KPMG is a proud Platinum Elite sponsor at SYNERGY 2024, the premier Thomson Reuters ONESOURCE event for tax insights and technology.

While at SYNERGY 2024, don’t miss the opportunity to connect with KPMG leadership:

- Demos: Stop by the KPMG booth on the exhibit floor for a live demo of KPMG Indirect Tax Toolkit or contact us to schedule a demo.

- 1:1 strategy sessions: Meet with KPMG advisors to address key challenges in areas such as: Tax Technology, Indirect Tax, Direct Tax, Transfer Pricing. Contact us to request a meeting.

- Visit our booth in Orlando to learn how we can help you on your tax transformation journey.

Modernize Your Tax Operations

Join the KPMG speaking sessions at SYNERGY2024

The KPMG team will be leading several speaking sessions. Check back here for speaking session details as they come available.

| Date & Time | Session Title | Firm/Org Speaker(s) Name and Title | Description |

11th November 10:10- 11:00am | Harnessing AI for Tax Efficiency — Product Classification and Exemption Management | Patrick Onderick | In this session, we are set to uncover the practical applications of AI in the domain of Indirect Tax, with a particular focus on the tax classification of products and exemption certificate management. By harnessing the power of AI, businesses can not only streamline their operations allowing for more precise tax compliance and efficient tax management but also significantly reduce the risks and exposures associated with tax audits. Through real-life examples, we will demonstrate how AI can be effectively integrated into tax workflows, transforming the way companies approach tax classification of products and exemption certificate management. This session is designed to provide actionable insights that participants can apply to their own organizations, equipping them with the knowledge to drive transformation initiatives in their tax functions. |

11th November 10:10-11:00am | Accelerating the Tax Close Cycle with Alteryx and the ONESOURCE Suite of Tools | Andy Maryott, Chris Margiotta | In this session, KPMG will discuss how to leverage the ONESOURCE suite of tools and Alteryx to accelerate your close cycle. |

11th November 11:20-12:10pm | Customer Case Study – KPMG/ Bausch + Lomb Complex Global Supply Chain Using ONESOURCE Indirect Tax Determination with SAP S/4HANA | Jon Rezendes | In this session, KPMG and Bausch + Lomb will discuss continuing their global Financial Transformation project into the US and EU with SAP S/4HANA and ONESOURCE Indirect Tax Determination. We will review B+L’s complex supply chain scenarios and demonstrate how ONESOURCE has added significant value to Bausch + Lomb in managing its indirect tax calculation and reporting requirements. |

11th November 12:40-12:55pm | Automate OITD Testing: Campfire Session w/ KPMG Indirect Tax Toolkit | Fred Baumer | KPMG will demonstrate a tool which helps users validate their tax results during implementation and throughout the tax lifecycle with OneSource Indirect Tax Determination. |

11th November 3:05-3:55pm | Worldwide Waves — KPMG, Riding the E-invoicing Tsunami | Kathya Capote Peimbert | In this session, KPMG will explore the seismic shift transforming global commerce through e-invoicing. We will take a deep dive on how these requirements are reshaping business landscapes. Join us as we ride the crest of innovation, uncovering strategies to harness the power of this unstoppable force and propel your organization to new heights in the digital age. |

12th November 9:50-10:40am | Information Reporting Hot Topics |

| In this session, KPMG will cover the latest developments surrounding Forms 1099 and 1042-S compliance obligations, IRS audit efforts, as well as providing an update on the Transmitter Control Codes (TCCs) for filing electronically through the FIRE system. |

12th November 11:00- 12:15pm | Brazilian Tax Reform — The Imminent Need for a Tax Transformation | Paula Smith | In this session, we will address the recent Brazil Tax Reform and its implications for tax determination, focusing on the importance of Technology as an enabler for a smooth transition to the new tax system. You will learn about the changes introduced by the reform, how they affect tax determination processes, and the ways in which enhanced tax content can aid in navigating the new tax landscape. We will explore specific updates relevant to Brazil's tax environment and how to apply these within your determination software to maintain compliance. |

12th November 11:00-12:15pm | Grantor – Irrevocable, Revocable, Intentionally Defective, Qualified Personal Residence Trusts | Mike Macero | This comprehensive session will explore the nuances of irrevocable, revocable, intentionally defective, and qualified personal residence trusts, providing invaluable insights into their unique tax implications and reporting requirements. |

12th November 11:00-12:15pm | Cryptocurrency Regulatory Update and Associated Information Withholding Reporting Implications |

| Over the last few years, there has been explosive growth in cryptocurrency but very little guidance from taxing authorities on accounting for cryptocurrency transactions. This session will cover the latest information regarding cryptocurrency and 1099 reporting. We will also discuss the essential considerations for generating and filing information returns. |

12th November 2:40-3:30pm | Tax Provisioning in the AI Age — The Unseen Power of Copilot and GenAI | Charles Danguy, Ruchika Sharma | In this session, KPMG will give a brief introduction to Generative AI (GenAI), understanding its potential applications and how it can transform the way we interact with and utilize data from systems like OneSource. Discover how GenAI and Copilot can be utilized to generate meaningful insights from data extracted from OneSource, revolutionizing the approach to tax provisioning. Learn how to leverage the capabilities of GenAI and Copilot to pre-build prompts, enhancing efficiency and streamlining the decision-making process in tax management. |

12th November 2:40-3:30pm | Customer Roundtable — KPMG Leading Practices for ONESOURCE, Alteryx Implementation & Integration with the ERP System | Sandy Fisher, Arjun Sikka | In this session, KPMG will facilitate a roundtable with customers to discuss their experiences working with Alteryx and various ONESOURCE products to maximize efficiency in their Tax department and integrations to their ERP systems. |

13th November 8:00-8:50am | The Skill to Thrill — 3 Tools for Solving the Top 5 OIT Issues of 2024 | Jackie Ziemba | In this session we will share real-life examples of work situations where accurate leverage of ONESOURCE University, ONESOURCE Support, and the ONESOURCE Help Library have made our client users look like pros. We will be walking through a series of short narratives that tell the story of our ONESOURCE resources. |

13th November 9:10-10:00am | Get Ahead of the Curve — Everything You Need to Know About State Tax Information Filing Obligations (Forms 1099 and Equivalents) | Kelli Wooten, Martin Mueller | In this session, KPMG will review state tax information reporting concepts, including the combined fed/state Form 1099 filing program. Key state tax information reporting obligations in jurisdictions that fall outside this program will be addressed. |

13th November 9:10-10:00am | Navigating Digital Transformation and Organizational Adaptation to Drive Automation | Chris Karalis | In this session, explore how Verizon and KPMG navigated digital transformation and the transition onto the ONESOURCE suite of tools for compliance, provision and planning. Learn about their journey, the challenges faced, and the strategies used to extend the use of APIs to streamline their existing processes. |

Dive into our thinking:

Modernize your tax operations

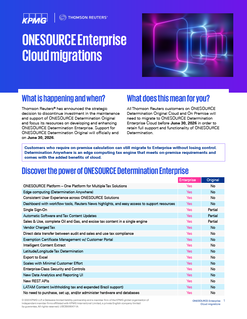

Discover the power of ONESOURCE Determination Enterprise

Onesource workflow manager & dataflow

Tax reimagined 2024: Perspectives from the C-suite

Indirect tax management

Managing direct tax challenges to add value

Improve efficiency and compliance with accurate use tax accruals

KPMG and IBM tax value acceleration

Meet our team

Explore more

Thomson Reuters

Our connected thinking approach helps you Rethink and Digitize Tax

Explore more

Thomson Reuters

Unique tax challenges deserve customized solutions

Discover upcoming events

Connect with us via webcast, podcast or in person/virtual at industry conferences.