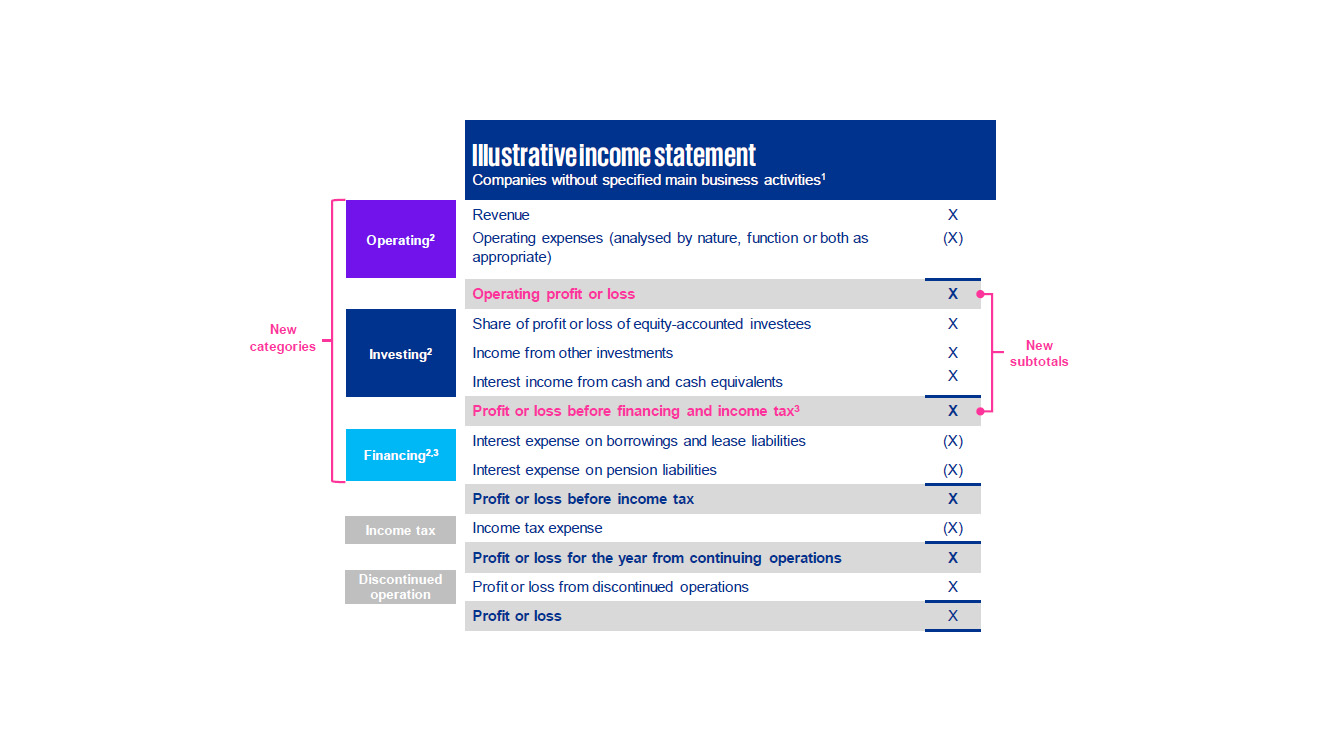

Responding to investor calls for more relevant and comparable information, the International Accounting Standards Board (IASB®) issued IFRS 18 Presentation and Disclosure in Financial Statements1 in April 2024. IFRS 18 aims to provide greater consistency in the presentation of the income and cash flow statements, as well as more disaggregated information. Effective 2027, the standard notably introduces new disclosures and a more structured income statement with three new categories of income and expenses and two defined income statement subtotals. It also brings certain ‘non-GAAP’ measures into the audited financial statements for the first time. IFRS 18 will result in many new differences with US GAAP and creates interpretive questions as to its interactions with SEC Regulations for SEC Foreign Private Issuers (FPIs).

So what does this mean for companies’ financial reporting? Essentially, companies’ net profit will not change. However, what will change is how they present their results on the face of the income statement and disclose information in the notes to the financial statements. Also, certain ‘non-GAAP’ measures – management performance measures (MPMs) – will now form part of the audited financial statements. Together, the new requirements will help companies to better tell their story and connect their reporting in the financial statements.

The new standard will affect all companies across different industries so now is the time to get ready. Companies need to focus on the detailed requirements and apply them to their specific circumstances to make new judgments, navigate complexities and oversee changes to systems and processes.

A more structured income statement

Under current IFRS® Accounting Standards, companies use different formats to present their results, making it difficult for investors to compare financial performance across companies.

IFRS 18 promotes a more structured income statement, as set out below. In particular, it introduces a newly defined ‘operating profit’ subtotal and a requirement for all income and expenses to be classified into three new distinct categories based on a company’s main business activities.