The Auto Insurance Affordability Crisis

Navigating the Rising Tide of UM/UIM Auto Claims

Persistent inflation is hurting the affordability of personal auto insurance. This concurs with a finding from the 2024 KPMG Perspectives Survey, which found that 65 percent of people plan to do more discount shopping. Seeking ways to lower their household costs, some drivers are opting for minimum coverage limits or even forgoing auto insurance altogether.

Auto insurers are also feeling the pressure from inflation that’s led to higher repair and replacement costs, skyrocketing medical expenses, and a marked increase in the frequency and severity of claims. As a result, insurers have been forced to safeguard their financial stability by raising rates, as much as 30 percent. This situation creates a game of chicken between the insured and the insurer, as more drivers choose to underinsure or go without insurance as rates continue to rise. However, minimum limits are not keeping pace with repair costs and liability jury verdicts. It’s bad for business. There is a way forward for insurers to satisfy the bottom line, mitigate inflation’s impact, and win over customers.

The insurance industry must address the rising tide of UM/UIM claims. Think holistically, from measuring insurance affordability and improving underwriting models to implementing creative claim handling strategies and shaping public policies that serve both insurers and policyholders.

Scott Shapiro

US Sector Leader, Insurance

Strategies for managing UM/UIM claims

The best way to manage the insurance affordability crisis is with a multi-prong approach focused directly on the issue of uninsured motorist (UM)/underinsured motorist (UIM) claims. The approach includes several strategies: quantifying insurance affordability, enhancing underwriting models, implementing innovative claim handling strategies and regulatory lobbying efforts.

Quantify insurance affordability

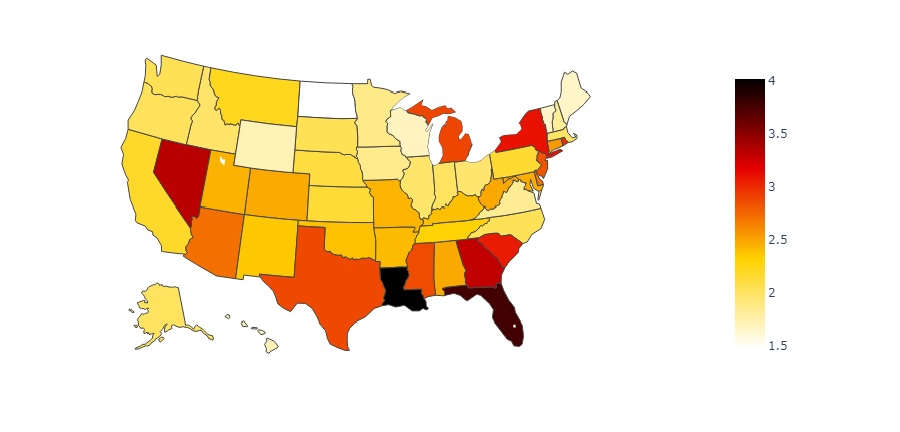

A key issue for UM/UIM is affordability. A simple and intuitive measurement of affordability is comparing the average price of a personal auto policy to the average wage in the region. It’s reflected in the heat map below. Command of data and analytics would offer other ways of considering affordability.

Just as driving history is factored into an auto insurance policy, affordability should be another consideration. Ultimately, rates must reflect expected loss costs and not tailored to willingness or ability to pay. But the insurer can use affordability metrics to intelligently decide whether to offer coverage at all as well as what deductibles/limits are suitable for a given customer.

People’s expectations of government using technology, especially genAI. #1 response: DMV services (driver’s license, vehicle registration, etc.)

Can auto insurance afford to be far behind?

Source: KPMG American Perspectives Survey, Summer 2024

Ratio by state: Average expenditure/average salary

Source: 2020/2021 Auto Insurance Database Report, National Association of Insurance Commissioners, January 2024 Source: Occupational Employment and Wage Statistics, U.S. Bureau of Labor Statistics, May 2023

Enhanced underwriting models

Underwriting models provide a score indicating the customer’s propensity for being involved in UM/UIM claim. The score is based on various factors. But what if these underwriting models could be enhanced with more finely tuned predictive analytics? Your insurance company might hit on different value propositions for more defined customers segments.

Does a particular applicant pose a greater risk of being a UM/UIM claimant? Is your organization able to answer this question? If so, how does this influence your underwriting?

Innovate claims handling strategies

It’s not often you can gain inspiration from ambulance chasers. However, by monitoring and analyzing traffic incident reports, social media alerts, and police records, insurers can identify policyholders involved in accidents more swiftly than traditional claims reporting.

This early detection system could be instrumental in managing UM/UIM claims more effectively. For example, instead of a policyholder reporting the incident, the insurer reaches out to the policyholder to start the claims process like documenting the incident and securing witness statements. Being proactive in this critical period can have a crucial impact on the trajectory of the claim. Ideally, carriers can negotiate a settlement before external legal become involved. At a minimum, proactive carriers can establish a level of ground truth around the facts of the claim which can mitigate a UM/UIM legal spiral.

Develop winning public policies

There is only so much that can be done internally to manage runaway UM/UIM claims. Accomplishing more requires an external focus—lobbying lawmakers and participating in public debates, ensuring industry viewpoints are heard.

Low hanging fruit includes lobbying, tort reform, aftermarket parts, and strengthening the safety net.

Tort reform

Approval to use aftermarket parts

Strengthening the safety net

Addressing the crisis of insurance affordability

Dive into our thinking:

The Auto Insurance Affordability Crisis

Navigating the Rising Tide of UM/UIM Auto Claims

Download PDFExplore more

From legacy to leading edge

Modernizing claims through purpose-driven technology strategies

37th Annual Insurance Industry Conference

Navigating the (un)Known

Property and casualty: Rising complexity

From litigation and climate change to innovation and new ways of working

GenAI in P&C insurance

Insurers harness the power of GenAI to drive advanced operations

Meet our team