In recent years, platform companies – e.g . food ordering platforms, ride hail platforms, online ticket sellers and discount websites – have thrived. These business models have in common the fact that multiple parties are involved in providing goods or services to end users. Typically in these arrangements, the platform company will provide incentives to the end users.

To apply the consideration payable to a customer guidance in these arrangements, the platform company determines its customer(s) among the various parties. When the platform company identifies both the end users and the good/service provider as its customers, all incentives reduce the transaction price.

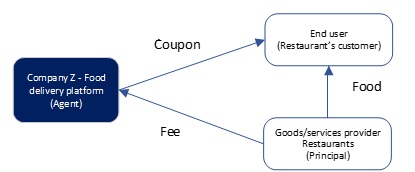

However, there may be situations where the platform company is acting as an agent in selling a good/service to end users and identifies only the good/service provider as its customer. Therefore, the party to which it makes incentive payments (i.e. the end user) is not its customer and is not within the direct distribution chain. In this case, the platform company needs to apply judgement to determine whether these payments represent consideration payable to a customer, i.e. as implied price concessions to the customer.

The SEC staff has expressed a view6 that the evaluation considers not only contractual obligations to the customer but also any implied promises to provide incentives to the customer’s customer. An implied promise may exist if the platform company’s incentive promotion or program is ‘reasonably knowable’ to the company’s customers.An incentive promotion or program may be reasonably knowable to a customer when the benefit is visible to the customer (e.g. via a platform app, website, e-mails, or other forms of communications that are accessible by the customer) such that the customer is reasonably aware that end users of the platform are receiving benefits on purchases and therefore has a reasonable expectation that incentives will be provided to its customers. Therefore, many platform incentives to a customer’s customer are recorded as a reduction of revenue.

In the KPMG comment letter to the IASB for the post-implementation review of IFRS 15, we recommended the IASB clarifies what the circumstances are, if any, in which an amount paid to a customer’s customer (that does not relate to a distinct good or service) is not treated as consideration payable to a customer.