The ISSB refers to the information disclosed as ‘sustainability-related financial disclosures’ – demonstrating that disclosures need to be connected with information in the financial statements, not a disconnected exercise.

Finance and sustainability teams will need to work closely together so that the information disclosed is complementary and based on the same facts and circumstances. Although the sustainability-related information may differ in nature from information presented in the financial statements, it needs to be consistent to the extent possible. This is required regardless of whether financial statements are prepared under IFRS Accounting Standards or other generally accepted accounting principles.

Companies will need processes and controls in place so that they can provide sustainability-related information of the same quality, and at the same time, as their financial statements.

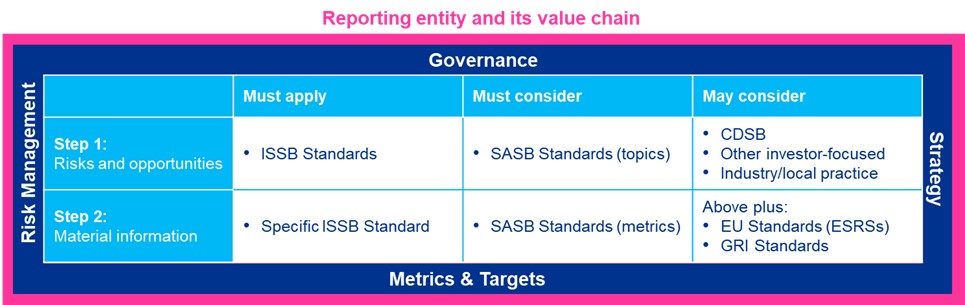

Step 1: Risks and opportunities

Sustainability-related risks and opportunities are specific to a company and arise from its:

- dependencies on resources and relationships; and

- impacts on resources and relationships.

These impacts and dependencies can arise from both within the company and across its value chain. When these dependencies and impacts create risks and opportunities, they can affect the company’s cash flows, its access to finance or cost of capital, and needed its prospects. Sustainability-related risks and opportunities may often be matters that management already monitors and manages when running the business.

Companies need to identify sustainability-related risks and opportunities that could reasonably be expected to affect the company’s prospects and determine the scope of their value chain in relation to each. To do this, companies exercise judgement, using all reasonable and supportable information available at the reporting date without undue cost or effort.

Companies apply the ISSB Standards and:

- MUST consider disclosure topics in the industry-specific SASB6 Standards; and

- MAY consider the CDSB8 Guidance for Water- and Biodiversity-related Disclosures; plus:

- other investor-focused frameworks; and

- industry or local practice.

Companies reassess the scope of all affected sustainability-related risks and opportunities when a significant event or change in circumstances occurs.

Step 2: Material information

Having identified sustainability-related risks and opportunities to report, a company then applies the relevant ISSB Standard and identifies material information to disclose.

If no relevant IFRS Sustainability Disclosure Standard applies to an identified sustainability-related risk or opportunity, a company uses judgment to identify information that:

- is relevant to investors’ decision-making; and

- faithfully represents the identified sustainability-related risk or opportunity.

In making this judgment, companies consider additional sources of guidance indicated by the general standard. Companies:

- MUST consider the metrics associated with disclosure topics in the industry-specific SASB6 Standards; and

- MAY consider the CDSB7 Guidance for Water- and Biodiversity-related Disclosures as well as other investor-focused frameworks and industry or local practice (consistent with Step 1) plus:

- ESRSs9,and

- GRI6 Standards.

In addition to the above requirements and guidance, management applies judgment to identify other or additional material information required to provide a complete, neutral and accurate depiction (i.e. faithful representation) of each sustainability-related risk or opportunity specific to the company. This could include, for example, providing additional explanation about a specified metric.

The role of materiality judgments

Materiality plays a critical role under the ISSB Standards. Companies make materiality judgments so their reporting focuses on information that is relevant to their facts and circumstances, rather than simply providing a prescribed list of information. For example:

- companies are not required to provide disclosures specified in the standards if the information is immaterial;

- companies are required to provide information required for a fair presentation of a sustainability-related risk or opportunity that is not otherwise specified in the standards if that information is material; and

- companies are not required to ensure their disclosures are perfectly precise in all respects, but they are required to ensure that factual information and assumptions applied in making estimates are free from material error.