The takeaway

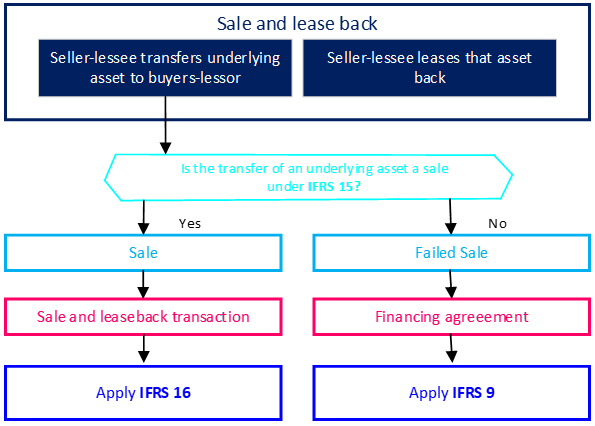

Sale-and-leaseback transactions are likely to remain a popular financing vehicle, notwithstanding the accounting and reporting challenges. For many companies, these transactions are infrequent but very material and can attract external scrutiny. Seller-lessees should be ready to document their accounting judgments based on the particular terms and conditions of an arrangement; it is often difficult to replicate an accounting analysis from one deal to the next.

Planning a sale and leaseback? Reach out to your KPMG contact and read KPMG publication Sale and leaseback – For lessees and lessors. For more in-depth guidance on complex areas of IFRS 16 – including lease modifications, lease term, discount rates and real estate leases – visit kpmg.com/ifrs16. For more information on the accounting for sale and leaseback transactions under US GAAP, see chapter 9 of KPMG Handbook, Leases.