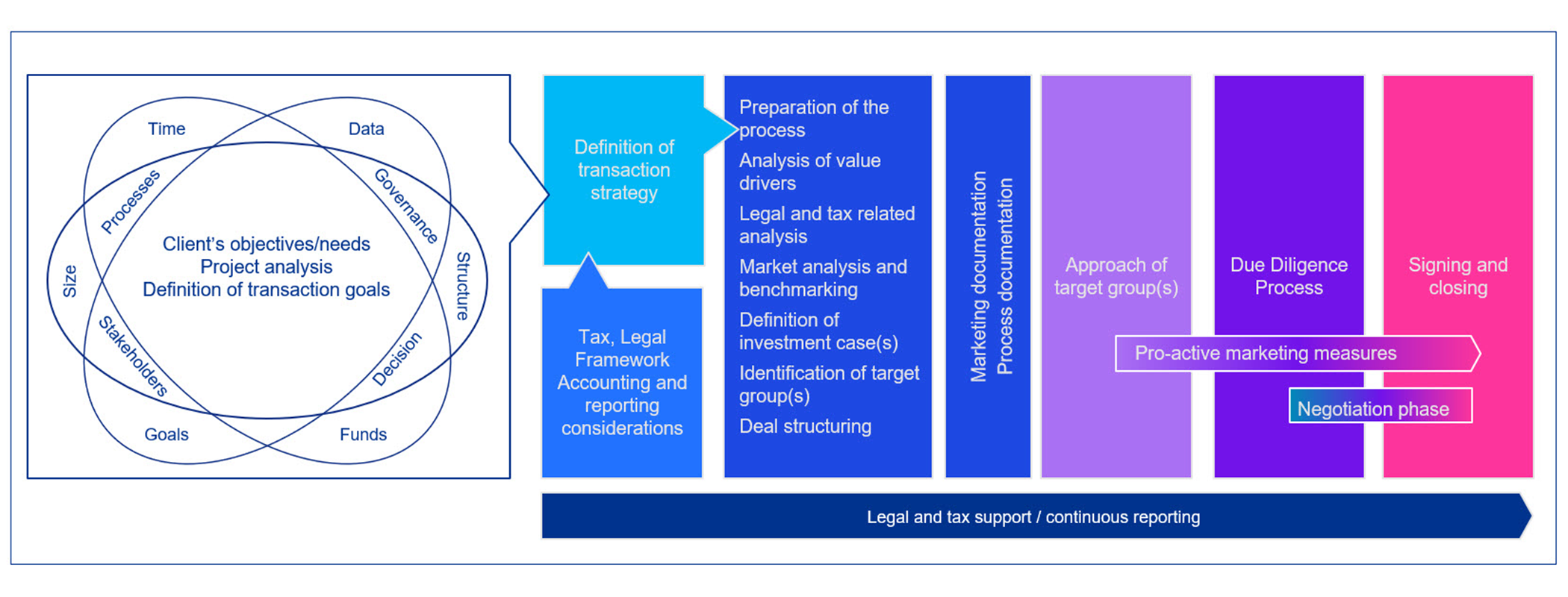

We help you to identify the appropriate transaction strategy for your needs, and to define, structure and effectively execute an outcome-based transaction process.

The outcome-based identification of value drivers and professionally prepared transaction information and presentations are key to the success of a transaction. To this end, we undertake a comprehensive analysis of all asset- and/or company-specific information and use our market analyses to boost purchaser interest.

Where appropriate, we involve KPMG Tax and Legal, and/or our financial analysts in the transaction process to ensure that the transaction is optimally structured from a tax or corporate law perspective.