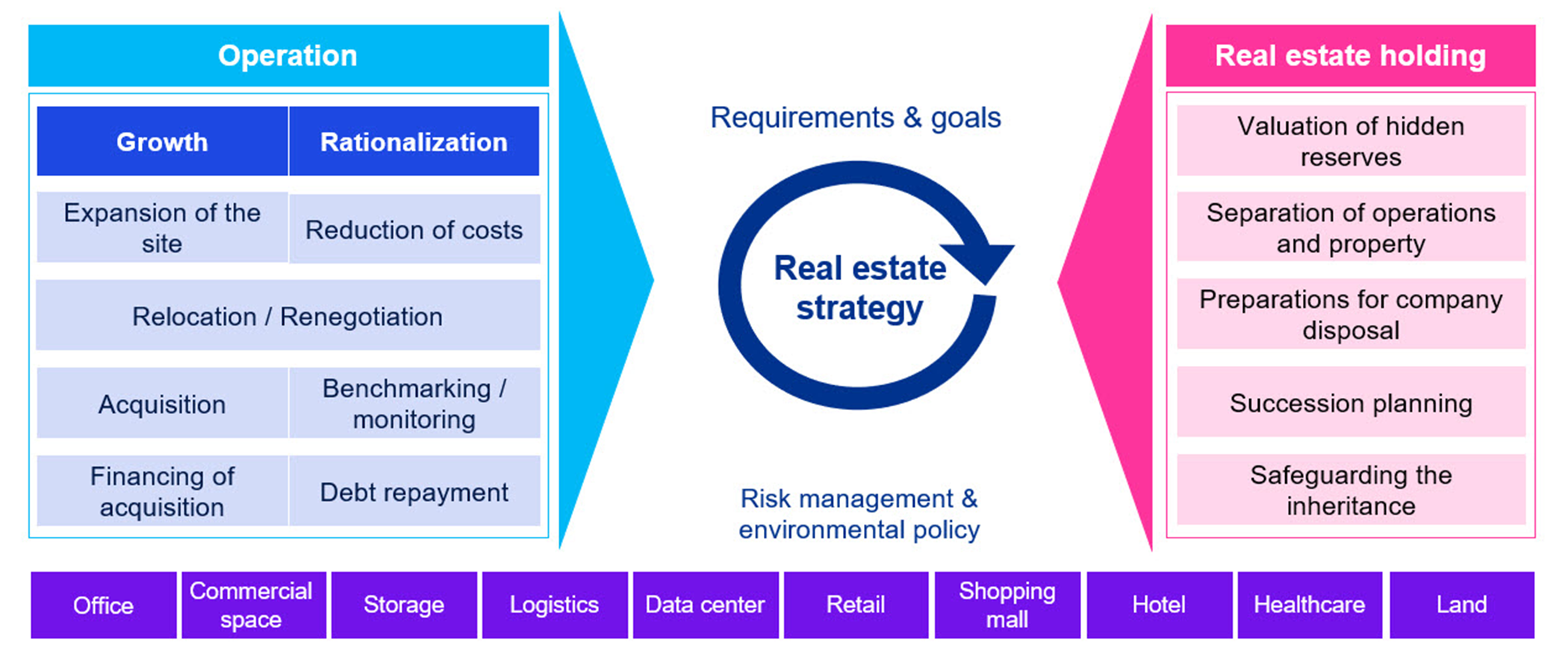

We help you define and implement your real estate strategy so that your properties meet your operational requirements and expectations, and so that your financial resources can be used efficiently.

We provide answers to various questions through space and portfolio analysis, property valuations or benchmarking. We conduct market studies and location analyzes, review management efficiency, identify potential savings or analyse operational processes.