Observations on M&A oversight

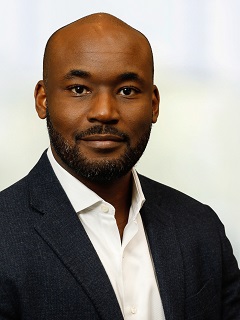

In an interview, Kevin Bogle, KPMG Global Lead Partner for Alphabet, shares his observations on the M&A environment and the implications for board oversight

March 17, 2025

Observations on M&A oversight

After several years of reduced deal volume, companies are looking to revive their mergers and acquisition activity. According to a December survey by KPMG US, 85 percent of corporate deal makers said they were evaluating more deals than in the six months prior, primarily seeking to drive growth in the core business, and more than half of those surveyed anticipated a new deal in the first half of 2025. Although valuation continues to be the primary barrier for buyers, interest rates and securing financing remain important considerations, and a third of respondents indicated they are prioritizing organic growth over external acquisitions. Nearly 80 percent of respondents are already using generative artificial intelligence (AI) in their M&A process, and even more say they plan to add it soon. These dynamics make board oversight of M&A critical, helping to ensure that deals are aligned with the company’s strategy, that key risks are evaluated, and that integration and other post-deal challenges such as talent and culture are carefully considered.

For more insights on the current deal environment and board challenges, the KPMG Board Leadership Center interviewed Kevin Bogle, KPMG Global Lead Partner for Alphabet Inc., and former principal in charge of Deal Advisory and Strategy for the Technology, Media, & Telecommunications practice.

Board Leadership Center (BLC): How do you expect the M&A landscape to change in the coming year with a new administration in the US and several other jurisdictions?

Kevin Bogle (KB): The prevailing sentiment is that the administration will be more business-friendly, primarily due to less regulation, and that means greater certainty around the ability to get deals done. We had noticed an uptick in M&A activity with an increase in financial due diligence during the last quarter of 2024, suggesting there could be more deals in 2025 compared to 2024. That would have been consistent with a stronger economic environment, steady interest rates, and technological advancements. Uncertainty, however, has slowed actual activity in the first quarter, as companies try to predict the impact of escalating tariffs around the world.

The amount of money in private equity (nearly $3 trillion globally in dry powder) also means that PE will be heavily involved on the buy side. They’ll have to be creative to compete with public companies whose ability to cut deals is fueled by high stock prices (and high valuations). I believe private equity firms will become very innovative, entering into deals and transactions they might not have previously considered, while simultaneously needing to divest a substantial number of assets.

BLC: What are you seeing as the greatest current barriers to M&A?

KB: Persistent uncertainty, particularly in geopolitics and cross-border transactions, is always a risk. This affects both buyers and sellers and can cause hesitation and a lack of confidence in making significant financial commitments. Regulatory complexities and potential changes in laws also pose significant hurdles for M&A transactions, as well as the economic uncertainty embedded in tariffs, inflation, valuations, recession fears, and the persistence of higher interest rates. The need for comprehensive due diligence and the integration of diverse company cultures are also challenges that must be navigated carefully to ensure successful mergers and acquisitions. Companies must assess the financial health, operational capabilities, and strategic fit of potential targets, which can be a lengthy and complex process. Lastly, the need to broaden the aperture for companies and talent globally—you need to be looking everywhere—makes pinpointing a deal or target that much harder.

BLC: How is innovative technology, such as AI, enhancing or impacting the M&A process, both in due diligence and integration? What about how targets are identified and evaluated?

KB: In the due diligence phase, AI can automate and streamline the analysis of vast amounts of data, allowing for more efficient and thorough evaluations of potential targets. This technology can identify patterns and insights that might be missed by traditional analysis, ensuring a more comprehensive understanding of the target company's financial health, operational efficiency, and potential risks. Additionally, AI can facilitate the integration process by analyzing and predicting the compatibility of different company cultures, operational systems, and strategic goals. In terms of identifying and evaluating targets, AI can leverage data to pinpoint companies that align with the acquirer's strategic objectives. By analyzing financial metrics, market trends, and competitive landscapes, AI can help companies identify the most promising acquisition opportunities. An emerging challenge on the technology side, however, is ensuring that the target is compliant with regulations on technology use and data privacy, as well as how that target is using AI and whether the company has guidelines regarding its use.

BLC: From your experience, where does governance and board oversight add the most value to M&A for acquirers and targets?

KB: For both acquirers and targets, the board adds the most value by ensuring that the transaction aligns with the company’s strategic objectives and that management is following its own “deal playbook.” Having such a playbook helps to manage risk and fosters transparency and accountability. Boards also provide oversight during the due diligence process, helping to identify and mitigate potential risks and ensure that all legal and regulatory requirements are met. When needed, boards can facilitate communication and collaboration between the acquirer and target, bringing their experience from past deals in helping to integrate (or not integrate) their cultures and operations more effectively and ensuring that the combined entity is well-positioned for long-term success.

BLC: In light of technology and regulatory trends, as well as the competitive landscape, how are boards engaging differently in the M&A process than they have in the past?

KB: With more data and information driving the M&A process, boards play a critical role in helping the company step back and evaluate whether the deal will genuinely provide shareholder value. The increased access to data allows the board to ask more questions and exercise greater skepticism, ensuring a thorough diligence process. This enhanced scrutiny not only helps to identify any potential issues but also contributes to a better overall understanding of the transaction, leading to more informed decision-making. Boards are now more focused on understanding the expertise and capacity of third-party advisors in the deal process. How have they been vetted? What is their experience? Boards should also be delving deeper into technological considerations, ensuring that management has adequately addressed these aspects to the board’s satisfaction.

BLC: How do boards assess culture and anticipate challenges that may arise in post-merger integration?

KB: Culture is one of the hardest areas to get right. I think one of the good things that came out of COVID is that companies are conducting more thorough diligence on people, not just in terms of retention bonuses and compensation, but helping to ensure a strong cultural fit. The board should help the company make that assessment early. Some acquisitions require fast integration to add processes and controls to grow and be successful. In other cases, the company may choose not to integrate at all. Regardless of which option the company takes, that decision can be determined up front, and the board (on both sides) can help to limit surprises and deal value erosion.

The views and opinions expressed herein are those of the interviewee and do not necessarily represent the views and opinions of KPMG LLP.

Meet our team