Global business services can provide companies with the necessary agility for future challenges.

Captive shared service center or outsourcing?

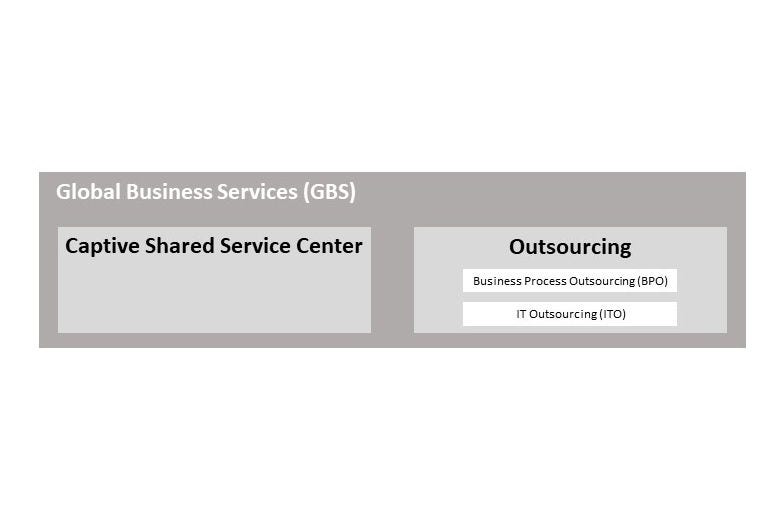

Global Business Services (GBS) are an organizational evolvement from the Shared Service Center model (SSC). GBS aim to minimize complexity in a vastly changing world. The right balance of the organizational ownership model (i.e. captive vs. outsourcing) is one of the key drivers for success.

What are Global Business Services?

GBS are an evolved model of traditional Shared Service Center (SSC) organizations. GBS is a concept that helps steer corporate functions such as Finance, Procurement, IT or HR. Its goal is to deliver certain capabilities in a centralized setup to the broader company while being customer-centric, more agile and cost-efficient compared to a decentralized organization. In order to achieve that, GBS makes use of seamlessly integrated and mostly digital end-to-end processes.

GBS typically show the following features:

- Representation at the top: designated position in the Executive Committee

- Global reach: architecture that spans all regions of the company’s operations in order to leverage effectiveness

- Home rule decisions: autonomy to decide which tasks to outsource to external providers and which to deliver through a captive SSC

- Economic sovereignty: providing services not only to the company itself but also to other companies

- Accounting independency: separate profit and loss accounts from the company

- Structural homogeneity: structured approach to governance to keep things lean

These characteristics lead to a significant value proposition of GBS. By providing a multiverse of services, they enable the company to tackle the most complex challenges more quickly, such as the integration of acquired companies or when entering new markets. The below graphic visualizes the two ownership models: captive and outsourcing.

Why do companies select captive organizational models?

Going captive specifically means that shared services are kept in-house, whether its on- or offshore. This allows the companies to maintain full control on the management as well as the governance side. Further benefits are that operational costs are minimized due to economies of scale while ensuring data quality and ownership. As the services remain within the company, the firm can set and control its own quality standards. The captive solution also has the benefit of protecting the company`s organizational culture.

However, building up a captive center involves high up-front investments in comparison to the traditional outsourcing model to third parties. In addition, not only financial factors but also regulatory requirements such as tax or labor laws must be considered in the planning phase. Thus, going captive might be complex to implement and needs a lot of planning as well as high time investments. Often, the organization needs to be set up from scratch.

Considering the strategic importance of Finance and HR functions it is no surprise that these are two very common functions that leverage captive SSCs as part of GBS. Furthermore, this starting point for captive SSCs is plausible when thinking about the presence of Finance for every business decision and the embeddedness of HR across all divisions. Thus, Finance and HR functions are mostly aiming for captive operating models. Examples for what captive SSCs typically deal with on a Finance side range from Order-to-Cash (O2C), Record-to-Report (R2R) to Procure-to-Pay (P2P) processes. For HR, captive SSCs for example cover the service portfolio around payroll processes, recruiting, employee data management or learning services. By doing so, quality as well as efficiency gains can be realized through process standardization and the bundling of administrative tasks from several legal entities.

In general, many companies decide to implement a captive SSC as part of their GBS organization. However, GBS do not necessarily need to deliver services for individual functions by a captive organization. Instead, they can choose to sign a contract with a third-party Business Process Outsourcing (BPO) provider when this more traditional model appears to be more suitable. Examples in Finance and HR can be invoice processing, tax services or payroll. However, even more often outsourcing is seen in the IT area.

What benefits do companies expect to get from IT Outsourcing (ITO)?

As the technological version of BPO, IT outsourcing describes the practice of engaging a third-party provider to deliver services to support, or fully manage, a specific IT capability. IT outsourcing typically consists of either the provision of an operational process (such as access management), or the provision of infrastructure components (such as hosting and/or maintaining server racks), or a combination of both (e.g. the provision of cyber security processes in combination with hosting and providing necessary software and hardware components to perform the service).

Throughout the recent years, an industry has emerged around XaaS (Anything as a Service), most often comprising of Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS). The general market movement towards a more cloud-based and managed service-based IT organization has led to a shift in focus of the typical IT department. More traditional tasks such as the setup and maintenance of infrastructure, networks and software management are increasingly complimented by the coordination of IT sourcing efforts to orchestrate suppliers. Consequently, we have observed a shift of IT workforce profiles. Employees increasingly need to manage requirements of internal and external stakeholders, create and develop service catalogues, receive and interpret external reports and be able to translate technical offering into value addition for the business.

The obvious benefit of IT outsourcing is clearly anticipated cost reduction. Labor arbitrage and economies of scale usually allow outsourced services to be delivered at a lower cost than a fully retained service. However critically, reducing cost without disproportionately impacting value and quality is a much harder challenge, and one that many companies struggle with.

There are other benefits though often overlooked. One example is access to best practices and enhanced skills. Typically, outsourcing partners provide these services on a large scale, meaning that they have developed and honed a set of best practices which they bring to a client. This scale means that outsourcing providers can invest much more significantly in a larger talent base, which can then be supplied to its clients – which in today’s resource-challenged environment can be highly attractive!

What does the future hold for GBS?

GBS will continue to focus on end-to-end services along the customer journey and serve as a governance concept for captive and outsourced functions. Already today, they can provide the company with automated virtual performance dashboards for all devisable scenarios in real time that are accessible from anywhere within cloud-based ecosystems. If fitted with an entrepreneurial mentality, GBS further have the potential to deliver added value by combining insights gained through processes from different service lines. The focus of the future will be towards a plug-and-play ecosystem for service delivery in order to strengthen agility independent from the outsourcing model.

Our Finance and IT Sourcing & Transformation specialists can help identify sourcing and transformation potential, plan and execute the transition, and continue to evaluate outsourcing risk and performance in the long term. Get in touch.