Strengthening Audit Quality

Standardizing, centralizing and automating key areas of the audit to drive consistency across our portfolio and create capacity for more extensive pre-issuance reviews.

This blog is an excerpt from our FY23 Audit Quality Report, Jan. 2024.

We are focused on standardizing, centralizing and automating key areas of the audit to pull work forward, enabling pre-issuance reviews, consultations and enhanced supervision and review to strengthen audit quality.

Executing orderly and timely audits

Our multi-year practice-wide effort and investment has fundamentally changed the audit lifecycle. Partners and professionals within our engagement teams, centralized services and DPP are collaborating to conduct more work earlier in the audit cycle, creating capacity for more extensive pre-issuance reviews.

In fact, for 2023 audits, we will be conducting our most extensive pre-issuance reviews to date, covering 100% of public audits.

How did we get here?

1. We set milestones and monitor progress at the engagement team, business unit, regional, and national level to best support all engagement teams during the audit.

Our monitoring efforts track 1) project management, 2) engagement execution and 3) key audit quality indicators at moments in the audit cycle, working closely with our resource management teams and leaders across the firm to properly support audit engagements.

Each category monitored includes a number of metrics. For example, project management monitoring will identify if teams shift due dates in significant ways, whereas engagement execution will identify if reviews of workpapers are lagging. Audit quality indicators include ratios of partner hours to total team hours and manager hours to associate hours, among others. This effort ensures our audits are being executed as planned with audit quality top of mind.

Across three key dates that span a 6-month period in the audit, we’ve increased the percentage of our audits meeting our milestones over the past three years. This monitoring allows us to better support all engagements with the appropriate resourcing, coaching and guidance to address any challenges early in the audit cycle.

Additionally, in 2023, we expanded this pull-forward effort from 100% of public integrated audits to all public financial statement audits and private engagements greater than 2,000 hours.

Engagements subject to these processes now make up nearly 90% of total audit hours compared with just over 50% in the prior year.

2. This effort enables more of our teams to pull work forward, completing more audit workpapers and planned hours by key dates in the audit cycle.

When evaluating 12/31 year-end audits, we are conducting far more work earlier in the audit cycle for public integrated audits. We set milestones to complete 40% of all workpapers by mid-October and 60% of workpapers by January 1. This effort also translated to significant changes in when our teams’ hours were executed.

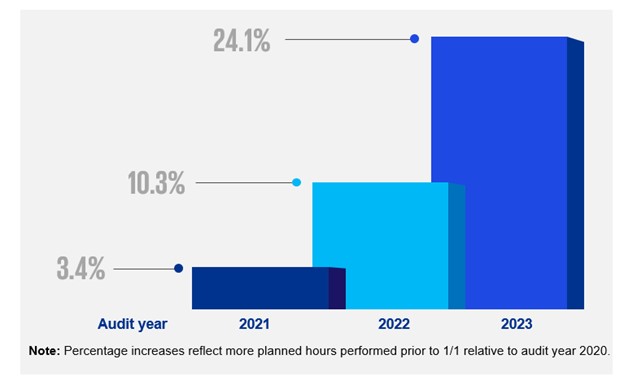

Compared to 2020, this effort moved 10.3% of planned audit hours out of the traditional busy season in FY22 and 24.1% in FY23.

Additionally, in 2023, we expanded this pull-forward effort from 100% of public integrated audits to all public financial statement audits and private engagements greater than 2,000 hours. Engagements subject to these processes now make up nearly 90% of total audit hours compared with just over 50% in the prior year.

3. Ultimately, this effort creates the capacity for expanded pre-issuance reviews of more areas of the audit.

Pre-issuance reviews involve assessments of our audit procedures, analysis and documentation by partners and professionals outside the core engagement team. These reviews enhance quality, drive consistency and help teams continue to improve over time. Over the past three years, these reviews have been driven by our Department of Professional Practice (DPP), Risk Management – Inspections and SEC Reviewing Partner Team.

Our effort to pull work forward enables more pre-issuance reviews, covering more and more areas of the audit.

In our 2021 audits, we conducted pre-issuance reviews for 100 engagements, focusing on materiality and group scoping for 50 engagements and certain audit work over business processes for the other 50.

In our 2022 audits, we conducted 400+ pre-issuance reviews, covering 100% of our public integrated audits. This effort combined work from Risk Management and the Audit practice and focused on two processes related to walk-throughs, risk assessments, and testing the design of controls.

In our 2023 audits, we are further expanding this effort and are aiming to conduct nearly 700 pre-issuance quality reviews, including all client entities that file a Form 10-K. The scope for the portion of those reviews performed by members of the SEC Reviewing Partner Team expanded once again to include reviews of control effectiveness, in addition to substantive testing and disclosures.

By coordinating efforts among Risk Management – Inspections, DPP and our SEC Reviewing Partner Team, we can deliver pre-issuance reviews at scale. Our SEC Reviewing Partner Team includes 281 partners and 263 assistants, which represents a 26% increase in total team size compared to the same time last fiscal year. With more time and resourcing to review engagement teamwork, this effort is able to drive enhanced audit quality across our portfolio.

Explore more

FY25 KPMG US Audit Quality Report

At KPMG, we are not responding to change; we are driving it forward. KPMG is leveraging artificial intelligence and modernizing our work to sustain trust and deliver value in the capital markets.

Transparency Reports

Continuous focus on delivering improved, sustainable audit quality through systems, tone, and governance grounded in integrity and values to earn the public’s trust.

Embedding Quality and Continuous Improvement throughout the Audit

The relentless focus on enhanced quality—not just compliance.